Swiss pharmaceutical giant Novartis (NVS) on Friday reported forecast-beating quarterly sales as its clutch of heart failure to breast cancer drugs delivered robust growth, though missed on its full-year guidance.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The company, which makes the blockbuster heart failure drug Entresto, said net sales rose 16% on a constant currency based in its Fiscal fourth quarter. However, full year sales failed to live up to expectations, rising 12% from the year before to $50.32 billion against $50.47 billion expected.

As is often the case with drugmakers, Novartis said sales were driven by a handful of its key drugs. Sales of Entresto, which loses patent protection later this year, rose 34% to $2.18 billion. Arthritis medication Cosentyx saw sales up 24% in the quarter from a year before to $1.6 billion.

Backing them up, multiple sclerosis self-administered treatment Kesimpta saw sales rise 49% to $950 million, while sales of its breast cancer treatment Kisqali were up 52% to $902 million.

Sclembix, which won US Food and Drug Administration (FDA) accelerated approval for treating adults with leukaemia in October, saw sales jump 66% to $207 million.

NVS Guides Higher

Full-year core operating income jumped 22% to $19.5 billion versus the $17.02 billion forecast.

NVS said net sales in 2025 will grow by “mid- to high single digits” and core operating income will increase by “high single to low double-digits.

It had raised its full-year 2024 guidance in October for a third straight quarter. Shares in Switzerland rose 3% following today’s results.

Patent Cliffs on the Horizon for NVS

NVS will lose patent protection for bestseller Entresto in the middle of the year, highlighting an industry-wide problem as pharmaceutical companies rise to the challenge of loss of exclusivity (LOE) for their bestselling drugs.

Pfizer (PFE) CEO Albert Bourla said there is “clearly a LOE wave that is coming” that will cost the company $17 billion or $18 billion between 2026 and 2028. And Merck (MRK) recently talked up its pipeline as its stares down the loss of exclusivity for its blockbuster cancer drug, Keytruda.

Looking ahead to its development pipeline, Novartis said it has more than 30 assets “with the potential to drive differentiated growth over the long term.”

Key clinical trial results are due this year, including a highly anticipated treatment for prostate cancer.

Is Novartis a Buy or Sell?

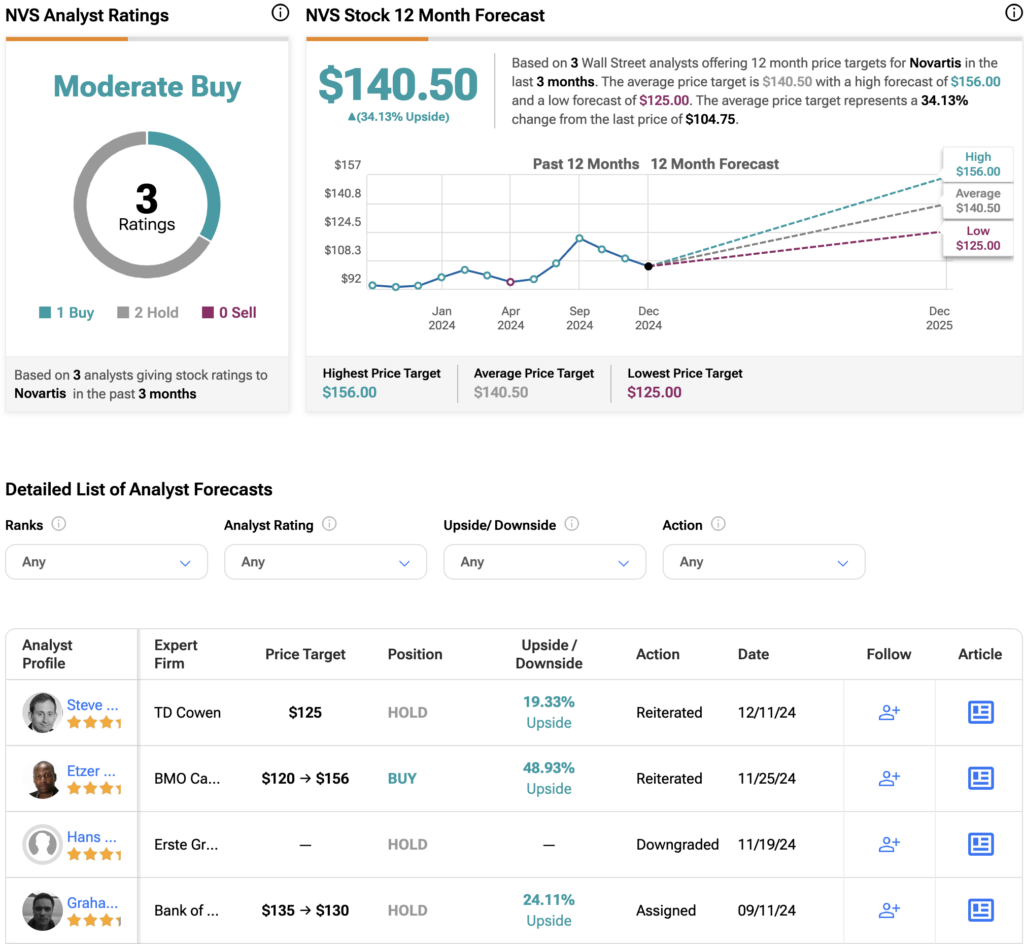

Overall, we can see the consensus analyst rating for NVS is a Moderate Buy, based on three Wall Street analysts offering price targets for NVS in the last three months. The average NVS price target of $140.50 implies 34% upside.