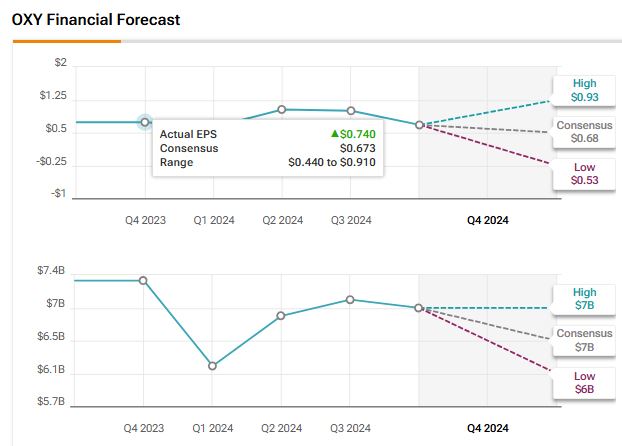

Oil company Occidental Petroleum (OXY) is set to release its Q4 results today. Wall Street analysts anticipate that the company will report earnings of $0.68 per share, reflecting an 8% year-over-year decrease. Meanwhile, revenues are expected to decline by 4.9% from the same quarter last year, reaching $6.98 billion, according to data from the TipRanks Forecast page.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

It’s important to highlight that OXY stock has lost over 15% over the past year due to falling oil prices.

Buffett’s Berkshire Ups Occidental Ahead of Q4 Print

On February 12, Warren Buffett’s Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) has again increased its stake in Occidental Petroleum, bringing it to 28.3%. On February 7, the investment conglomerate bought an additional 763,017 OXY shares valued at $35.72 million. According to Form 4 filed with the SEC on February 11, Berkshire purchased one single lot of Occidental stock at a weighted average price of $46.8195 per share.

Analysts’ Views on OXY Ahead of Q4 Results

Ahead of OXY’s Q4 results, Roth MKM analyst Leo Mariani lowered the price target to $54 from $56 and kept a Neutral rating. The firm raised its 2025 oil price forecast to $71 but noted a slight risk of lower prices due to increased supply from OPEC. However, Mariani believes this could be offset by reduced exports from sanctioned countries like Iran and Russia.

Meanwhile, another analyst, Neil Mehta of Goldman Sachs, downgraded Occidental Petroleum from Neutral to Sell and cut the price target from $54 to $45. He notes that OXY is prioritizing debt reduction following its January 2024 acquisition of CrownRock, which will take years before it can boost shareholder returns. He added that management plans to bring debt down to $15 billion before turning its attention to shareholder distributions. Notably, as of the third quarter of 2024, OXY reported a total debt of approximately $27.6 billion.

As a result, Mehta expects OXY’s stock to underperform peers, especially during market downturns, since it lacks a strong buyback program to support the share price.

Options Traders Anticipate a 5.01% Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 5.01% move in either direction.

Is OXY a Buy or a Sell?

Turning to Wall Street, Occidental is considered a Hold. The average price target for OXY stock is $58.69, implying a 22.12% upside potential.