Earlier today, Piper Sandler warned that Nvidia (NVDA) could lose up to 6.45% of its important data-center revenue if companies cut back on spending. This could mean about $9.8 billion in lost revenue if corporate capital expenditures shrink and demand from China stays weak. Indeed, five-star analyst Harsh Kumar explained that in the worst-case scenario, Nvidia’s share price could drop to about $76.25 per share if the revenue loss happens, based on a conservative valuation. As a result of this warning, Nvidia’s stock slipped in today’s trading but recovered some of its losses.

On the other hand, if corporate spending returns to normal and China demand picks up, shares could rise to around $126. While the possible outcomes vary widely, Piper Sandler still sees more chances for gains, mainly because Nvidia is a leader in AI hardware and benefits from strong demand. However, Kumar also pointed out that data-center sales are at the core of Nvidia’s growth, especially in the AI market. Therefore, this makes the company vulnerable to changes in business spending and global regulations.

Even a small decline in this key area could cause big swings in Nvidia’s total revenue and profits. As a result, investors need to consider the risk of losing $9.8 billion in revenue alongside Nvidia’s exciting AI-driven growth potential. Interestingly, though, even with this risk, Piper Sandler kept its Overweight rating and $150 price target, showing that it still believes in Nvidia’s long-term growth.

Is NVDA a Good Stock to Buy?

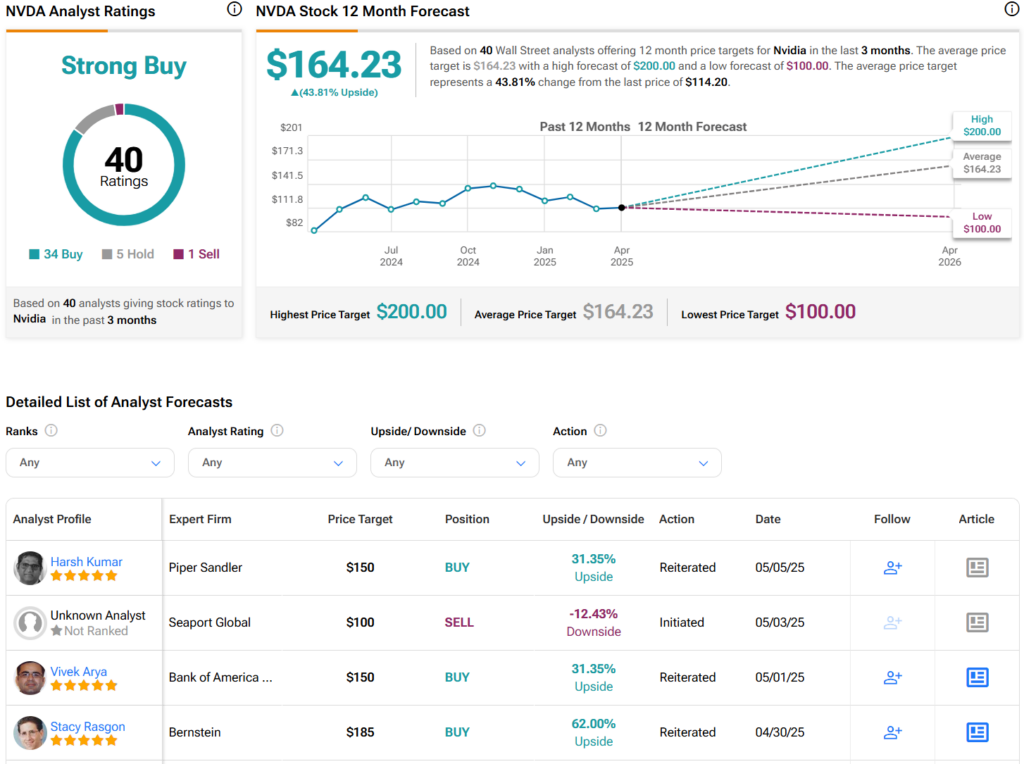

Turning to Wall Street, analysts have a Strong Buy consensus rating on NVDA stock based on 34 Buys, five Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average NVDA price target of $164.23 per share implies 43.8% upside potential.