Nvidia shares (NVDA) edged lower on Wednesday morning after closing at a record high the day before. The AI chipmaker, which briefly touched a $4.5 trillion market value, is now facing new questions as one of its largest customers accelerates efforts to build alternatives.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Nvidia stock dipped 0.6% in premarket trading to $185.44 after rising 2.6% on Tuesday. The slip came as Meta (META) announced plans to acquire chip startup Rivos to strengthen its custom silicon program, the Meta Training and Inference Accelerator (MTIA).

Meta Pushes Forward with MTIA

Meta’s MTIA chips debuted in 2023 and were designed with Broadcom. Company executives have said the chips could eventually replace Nvidia GPUs in parts of its data centers, cutting costs and boosting efficiency.

In a LinkedIn post on Tuesday night, Meta’s VP of engineering Yee Jiun Song confirmed the acquisition, saying Rivos’ “deep technical expertise and experience designing and developing the full stack of AI systems” will accelerate the roadmap.

Meta has already invested billions in Nvidia hardware, but building in-house capacity gives it more control over performance and supply. The strategy mirrors moves by other hyperscalers to balance reliance on third-party suppliers.

Nvidia Demand Remains Strong But Rivals Close In

Even as Meta builds MTIA, it continues to spend heavily on Nvidia gear. Last week, the company agreed to a deal worth up to $14.2 billion with CoreWeave, an AI infrastructure firm that rents out Nvidia-powered compute. This reinforces near-term demand and shows Nvidia’s position at the center of the AI buildout.

The challenge comes later. If Meta’s chips mature, some workloads could move away from Nvidia. Combined with competing efforts at Google (GOOGL), Amazon (AMZN), and Microsoft (MSFT), that creates the possibility of a more competitive AI chip market over time.

Nvidia Faces a Long-Term Test

Analysts say Nvidia’s software ecosystem, led by CUDA, remains a major moat. But investors will be looking out for signs that in-house chips from big buyers start to meaningfully displace demand.

At the moment, Nvidia remains the default choice for AI workloads. The stock’s record-breaking run reflects that dominance. But as Meta ramps up MTIA with the help of Rivos, the long-term question is whether Nvidia can maintain the same grip on the industry it enjoys today.

Is Nvidia a Good Stock to Buy?

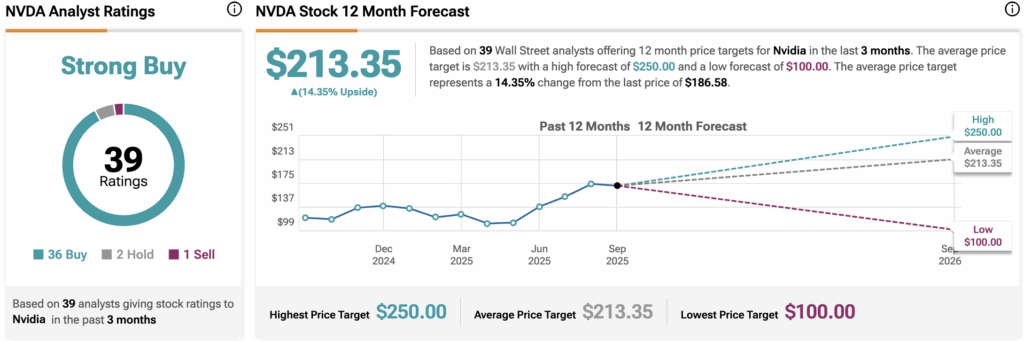

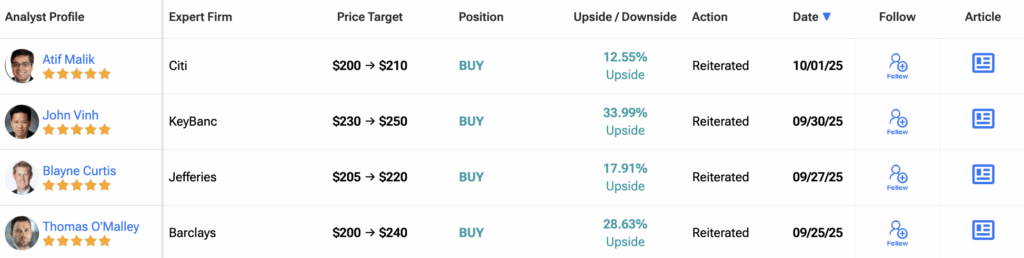

Wall Street sentiment remains highly supportive of Nvidia despite the recent pullback. Out of 39 analysts covering the stock in the past three months, 36 recommend a Buy, two suggest a Hold, and only one advises a Sell. The consensus rating is a Strong Buy.

The average 12-month NVDA price target sits at $213.35, representing a 14% upside from the current price.