Nvidia (NVDA) isn’t taking its foot off the gas lately, playing both offense and defense in the global AI race. On one front, the chip giant is teaming up with Swedish industrial powerhouses — including AstraZeneca (AZN), Ericsson (ERIC), Saab (SAABF), and SEB, a leading Nordic financial services group, to build the largest enterprise AI supercomputer in Sweden. Backed by the influential Wallenberg family, this project will also see Nvidia set up its first AI technology center in the country.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

CEO Jensen Huang says this is about building “the country’s first AI infrastructure,” setting the stage for scientific and industrial breakthroughs. Saab plans to use the tech to boost defense capabilities, while other partners will tap AI for everything from drug discovery to 5G networks.

What Is Nvidia’s Strategy?

This is a long-term bet. By embedding itself into Europe’s industrial base, Nvidia secures deep roots in stable, high-value markets. It’s also a clear move to diversify away from regions like China, where the rules are shifting fast.

And that brings us to Nvidia’s second major play: launching a new, lower-spec AI chip for China. After U.S. export controls effectively banned Nvidia’s high-performance H20 chip, the company had to scrap $5.5 billion in inventory and walk away from $15 billion in potential sales.

Now, Nvidia is rolling out a toned-down chip based on its latest Blackwell architecture. It’s expected to be called the RTX Pro 6000D or B40, priced between $6,500 and $8,000 — much cheaper than the H20’s $10K+ price tag. It’ll use standard memory and avoid the advanced packaging tech that triggered U.S. restrictions.

The goal is clear: Stay in China’s $50 billion data center market without crossing red lines. But it’s not all good news. Nvidia’s China market share has dropped from 95% to 50%, and Huawei’s homegrown AI chips are gaining steam quickly.

However, the bottom line is that Nvidia is adapting quickly. In Europe, it’s building lasting AI infrastructure. In China, it’s squeezing value from what’s left. For investors, this shows Nvidia’s global reach and agility, even under intense political and regulatory pressure.

Is NVDA stock a Good Buy?

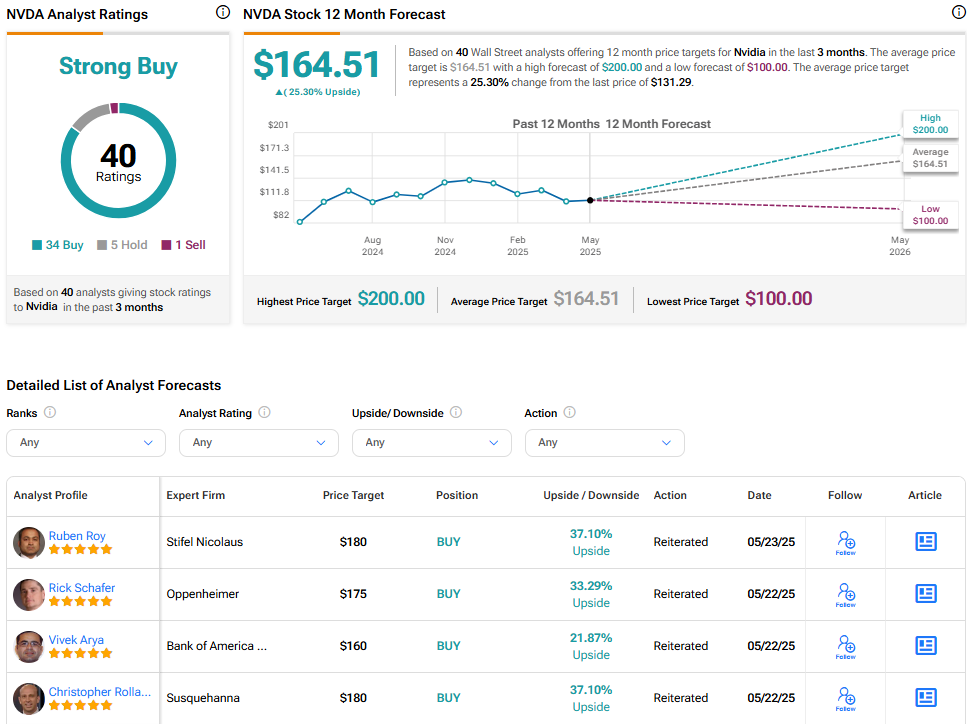

According to The Street’s analysts, Nvidia has a Strong Buy rating and an average NVDA stock price target of $164.51. This implies a 25.30% upside.