Nvidia (NVDA) stock is entering 2026 on a positive footing, supported by several catalysts that could bolster its already elevated valuation. Investors will be watching for clarity on Nvidia’s $20 billion Groq acquisition, the upcoming CES event, H200 chip exports to China, and other developing factors as the year unfolds.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

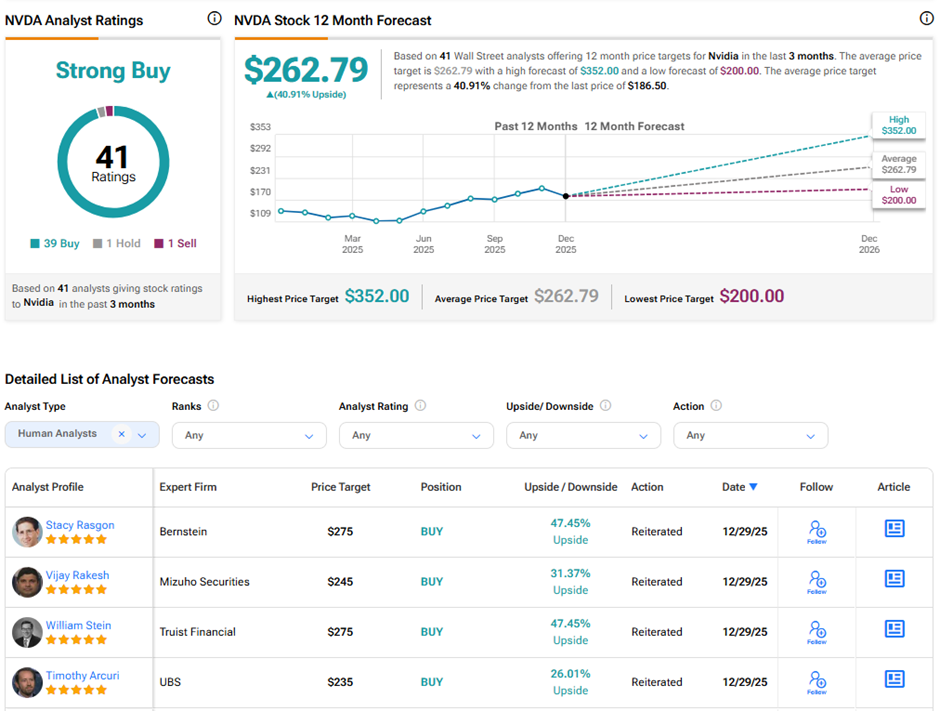

At this crucial juncture, it is worth noting that NVDA stock is trading at roughly a 12% discount to its 52-week high of $212.19, reached on October 29, 2025. Meanwhile, Wall Street is predicting a 41% surge in Nvidia shares in 2026, compared with a 34.8% gain in 2025.

Groq’s LPUs vs. Nvidia’s GPUs

Last week Nvidia announced it would acquire assets of AI-chip startup Groq, marking one of its largest acquisitions to date. Nvidia will license Groq’s chip technology and recruit several senior Groq leaders, including founder Jonathan Ross and President Sunny Madra.

TD Cowen analyst Joshua Buchalter highlighted the rationale for the deal and clarified the differences between Nvidia’s GPUs (Graphics Processing Units) and Groq’s LPUs (Language Processing Units). Groq, founded by former Google (GOOGL) engineers, is known for its inference chips that accelerate responses to user queries.

Groq employs a spatial dataflow approach for low-latency inferencing, reduced jitter, and lower-power operation. Its architecture is deterministic, executing operations in a fixed order to minimize hardware scheduling overhead. This makes Groq fast but potentially less flexible than GPUs, which are designed for dynamic scheduling and broader memory use. In practical terms, an LPU is like a high-speed, finely tuned assembly line, whereas a GPU is a busy factory where managers continually assign tasks.

Buchalter noted that Groq’s LPUs are primarily designed for inference, not training. Nvidia’s adoption of an inference-focused architecture signals that low-latency inference is now a mature market. Historically, investments were focused on training needs, with the expectation that today’s training chips could evolve into inference engines tomorrow.

Jensen to focus on Data Centers and Physical AI

CES (Consumer Electronics Show) 2026 is an annual event that is set to take place in Las Vegas from January 6 to 9. The event gathers cutting-edge consumer electronics, AI, automotive tech, and digital health, with hundreds of exhibitors and numerous product launches and keynote speeches. Nvidia CEO Jensen Huang and rival AMD (AMD) CEO Lisa Su are expected to deliver keynotes, with Huang appearing on January 5.

Wedbush analyst Daniel Ives expects Huang to emphasize data centers, physical AI, and robotics in his keynote. He also suggests Nvidia could highlight the Cosmos platform for accelerating AI development and discuss autonomous technology as a major theme for 2026. CES announcements can influence stock prices in the short term, particularly for companies unveiling new products, partnerships, or indications of technology leadership. Investors will closely watch CES updates for signals about Nvidia and its peer.

H200 AI Chip Exports to Boost Nvidia Sales

China remains a largely untapped market for Nvidia due to strict export restrictions. The U.S. administration recently allowed Nvidia to sell its H200 AI chips to the country. Exports of the H200 chips could boost Nvidia’s 2026 revenue by unlocking a large new sales channel in China, potentially adding multi-billion-dollar annual revenue if demand scales as expected and shipments ramp smoothly.

Taiwan Semiconductor Manufacturing (TSM) produces the H200 chips based on Nvidia’s Hopper architecture, using a 4-nanometer process. Nvidia has asked TSMC to increase production to meet rising demand. Reports indicate Chinese tech firms have placed orders for several hundred thousand H200s for 2026, with total orders potentially in the millions. Current stock is around 700,000 units, suggesting a potential expansion in supply if orders materialize. Reportedly, ByteDance, the parent company of TikTok, is expected to spend around $14 billion on Nvidia AI chips in 2026, which could include the H200 chips.

Is NVDA Stock a Buy in 2026?

Analysts remain highly optimistic about Nvidia’s long-term prospects. On TipRanks, NVDA stock has a Strong Buy consensus rating based on 39 Buys, one Hold, and one Sell rating. The average Nvidia price target of $262.79 implies 41% upside potential from current levels.