Shares of Realty Income (O) slipped in after-hours trading after the real estate investment trust (REIT) reported earnings for its second quarter of Fiscal Year 2024. Earnings per share came in at $0.29, which missed analysts’ consensus estimate of $0.36 per share. However, Funds from Operations (FFO), which is the more widely used metric for REITs, came in at $1.07 per share (when normalized to exclude acquisition costs), which beat estimates by $0.02.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

FFO is measured by adding back depreciation and amortization, along with losses incurred on asset sales, to earnings. After that, any gains on asset sales and interest income are subtracted from earnings.

Furthermore, sales increased by 31.4% year-over-year, with revenue hitting $1.34 billion. This beat analysts’ expectations of $1.206 billion. These results were driven by a strong occupancy rate of 98.8% and same-store rent growth of 0.2% year-over-year.

Looking forward, management now expects normalized FFO per share for 2024 to be between $4.19 and $4.29. In addition, same-store rent growth and occupancy rates are expected to be approximately 1% and over 98%, respectively.

Is O Stock a Buy or Sell?

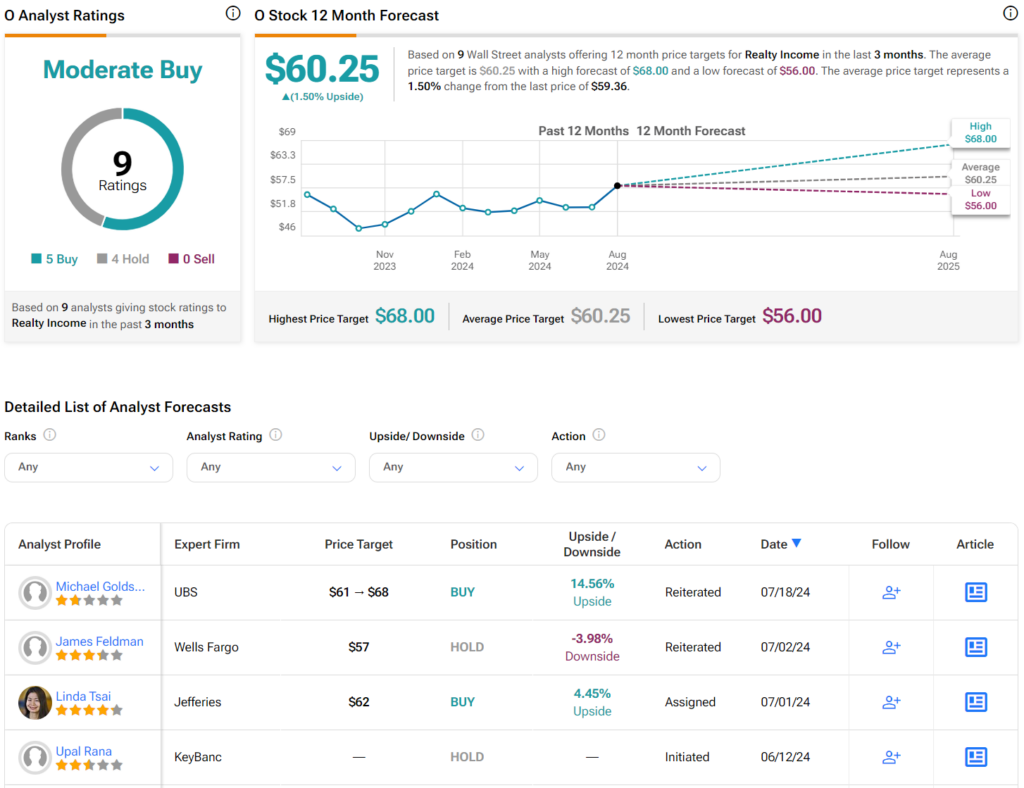

Turning to Wall Street, analysts have a Moderate Buy consensus rating on O stock based on five Buys, four Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 5% increase in its share price over the past year, the average Realty Income price target of $60.25 per share implies 1.5% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.