Nvidia (NVDA) may take its partnership with OpenAI to the next level. According to a Wall Street Journal report, the chipmaker has discussed guaranteeing some of OpenAI’s loans, a step that could make it responsible for billions in potential liabilities if OpenAI cannot cover its debts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The arrangement follows Nvidia’s existing $350 billion leasing deal with OpenAI to supply up to five million chips, used to train the company’s next generation of AI models. These chips form the backbone of OpenAI’s sprawling infrastructure push, which includes massive data center projects across the U.S.

Guaranteeing the loans would effectively make Nvidia a financial backstop for its biggest customer, blurring the line between supplier and underwriter. This could raise questions about circular financing, where the same companies fueling AI growth are also indirectly financing one another’s bets.

Markets React Cautiously as AI Financing Gets Complicated

Investors reacted cautiously. Nvidia stock slipped 0.1% in pre-market trading after falling 0.3% on Monday, mirroring broader market hesitancy. The S&P 500 (SPX) was little changed, as traders weighed whether the report signaled greater opportunity or greater risk.

While Nvidia remains the undisputed hardware leader of the AI revolution, the structure of its deals is drawing closer scrutiny. Analysts worry that financing arrangements linking Nvidia, OpenAI, Oracle (ORCL), and CoreWeave (CRWV) could create feedback loops that magnify exposure across the ecosystem.

If OpenAI’s growth slows or its cash flow tightens, Nvidia could find itself indirectly holding the bag for the very loans that helped build OpenAI’s infrastructure.

AI Expansion Creates Opportunity and Exposure

The Journal report comes just months after Nvidia announced plans to invest up to $100 billion in OpenAI, a move that underscored its long-term confidence in the AI sector. OpenAI, valued at $500 billion, is on track to generate $13 billion in revenue this year.

Still, its expansion has been aggressive. OpenAI has signed a $300 billion cloud deal with Oracle, up to $22.4 billion in contracts with CoreWeave, and a multibillion-dollar chip deal with Broadcom (AVGO). Each layer of financing raises the stakes for Nvidia, whose chips power nearly every large-scale AI training cluster in operation.

If Nvidia guarantees OpenAI’s borrowing, it could extend its influence even deeper into the AI supply chain, but also tie its fortunes more tightly to the financial health of its customers.

Nvidia Stock Stays Steady but Sentiment Shifts

For now, Wall Street seems divided. Some analysts view the reported guarantee as a strategic move, one that ensures Nvidia remains indispensable to OpenAI’s growth and the broader AI ecosystem. Others see it as a sign of overreach, with Nvidia taking on risks better suited for lenders.

Among peers, Advanced Micro Devices (AMD) edged up 0.2%, while Broadcom added 0.1% in pre-market trading. AI infrastructure stock CoreWeave (CRWV) slipped more than 4%, continuing its recent volatility.

In conclusion, Nvidia’s dominance in AI has made it the most powerful hardware player of the decade, but that dominance now comes with higher financial and reputational stakes.

If it moves forward with backing OpenAI’s debt, Nvidia will be helping finance the AI boom.

Is Nvidia Stock a Buy, Sell, or Hold?

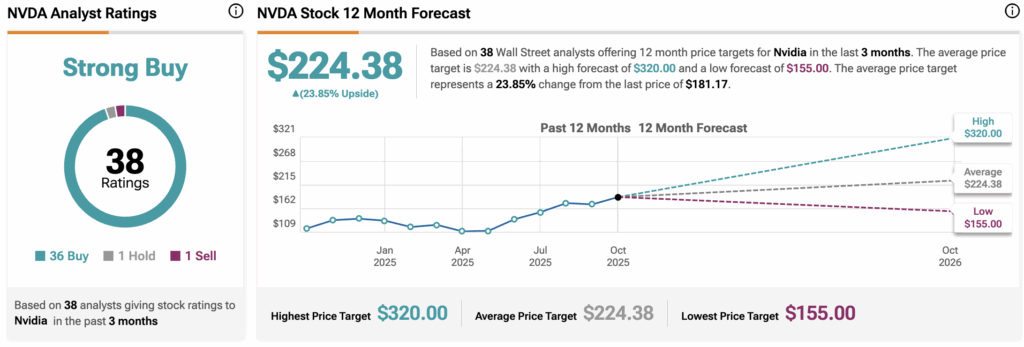

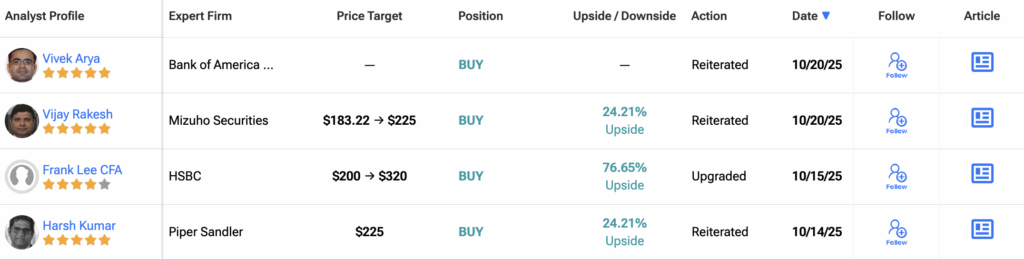

According to TipRanks, NVDA stock has a Strong Buy consensus rating based on 36 Buys, one Hold, and one Sell assigned in the last three months. At $224.38, the Nvidia average share price target implies a 23.9% upside potential from the current level.