Artificial intelligence has become the defining race of this decade, and two of the world’s biggest companies are leading it. Nvidia (NVDA) and Microsoft (MSFT) both made massive investments in OpenAI, but for very different reasons.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Nvidia’s investment is centered on the hardware driving the AI revolution. Microsoft’s is built on integrating AI into the cloud and software tools used by millions worldwide. Both companies now sit at the center of the AI boom, but investors are wondering which one holds the advantage moving forward.

Moreover, timing has played a critical role. Microsoft made its move early, gaining a crucial head start in commercial AI adoption. Nvidia entered later, but its partnership may secure its role as the foundation of the world’s AI infrastructure for decades to come.

Nvidia Strengthens Its Hold on AI Infrastructure

Nvidia is investing up to $100 billion in OpenAI to cement its position at the core of artificial intelligence. The partnership ensures that OpenAI, one of the largest developers of AI systems, will remain a major customer for Nvidia’s graphics processing units.

This deal creates a cycle of innovation that benefits both companies. OpenAI gains reliable access to high-performance hardware, while Nvidia gains insight into the evolving needs of AI systems. This collaboration helps Nvidia design future chips tailored for advanced workloads, keeping rivals like AMD (AMD) and Broadcom (AVGO) from closing the gap.

In addition, Nvidia’s software ecosystem reinforces its lead. Its CUDA platform has become the global standard for AI development, and NVLink allows its GPUs to function as a unified supercomputer. Combining that foundation with its OpenAI investment solidifies Nvidia’s role as the essential infrastructure provider for the entire AI economy.

Microsoft Expands Its AI Reach Through Cloud and Software

Microsoft’s early investment in OpenAI reshaped its business. The company used the partnership to build new services and products that integrate artificial intelligence directly into its operations.

The Azure OpenAI Service, launched through this collaboration, allows businesses to run OpenAI’s most powerful models on Microsoft’s cloud infrastructure. This offering has fueled a sharp rise in Azure’s growth, with enterprise demand for AI services climbing faster than expected.

Adding to this, Microsoft brought AI to its productivity apps through Copilot, an assistant that helps users write, analyze, and code across Word, Excel, and Outlook. The $30 monthly subscription has become a new revenue stream and strengthened Microsoft’s position as the leader in practical, enterprise-ready AI.

Furthermore, Microsoft continues to benefit from its early access to OpenAI’s newest technologies. This advantage lets the company deploy new tools faster and at a lower cost than competitors, giving it a durable lead in AI-enabled enterprise software.

Both Companies Shape the Future of AI in Different Ways

Nvidia and Microsoft may share a partner in OpenAI, but they occupy different roles in the AI landscape. Microsoft turned its early investment into real-world products that drive immediate revenue growth. Nvidia’s move focuses on the technology that makes all of those products possible.

In many ways, Nvidia is building the digital backbone of artificial intelligence, while Microsoft is defining how people use it. Their strategies complement each other but also reveal two sides of the same race: one focused on infrastructure, the other on innovation.

As global demand for AI accelerates, both companies remain positioned for continued strength, though their growth will play out on different timelines.

Both Stocks Offer Two Different Kinds of AI Opportunity

Microsoft’s early access to OpenAI turned its AI ambitions into tangible profits through cloud and software integration. Nvidia’s later move secured its leadership in the chips that power those technologies and positioned it for the next phase of AI expansion.

If the question is which company made the smarter OpenAI deal, Microsoft holds the edge. But for investors focused on long-term potential, Nvidia’s role in building the hardware foundation of artificial intelligence could deliver more sustained growth in the years ahead.

Analysts Maintain Strong Buy Ratings on Both Stocks

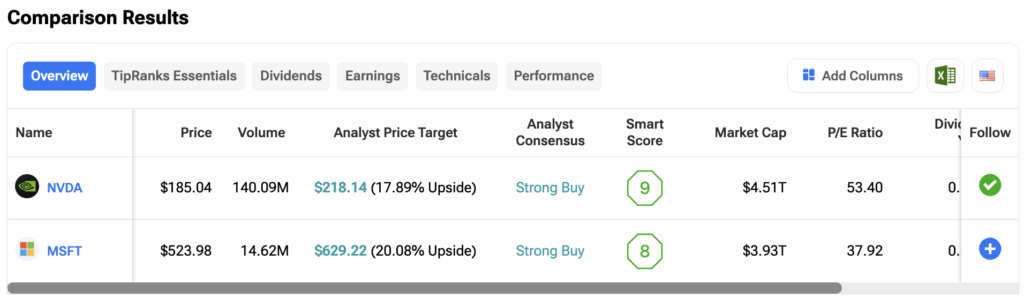

According to data from TipRanks, both Nvidia and Microsoft hold a “Strong Buy” analyst consensus. Nvidia stock trades at $185.04, with an average price target of $218.14, suggesting a 17.89% upside. Microsoft stock is priced at $523.98, with analysts targeting $629.22, reflecting a potential 20.08% gain.

Nvidia currently carries a Smart Score of 9, slightly ahead of Microsoft’s 8, highlighting stronger sentiment from analysts and institutional investors. Both companies remain among the most favored AI stocks on Wall Street, backed by their continued growth in artificial intelligence and cloud technology.

Investors can compare Nvidia and Microsoft stocks side by side using various analyst ratings and financial metrics on the TipRanks Stocks Comparison Tool. Click on the image below to explore the tool.