Nvidia (NVDA) stock has surged 7.5% over the past five trading days amid the year-end “Santa Claus” rally. Despite early December jitters among tech and artificial intelligence (AI) names, Nvidia has gained 3.6% over the past month. Yet, Evercore ISI analyst Mark Lipacis expects the chip giant’s shares to surge a further 86% in 2026, citing Nvidia’s continued dominance in the AI space. However, Nvidia faces ongoing China export issues, macro headwinds, and AI demand variability, which could impact its stock performance going forward.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge-fund level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

In his latest stock review, Lipacis lifted Nvidia’s price target from $261 to $352, implying 86% upside from the current levels of $189.21 per share. The five-star analyst ranks #42 out of 10,201 analysts tracked on TipRanks. He has a 68% success rate and an impressive average return per rating of 27.10%.

Nvidia Is the AI Ecosystem of Choice

Lipacis was impressed by Nvidia’s blockbuster Q3FY26 results, which demonstrated accelerating revenue growth and expanding product availability. He highlighted improvements in the supply of GB200 and GB300, high-performance AI computing platforms based on the Blackwell architecture. He also noted that during Q3, Blackwell compute revenue grew by an estimated 48% quarter-over-quarter, adding over $13 billion to the July quarter figure.

Nvidia stated earlier that it has $500 billion in data-center orders for its Blackwell and more advanced Ruben platforms in 2025-26. Lipacis stated that although supplies remain tight, Nvidia’s higher inventory (up 32% in Q3) and increased supply commitments (up 63% quarter-over-quarter) will help support these massive orders.

To conclude, Lipacis noted that Nvidia’s estimated $493 billion in total 2025 and 2026 revenue is “potentially conservative” given current trends, underscoring the stock’s potential upside if demand and execution stay strong. His $352 price target is based on applying a 35x multiple to the Base Case CY2030 earnings per share (EPS) of $14.74, with the valuation discounted back to 2026.

Is Nvidia Stock a Buy Before 2026?

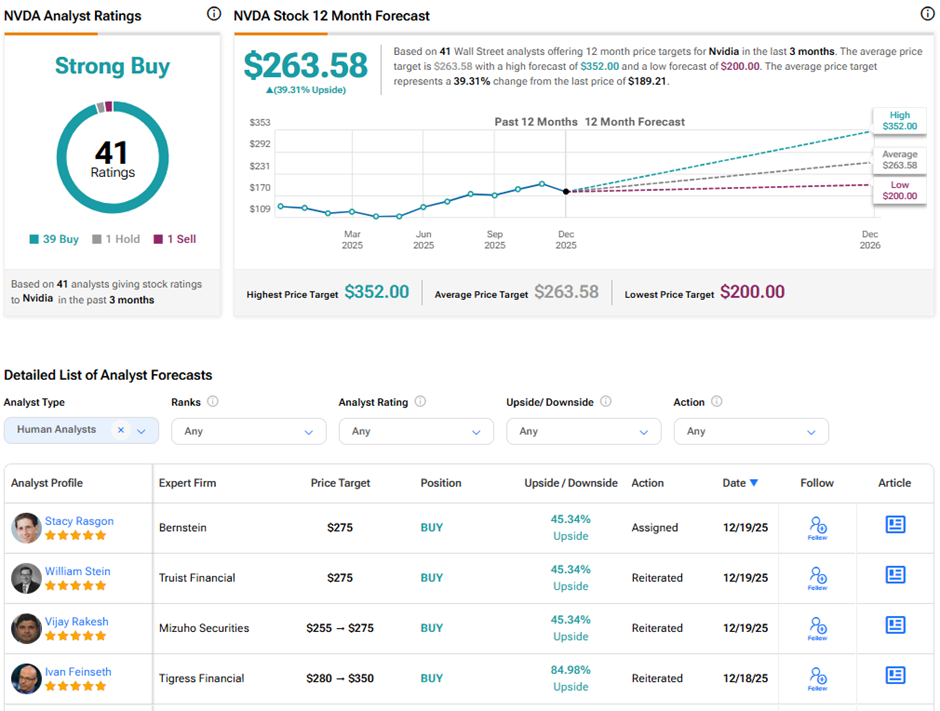

Wall Street remains highly optimistic about Nvidia’s long-term outlook. On TipRanks, NVDA commands a Strong Buy consensus rating based on 39 Buys and one Hold and Sell rating each. The average Nvidia price target of $263.58 implies 39.3% upside potential from current levels. Year-to-date, NVDA stock has gained nearly 41%.