Nvidia (NVDA) stock has risen 10.3% over the past five days as investors moved back into tech and artificial intelligence (AI) names in a year-end rally. NVDA stock is up more than 40% year-to-date. While concerns about elevated AI spending and lofty valuations, rising competition in the AI chip space, and uncertainty related to China chip exports could weigh on investor sentiment over the near term, several top analysts are bullish on the chip giant and see strong upside potential in NVDA stock heading into 2026.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Top Analysts See Strong Upside in NVDA Stock

Recently, Bernstein analyst Stacy Rasgon reiterated a Buy rating on Nvidia stock with a price target of $275 following an investor meeting with Stewart Stecker, senior director of investor relations at Nvidia, as part of his firm’s 2nd annual Asia Semiconductor Forum. Rasgon believes that Nvidia CEO Jensen Huang’s forecast of $500 billion in cumulative Blackwell, Rubin, and networking sales through 2025 and 2026 will likely be higher, given that it doesn’t include new deals, including the Anthropic (PC:ANTPQ) collaboration, agreements in the Middle East, and the OpenAI (PC:OPAIQ) 10 GW deployment.

Rasgon also noted that while Nvidia acknowledges the progress that Alphabet-owned Google (GOOGL) has made in its more than 10-years journey in the chip space, the company believes that it is about two years ahead of Google’s TPU (tensor processing unit) program. Management highlighted that Nvidia’s chips have better performance, better token throughput, and higher revenue generated per data center compared to Google’s TPUs.

Likewise, Jefferies analyst Blayne Curtis reiterated a Buy rating on Nvidia stock with a price target of $250. While the 5-star analyst called Broadcom (AVGO) his top pick for 2026 in the semiconductors space due to the magnitude of upside to consensus estimates, he remains bullish on Nvidia, given its technology moat and attractive valuation. Curtis contends that concerns around Nvidia are “largely overdone,” with Blackwell Ultra rollout fully underway and Rubin on track to ramp in the second half of 2026.

“We continue to view NVDA as the technology leader in the space and expect another significant leap forward with Vera-Rubin and NVLink 6 in 2H26,” said Curtis. He expects the launch of the latest large language models (LLMs) backed by Blackwell in the first half of 2026 to act as a catalyst for NVDA stock. Also, Curtis expects higher hyperscaler capital spending and rising focus on AI inference to benefit NVDA’s new CPX chip, scheduled to be released in the second half of 2026.

Is NVDA a Good Stock to Buy?

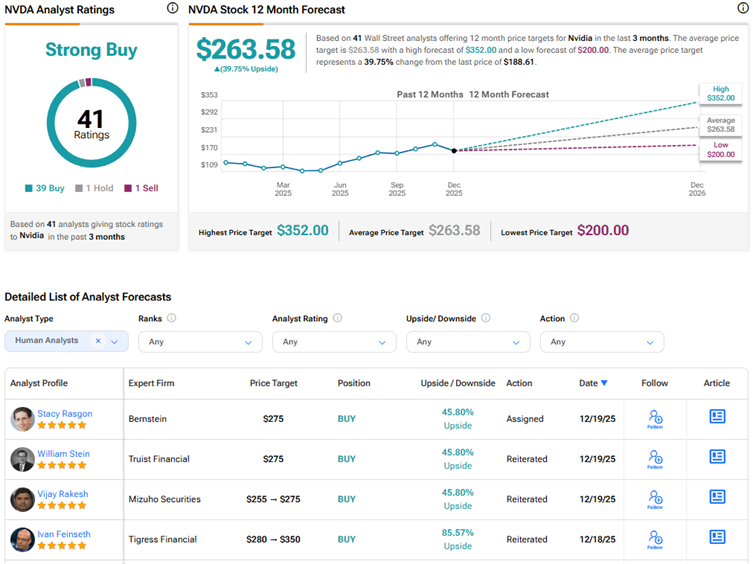

Overall, Wall Street has a Strong Buy consensus rating on Nvidia stock based on 39 Buys, one Hold, and one Sell recommendation. The average NVDA stock price target of $263.58 indicates about 40% upside potential.