As markets cheer a 90-day tariff pause between the U.S. and China, Wedbush analyst Dan Ives sees Nvidia (NVDA) as one of the biggest beneficiaries. Shares of the chipmaker surged over 5% following the news, with its market cap topping $3 trillion once again, ahead of Apple (AAPL). The temporary rollback of tariffs, from 145% to 30% on U.S. imports and 125% to 10% on Chinese goods, has soothed supply chain concerns and lifted tech sentiment.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

Other tech giants also rallied on the news, including Amazon (AMZN), up more than 8%, and Apple, which climbed over 6%. But Ives believes Nvidia is in a “dream scenario” as it continues to lead the AI revolution at a time when demand remains red-hot.

But the case for Nvidia goes deeper.

AI Momentum Meets Geopolitical Tailwinds

According to Ives, there’s “only one chip” powering the global AI buildout, and it’s made by Nvidia. With CEO Jensen Huang at the helm, the company is driving AI infrastructure development from Silicon Valley to Saudi Arabia. Ives sees this global expansion as a multi-year opportunity, fueled by sovereign and enterprise investment alike.

Yesterday, Nvidia announced the shipment of 18,000 GPUs to Humain, a Saudi-backed AI startup. As part of the deal, the two companies aim to develop large-scale “AI factories” in Saudi Arabia, with planned capacity reaching up to 500 megawatts. Over the next five years, these data centers are expected to deploy hundreds of thousands of Nvidia’s cutting-edge GPUs. The deal reflects growing international demand for AI hardware, even as the U.S. continues to tighten export restrictions on China.

Yet despite Washington’s efforts, some analysts suggest export curbs on China are difficult to enforce. “It’s just very, very hard to put a net around this stuff,” said Brian McCarthy of MacroLens, noting that chips may still filter into China through unofficial channels.

More Than Just China

Ives emphasizes that the AI opportunity stretches far beyond China. From sovereign governments to hyperscalers, global demand for AI infrastructure continues to accelerate. Nvidia, with its unmatched grip on AI chips, is poised to benefit as spending surges worldwide, according to the analyst.

With tariff relief acting as a near-term tailwind and AI demand showing no signs of slowing, Ives believes Nvidia is well on track to hit “new all-time highs.”

Is NVDA Stock a Buy?

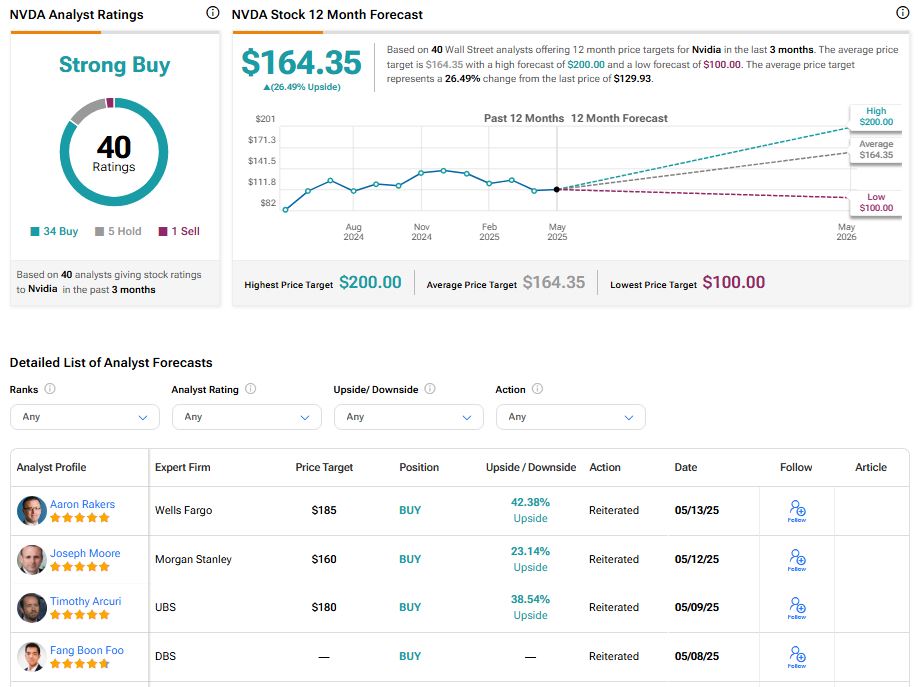

The stock of Nvidia has a consensus Strong Buy rating among 40 Wall Street analysts. That rating is based on 34 Buy, five Hold, and one Sell recommendations assigned in the last three months. The average NVDA price target of $164.35 implies 26.49% upside from current levels.