Swiss healthcare giant Novartis (NYSE:NVS) delivered better-than-expected first-quarter results and raised its outlook for the full year.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Novartis’ Robust Q1 Momentum

With a year-over-year increase of 11%, revenue of $11.83 billion came in better than expectations by $390 million. Furthermore, the EPS of $1.80 outpaced estimates by $0.12. This was a 23% growth in the company’s bottom line.

The quarter was marked by robust sales momentum in Novartis’ key products. Sales of Entresto, Cosentyx, and Kesimpta jumped by 36%, 25%, and 66%, respectively. In tandem, Pluvicto and Leqvio sales rose by 47% and 139%, respectively.

Moreover, now that Novartis has completed its transition into a specialized “pure-play” innovative medicines business, it’s concentrating on four main therapeutic areas: cardiovascular-renal-metabolic, immunology, neuroscience, and oncology.

Novartis’ Promising Outlook

Importantly, Novartis has raised its financial outlook for Fiscal Year 2024. Net sales for the year are expected to increase in the high single to low double digits, compared to prior estimates of mid-single-digit growth. Similarly, core operating income during this period is estimated to experience low double-digit to mid-teens growth, in contrast to the previous outlook of a high single-digit increase.

What Is the Target Price for NVS Stock?

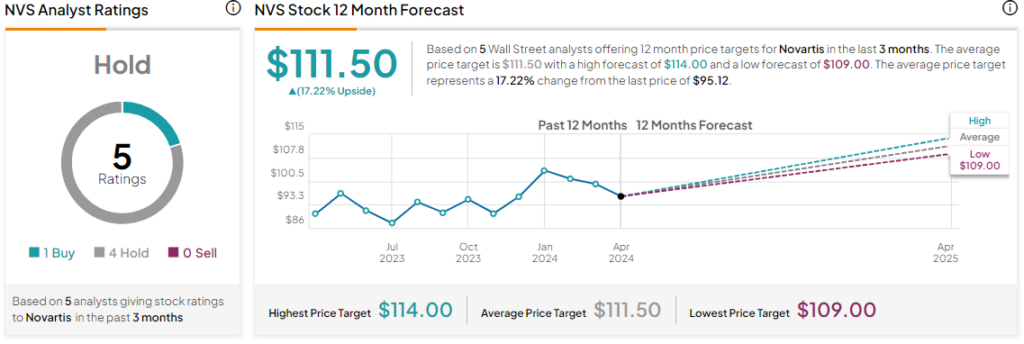

Novartis’ stock price has gradually ticked up by around 23% over the past three years. Overall, the Street has a Hold consensus rating on the stock, alongside an average NVS price target of $111.50. However, analysts’ views on Novartis could see changes following today’s earnings report.

Read full Disclosure