Nvidia (NVDA) is a tech titan that only seems to get bigger, and the share price only seems to go up – until it doesn’t anymore. The fall could be steeper than anyone ever expected, and it’s already in progress. I wouldn’t dare bet against Nvidia, but I am neutral on NVDA stock as a healthy and necessary pullback is afoot, and it could last for a while.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Nvidia designs processors, including graphics processing units (GPUs) that are built to handle intense artificial intelligence (AI) workloads. Nvidia became a darling of the financial market due to the popularity of generative AI applications and the demand for hardware to support these applications.

Over the past year and a half, Nvidia’s investors had opportunities to take profits and wait for a drawdown. That drawdown is happening now, as you can see below, and there’s no need to rush into a trade right now, even if you like Nvidia as a company.

The Justice Department Probes Nvidia

One of the problems with being a dominant giant in a particular field is that sometimes regulators will come knocking. This is happening to Nvidia now, as a report from The Information indicates that the U.S. Department of Justice (DOJ) is investigating whether Nvidia may be engaging in unfair trade practices to sell more of its advanced AI chips.

The DOJ alleged that Nvidia “threatens” customers buying chips from other semiconductor companies and is looking into whether Nvidia overcharges customers for networking gear if they buy chips from rivals. Additionally, there are concerns about Nvidia possibly acquiring AI start-ups in order to suppress potential competition and strengthen its position.

Since Nvidia controls a nearly 80% share of the AI chip market, I’d say that this type of probe was bound to happen sooner or later. The issue is that some investors didn’t anticipate this type of problem. They were distracted by Nvidia’s rapid expansion and didn’t stop to think about whether regulators would investigate the company.

Any DOJ investigation is bound to cost a company financially while also diverting its human capital. Nvidia may have to deal with the “monkey on its back” for months or even years, as the DOJ isn’t known for moving through the legal process quickly. Consequently, Nvidia’s shareholders might choose to take profits, since some of them are still up by 50%, 100%, or more.

Nvidia Chip Delay Causes Dismay

Nvidia’s valuation and share price ballooned over the past year and a half. This was based on Nvidia’s strong revenue and earnings growth, to a certain extent. However, there was also an assumption that the company would continue to introduce new, game-changing chips to the market in a timely manner.

Nvidia seemed to have a perfect track record of timely chip releases, so what could possibly go wrong? Actually, no company is always 100% perfect in every way, and even Nvidia can disappoint the market with a chip-release delay.

That’s exactly what’s happening now, according to a report from The Information (via TheFly). Apparently, Nvidia’s upcoming AI chips “will be delayed by three months or more due to design flaws.” Because of the design issues, Nvidia is conducting new test production runs with Taiwan Semiconductor Manufacturing Company (TSM).

As a result, Nvidia’s timeline for large-scale shipments of its upcoming AI chips will be delayed to the first quarter of 2025. There will be ripple effects, as clients, including Meta Platforms (META), Alphabet’s (GOOG) (GOOGL) Google, and Microsoft (MSFT), already placed large orders for these chips.

The point here isn’t to detract from Nvidia’s powerful and popular Blackwell series of chips. Yet, when a company like Nvidia is viewed as all-powerful and infallible, there’s bound to be trouble.

The Nvidia stock drawdown provides an important lesson about what can happen when the market puts a company on a pedestal. It can be painful for bandwagon-jumping investors when that company gets knocked off the pedestal.

Is Nvidia Stock a Buy, According to Analysts?

On TipRanks, NVDA comes in as a Strong Buy based on 37 Buys and four Hold ratings assigned by analysts in the past three months. The average Nvidia stock price target is $142.74, implying 40.7% upside potential.

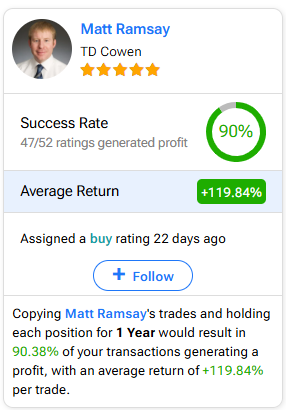

If you’re wondering which analyst you should follow if you want to buy and sell NVDA stock, the most profitable analyst covering the stock (on a one-year timeframe) is Matt Ramsay of TD Cowen, with an average return of 119.84% per rating and a 90% success rate. Click on the image below to learn more.

Conclusion: Should You Consider Nvidia Stock?

It’s actually a healthy development, in my opinion, for Nvidia’s share price and valuation to come down. Normalization will allow Nvidia to move forward in a sustainable manner. For the foreseeable future, however, the company will have to deal with a regulatory probe as well as a chip-release delay.

Therefore, there’s no need to rush into an investment that you might regret later on. It’s fine to just let some of the air come out of Nvidia’s balloon, so to speak. When all is said and done, I am neutral on NVDA stock and wouldn’t consider purchasing it today.