Nvidia (NVDA) is being added to the Dow Jones Industrial Average, replacing rival chipmaker Intel (INTC).

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

The change will occur on November 8, according to S&P Global (SPGI), the company that manages the Dow Jones Industrial Average and is responsible for its composition. Additionally, S&P Global said that paint company Sherwin Williams (SHW) will replace chemical company Dow Inc. (DOW), also on November 8.

The switch between Nvidia and Intel is a significant shake-up for the Dow Jones Industrial Average, which is an index comprised of 30 blue-chip stocks that is meant to represent a cross-section of the U.S. economy. It also reflects the diverging fortunes of Nvidia and Intel.

Nvidia’s Success and Intel’s Struggles

Joining the Dow index is the latest achievement for Nvidia, whose stock has rallied 173% this year as demand for its microchips rises with the artificial intelligence (AI) boom. Nvidia is now one of only three companies that has a $3 trillion market capitalization, along with Microsoft (MSFT) and Apple (AAPL).

For Intel, being removed from the Dow 30 is another blow to the once-leading microchip company that has fallen on hard times. Intel’s stock has declined 53% this year as the company struggles to develop a foundry business and manufacture, as well as design, chips and processors.

These are the first changes to the Dow since February of this year when e-commerce giant Amazon (AMZN) joined the index. Being added to the Dow is positive for Nvidia as mutual funds and exchange-traded funds (ETFs) that track the index will now be required to buy NVDA stock.

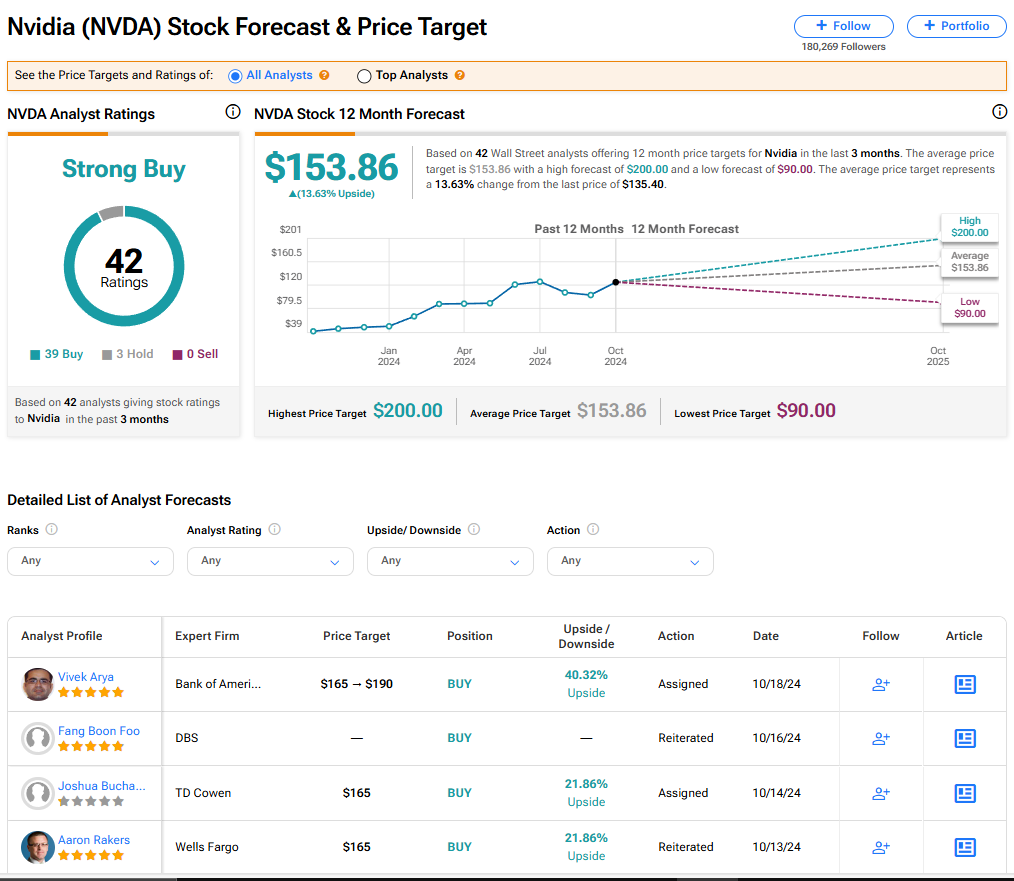

Is NVDA Stock a Buy?

Nvidia’s stock has a consensus Strong Buy rating among 42 Wall Street analysts. That rating is based on 39 Buy and three Hold recommendations assigned in the last three months. There are no Sell ratings on the stock. The average NVDA price target of $153.86 implies 13.63% upside from current levels.