The New York Stock Exchange is relocating its Chicago division to Dallas, Texas to take advantage of the state’s favorable legal and business environment. This will see NYSE Chicago renamed to NYSE Texas as it seeks regulatory approval to launch the Texas Stock Exchange.

Proving that everything’s bigger in Texas, the Texas Stock Exchange won’t just focus on the area around it. Instead, the NYSE intends for it to be a national securities exchange. This would challenge the two major exchanges in the U.S., the NYSE and Nasdaq. The plan is to launch the exchange in 2026 and attract listings from businesses incorporated in Texas.

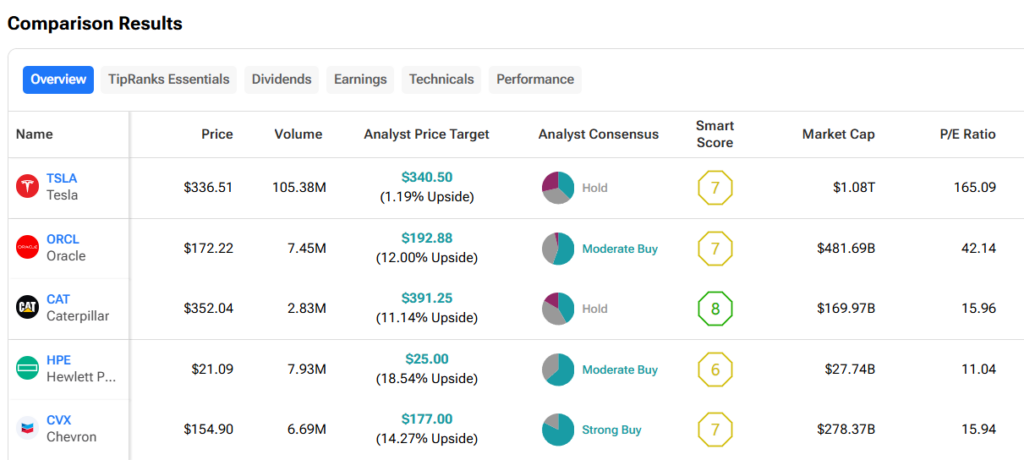

Appealing to Texas businesses is a solid plan as the state has the biggest number of NYSE listings. This comes as several major companies, such as Tesla (TSLA), Oracle (ORCL), and Caterpillar (CAT), have moved their operations to the state.

Big Names Already Back the Texas Stock Exchange

The Texas Stock Exchange has support from BlackRock (BLK) and Citadel Securities and has raised $135 million. The exchange also intends to focus on the top-performing companies with incredibly strict listing standards. While there are roughly 4,400 public companies in the U.S., only about 1,600 of them meet the requirements to be listed on the Texas Stock Exchange.

Hot to Play the NYSE Texas News

The NYSE moving to Texas and opening a new exchange is major news for the stock market. Traders might want to get in on the action early with investments in public companies in the state. A few worth mentioning are Tesla, Oracle, Caterpillar, Hewlett Packard Enterprise (HPE), and Chevron (CVX). Of these five, CVX has the best prospects with a Strong Buy rating and a $177 price target, representing a potential 14.27% upside.

See more Texas stock comparisons

Questions or Comments about the article? Write to editor@tipranks.com