Nvidia clawed back some ground after last week’s heavy losses, with shares closing up 3.5% at $97.64 on April 7. The rebound follows a punishing few days that saw the stock dip below the $100 mark amid Trump’s surprise tariff crackdown. The fear? Rising trade tensions could slam chip demand and spook enterprise buyers. But Nvidia’s AI dominance may be doing just enough to offset the heat.

Tariff Shock Sparks Sector-Wide Semiconductor Selloff

At the start of April, Nvidia got swept up in a brutal tech selloff. The Philadelphia Semiconductor Index fell nearly 10% in a single session, blowing past even the S&P 500’s 5% slide. Investors were reacting to Trump’s 34% tariff on Chinese imports, with retaliation from Beijing kicking in fast. While Nvidia isn’t directly tariff-exposed on hardware, the sector panic still dragged it down hard.

AI Sales Provide Powerful Cushion for Nvidia Bulls

Still, there’s a reason the stock is bouncing back. In its latest earnings report, Nvidia announced a jaw-dropping $39.3 billion in Q4 revenue—up 78% from the year before. The company’s data center division brought in $35.6 billion alone. According to CEO Jensen Huang in Nvidia’s official statement, “Demand for Blackwell is amazing as reasoning AI adds another scaling law.” Translation? Nvidia’s AI chips are still flying off the shelves.

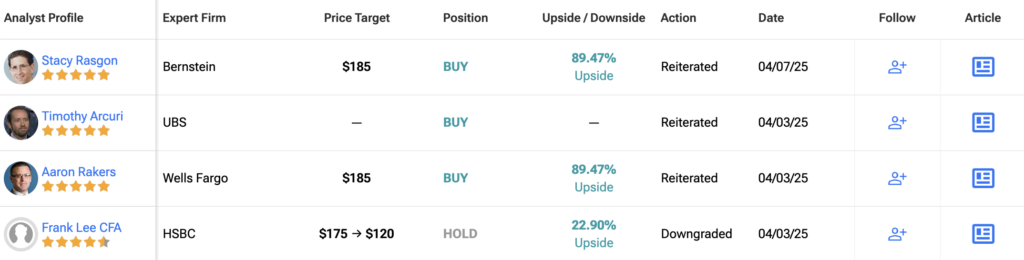

Wall Street Holds Mixed Views on NVDA’s Path Forward

Some analysts argue Nvidia is oversold and due for a rebound. Others are more cautious. In a note shared with Investors.com, analysts warned the stock’s steep run-up could leave it exposed if tariffs choke enterprise sentiment. Semis may not be hit immediately—but sentiment doesn’t always follow logic.

Even though the macro picture is still unclear, Nvidia’s strength in AI may be the only reason bulls are still in the game. Nvidia’s fighting back—and doing it with chips that every data center still wants.

Is NVDA a Buy or Hold?

That confidence isn’t just coming from the numbers—analysts are backing it too. Nvidia holds a Strong Buy consensus, with 37 analysts rating it a Buy and just four on Hold. Not a single Sell in sight. The average NVDA stock price target stands at $175.06, which suggests a 79.3% climb from here. If Wall Street’s right, this bounce could be the opening act—not the finale.