AI chips sit at the forefront of the current tech boom. As data centers increasingly emphasize parallel computing to support AI workloads, this shift is expected to drive innovation across a wide range of industries, including healthcare, retail, banking, and e-commerce. At the same time, rising shipments of AI-optimized servers are reinforcing demand for advanced chips. Beyond data centers, broader adoption of industrial robotics and automation is also contributing to growth, as AI capabilities become a core requirement rather than a nice-to-have.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

According to MarketsandMarkets, the AI chip industry is projected to grow from $203.24 billion in 2025 to $564.87 billion by 2032, representing a compound annual growth rate of 15.7% over the period.

Much of this expansion has already been visible in equity markets. For several years, AI-focused companies have been among the primary drivers of the broader bull market.

But moving forward, which ones still offer investors the best opportunities? Morgan Stanley analyst Joseph Moore, who ranks among the top 3% of Wall Street analysts, has been taking a closer look at two AI stalwarts – Nvidia (NASDAQ:NVDA) and Advanced Micro Devices (NASDAQ:AMD) – and sees a clearer path ahead for one of these chip giants. Let’s take a closer look.

Nvidia

Nvidia’s rise to its current status as the world’s most valuable company is a well-documented story based on real-world AI adoption. The company is widely known for getting its start as a pioneer of GPUs, initially focused on the gaming market. While Nvidia was highly successful in that niche, it was not long regarded as one of the market’s true heavyweights. That perception began to shift when the company redirected its focus toward high-performance computing and, eventually, AI.

By adapting its GPU architecture to handle parallel workloads at scale, Nvidia cemented its position at the center of the AI revolution just as demand for accelerated computing began to surge. What was once a specialized strength in gaming graphics became a clear advantage for AI training and inference, enabling Nvidia’s transition from a respected specialist into a critical supplier for data centers, cloud providers, and AI developers.

A unique aspect of Nvidia is that it not only provides chips; the company also delivers much of the surrounding software and systems that make those chips usable at scale. Alongside its hardware, Nvidia has built a broad software stack, development tools, and libraries that are deeply embedded in AI workflows. This has helped create a level of switching cost that goes beyond hardware alone.

And while other names are playing catch-up, Nvidia continues to innovate. At the recent CES conference, CEO Jensen Huang said the Rubin platform is now in full production. The system succeeds the Blackwell architecture and represents the company’s first extreme codesigned AI platform, built around a six-chip configuration.

With Nvidia facing competition from other tech giants’ AI efforts, the stock’s recent performance has been nothing to shout about, with shares largely stuck in a range-bound pattern. But Morgan Stanley’s Moore thinks that could be about to change.

“Confidence on Rubin should be positively received given competitive noise exiting 2025 around broader TPU traction,” the 5-star analyst said. “While the obvious pushback is that Rubin specs and timelines haven’t changed, the stock is still 10% below highs immediately following Jensen’s $500bn comments at GTC DC (Huang said in October that Nvidia has a combined $500 billion in chip orders scheduled across 2025 and 2026), numbers which have since moved higher post earnings… With no hedging on supply or demand, we think enthusiasm can return as that plays out in numbers this year.”

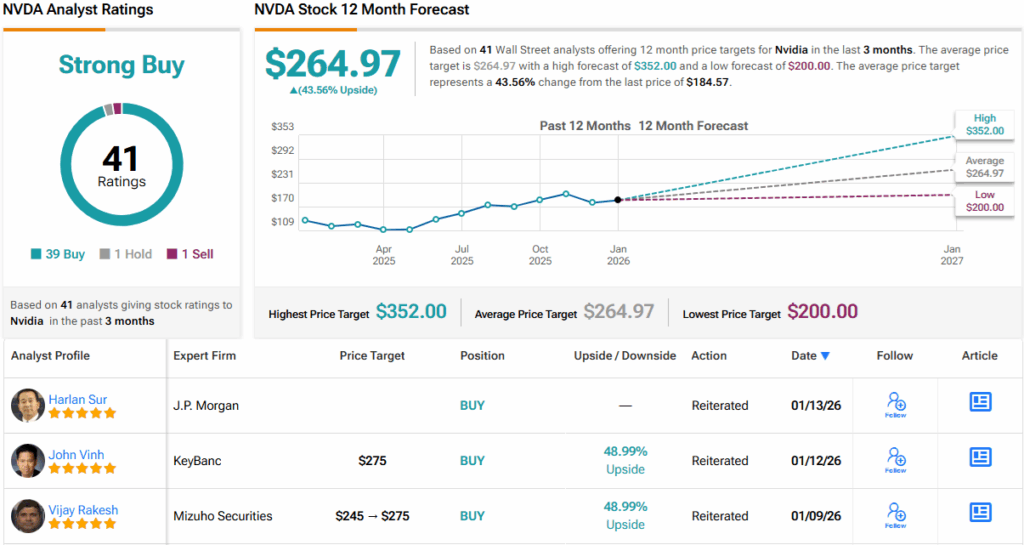

Accordingly, Moore rates NVDA stock as Overweight (i.e., Buy), while his $250 price target points toward 12-month returns of 35%. (To watch Moore’s track record, click here)

Almost all other analysts agree with that take; based on a mix of 39 Buys vs. 1 Hold and Sell, each, the stock claims a Strong Buy consensus rating. Going by the $264.97 average price target, shares are expected to appreciate by 43% over the one-year timeframe. (See NVDA stock forecast)

AMD

AMD and Nvidia are often paired together, and for reasons beyond the nice fact that Nvidia CEO Jensen Huang and AMD CEO Lisa Su are distant cousins. It’s mainly because AMD has often been touted as the one company that can challenge the AI chip king’s dominance of the GPU space.

After all, AMD had exactly that kind of success in the world of CPUs, where its superior products helped it close the gap considerably on segment leader Intel, while it also took advantage of Intel’s various missteps.

But as has been noted by many, Nvidia is a superbly managed company firing on all cylinders – whereas Intel was mismanaged for years – and questions have been raised about AMD’s ability to really bring to market products that can eat away at Nvidia’s leading market share.

That said, perception has begun to shift regarding that stance. Last year, AMD nabbed some huge deals with major industry players such as OpenAI and Oracle, and the company is readying to launch a product that has very strong credentials.

Meanwhile, at CES, AMD introduced Helios, its latest AI compute rack, designed to deliver an immense amount of processing power. In fact, throwing shade Nvidia’s way, Su even dubbed Helios “the world’s best AI rack,” and it is set to compete directly with Nvidia’s NVL systems, pairing 72 of AMD’s MI455X chips against the 72 Rubin GPUs in Nvidia’s latest NVL72. The product is expected to be released in the second half of the year.

Will it be a game-changer for AMD? That remains to be seen, although coming out of CES, Morgan Stanley’s Moore thinks investor enthusiasm should be kept in check.

“We didn’t hear much that alters the debate around AMD stock,” the analyst said. “The company is maintaining their conviction in MI455 as a leadership product, and with OpenAI’s support as the anchor customer we expect to see a strong ramp in Q3/Q4 of this year. That being said we view AMD’s success as partially a function of still overwhelming demand for compute overall vs an emerging TCO advantage vs the competition, something that will have to change to see sustained success as Nvidia continues to push the envelope across the entire technology stack. CES does highlight leadership in CPUs vs Intel, but with that market bearing the brunt of headwinds from higher memory prices, our near-term enthusiasm is somewhat limited.”

Accordingly, Moore rates AMD shares as Equal-weight (i.e., Neutral), although his $260 price target actually factors in 12-month returns of 17%.

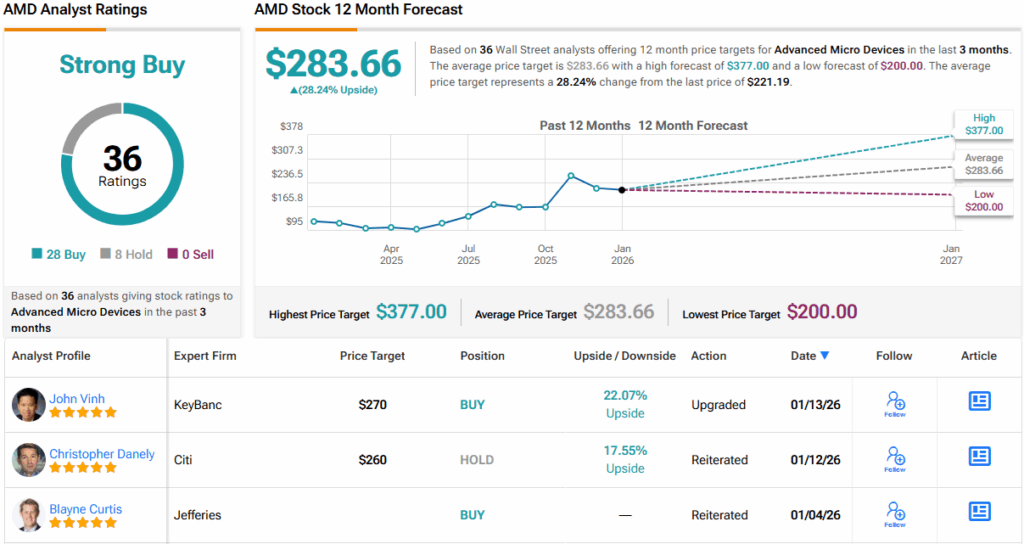

7 other analysts join Moore on the AMD fence, but with an additional 28 Buys, the stock claims a Strong Buy consensus rating. Going by the $283.66 average price target, a year from now, shares will be changing hands for a 28% premium. (See AMD stock forecast)

To find good ideas for AI stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.