Nvidia stock climbed after Amazon boosted AI spending plans and the chipmaker announced massive new partnerships across South Korea, including a 50,000-GPU deal with Samsung.

Nvidia Stock Struts Higher on Amazon’s AI Splurge and Korea Boost

Story Highlights

Nvidia shares (NVDA) were up 1.1% to $205.16 on Friday after a rough session the day before. The stock fell 2% on Thursday, so today’s move is a quick rebound. The driver is new confidence from Amazon (AMZN).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Executives said capital spending will be about $34.2 billion this quarter and about $125 billion for the full year, with more to come in 2026. A large slice of that money goes to Nvidia hardware that powers artificial intelligence in Amazon’s cloud.

Amazon Signals Ongoing Purchases of Nvidia Gear

Amazon’s message was not subtle. CEO Andy Jassy told analysts, “We have a very deep relationship with Nvidia. We have for a very long time. And we will for as long as I can foresee the future.”

He added, “We are not constrained in any way in buying Nvidia, and I expect that we’ll continue to buy more Nvidia both next year and in the future.” This is the kind of language investors want to hear when they are trying to gauge demand for AI chips.

Nvidia Strikes New Partnerships In South Korea

At the same time, Jensen Huang is in South Korea meeting customers and announcing deals. Nvidia said Korean partners will deploy more than 260,000 GPUs across the country. A GPU is a graphics processing unit. In AI, it is the workhorse chip that trains and runs large models.

Huang connected Korea’s strengths to the AI buildout. “Korea’s leadership in technology and manufacturing positions it at the heart of the AI industrial revolution,” he said. He added that the country can now “produce intelligence as a new export.” This is a powerful framing for investors who think in terms of national capacity and long demand cycles.

Samsung Plans a Megafactory Using 50,000 Nvidia GPUs

One centerpiece is Samsung’s (SSNLF) plan for a “megafactory” built on more than 50,000 Nvidia GPUs. Samsung aims to apply that compute to semiconductors, mobile devices, and robotics. The two companies also plan to keep working together on advanced memory and manufacturing services.

The scale of this is key. A 50,000 GPU build means long purchase schedules, deep software integration, and a steady stream of replacement and expansion orders. This type of footprint often creates multi-year revenue visibility for a supplier like Nvidia.

AI Demand Ripples across The Chip Sector

The positive tone reached peers as well. AMD (AMD) was up about 2.1% in early trading. Broadcom (AVGO) was roughly flat. Investors are sorting through who benefits most from hyperscale spending and who gets the follow-on orders for networking, memory, and custom silicon.

The larger theme is unchanged. Cloud giants say AI demand still exceeds supply. When the buyers keep saying they cannot get enough capacity, the chip makers and their key partners tend to hold pricing power and backlog.

Why This Is Important for Nvidia Right Now

Today’s move is modest, but the signals are strong. Amazon’s spending plan points to sustained purchases. Korea’s announcements show global demand is broad, not just centered in the United States. Together they suggest that the AI buildout is still in the early innings.

For Nvidia, that means two things. First, a clear customer who is willing to keep buying at scale. Second, new national-level projects that lock in thousands of GPUs for years. Those are the building blocks of durable revenue, even if the stock takes breathers along the way.

What Should Investors Look Out For Next?

Watch Amazon’s capital spending cadence through year-end and into 2026. If the numbers hold or rise, Nvidia’s order book should stay firm. Track the rollout of the Korean deployments, especially Samsung’s megafactory milestones. Big projects like these usually come with follow-on phases.

Keep an eye on supply conditions too. If supply loosens faster than expected, pricing could normalize. If supply stays tight, the winners will be the companies that can deliver compute at scale. Today, Nvidia still sits in that seat.

Is Nvidia a Good Stock to Buy Now?

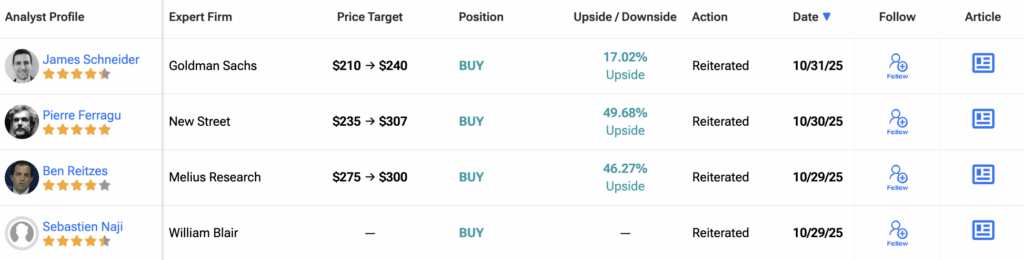

According to TipRanks data, Wall Street analysts remain overwhelmingly bullish on Nvidia. Out of 38 analysts, 36 rate the stock a Buy, one calls it a Hold, and just one recommends a Sell. This is as strong a consensus as it gets in the chip sector.

The average 12-month NVDA price target now sits at $233.82, suggesting a potential 14% upside from the current price.

1