The benchmark crude WTI (CM:CL) is up by nearly 2.15% today as the risk of a widening conflict in the Middle East has increased significantly. Israel has threatened reprisals against Iran, though U.S. President Joe Biden has urged restraint, advising against any immediate attacks on Iran’s nuclear facilities. It is important to note here that the Middle East supplies around 33% of the world’s oil. As a result, traders are concerned that the latest escalation could disrupt energy flows if supply routes are blocked or facilities are attacked.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Citigroup Estimates Disruption in Oil Supply

Turning to expert estimates, Citigroup has projected potential disruptions in oil supply. According to a Bloomberg report, citing Citigroup estimates, a significant strike by Israel on Iran’s export infrastructure could potentially remove 1.5 million barrels of oil from daily supply. However, if Israel were to target smaller infrastructure, such as downstream assets, the potential loss could range from 300,000 to 450,000 barrels of daily output.

Reflecting this uncertainty in the oil market, bullish sentiment is growing among traders. In fact, trading of bullish Brent call options hit a record on Wednesday, particularly for contracts targeting $100 per barrel, according to Bloomberg. A call option gives the holder the right, but not the obligation, to buy underlying shares at a predetermined price by a specific date.

Oil Remains in Ample Supply

On the supply front, there are still signs of ample availability. Despite the rising crisis, the Organization of the Petroleum Exporting Countries (OPEC+) plans to ease some of its production curbs, with supply increases set to begin in December after a two-month delay. Key OPEC+ members met virtually on Wednesday and reportedly agreed to proceed with the plan for a 180,000 barrels per day increase in December.

Additionally, U.S. crude oil inventories have shown unexpected growth. Last week, inventories rose by 3.9 million barrels, marking their largest increase in about five months, further indicating that supply may remain steady despite geopolitical tensions.

What Is the Outlook for Oil?

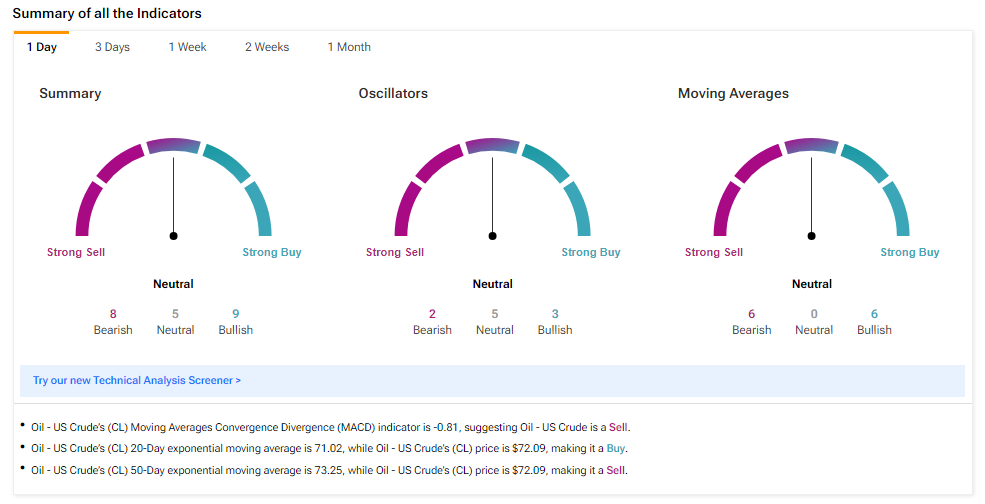

Meanwhile, the TipRanks Technical Analysis tool is flashing a Neutral signal for oil on a daily time frame. This means the price action in oil could remain stable over the coming sessions but could change as the geopolitical situation changes.

Ready to “commodi-tize” your knowledge? Click here to dive into the world of commodities on TipRanks