Once the pride of Nordic mobile innovation, Nokia (NOK) has seen its stock surge more than 30% this week following news of a $1 billion investment from AI chip leader Nvidia Corporation (NVDA). The partnership means NVDA will take a 2.9% stake and centers on developing AI-native mobile networks, signaling a bold new chapter for the former mobile titan.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

After reorganizing in September into two new divisions — a Technology and AI organization and a Corporate Development organization — Nokia appears to be positioning itself as a critical infrastructure player in the global AI revolution.

In my view, this AI pivot represents a smart strategic move for Nokia, positioning the company to leverage its networking strengths and gain traction in the optical networking hardware market. For Nvidia, the partnership marks a significant step toward expanding its footprint in the AI-native wireless space, especially as telecom providers accelerate the rollout of 6G capabilities.

While I remain Neutral on both stocks due to their elevated valuations, I believe each company is executing the right strategic moves for long-term growth.

Nvidia Dominates 6G Technology Speculation

To grasp Nokia’s long-term significance in the emerging AI-native wireless network market, investors must first understand how Nvidia—its strategic partner—is laying the groundwork. Nvidia is investing heavily to develop an AI-native wireless stack for 6G, anticipating the rollout of the first commercial 6G applications by 2030.

According to company filings, this next-generation wireless stack is being built on the Nvidia AI Aerial platform, designed to support the massive data throughput and low-latency demands of AI-driven connectivity. Telecom operators have already recognized the need to adopt AI-RAN (AI-powered Radio Access Network) architecture to manage billions of simultaneous connections with unprecedented efficiency—an imperative that’s driving aggressive global investment in 6G infrastructure.

As part of its broader AI wireless expansion strategy, Nvidia has already established key partnerships with major U.S. telecom players, including Booz Allen Hamilton (BAH), Cisco Systems (CSCO), and T-Mobile US (TMUS)—each playing a role in advancing the company’s vision for an AI-native network ecosystem.

Building Nvidia’s 6G Wireless Stack

Nokia’s role in this partnership stems from its extensive Radio Access Network (RAN) portfolio, which is already deployed by major global telecom providers such as AT&T (T), Bell Canada, Vodafone (VOD), Orange France (ORA), and T-Mobile. Under its new collaboration with Nvidia, Nokia will integrate Nvidia’s AI technology into its RAN ecosystem—a move that includes introducing the Nvidia Arc Aerial RAN computer and upgrading its RAN software to operate on the Nvidia CUDA platform. To support this transformation, Nvidia will invest $1 billion in Nokia, purchasing shares at $6.01 per share.

Beyond mobile infrastructure, Nokia and Nvidia will also partner on the data center front, developing AI-powered networking solutions by combining Nokia’s data center switching and optical networking technologies with future Nvidia data center architectures.

Additionally, Dell Technologies (DELL) is expected to play a supporting role, as Dell’s PowerEdge servers will power the new AI-RAN portfolio, reinforcing a broader ecosystem built to accelerate next-generation AI-driven connectivity.

Nokia Still Faces Many Challenges

While Nokia appears to be making the right strategic pivot by emphasizing its optical networks division—a segment well-positioned to benefit from the expansion of AI-driven infrastructure—its legacy businesses remain a significant drag on overall profitability.

In Q3, the Mobile Networks segment’s operating margin fell sharply to 0.7% from 5.4% a year earlier, pressured by a one-time contract settlement and weak software distribution performance. Compounding the problem, Mobile Networks’ revenue continues to face structural decline. The lingering effects of the costly 2016 Alcatel-Lucent merger and the early missteps of the ReefShark chip program still weigh heavily on the company’s financials.

Ultimately, execution remains Nokia’s biggest challenge. The company has a long history of inconsistent strategic execution. While investors must take a forward-looking view, Nokia faces a steep uphill battle: it must offset the erosion of its legacy operations while simultaneously investing aggressively in optical networks to secure high-value partnerships with data center operators and AI chipmakers.

Is Nokia Stock a Buy, Hold, or Sell?

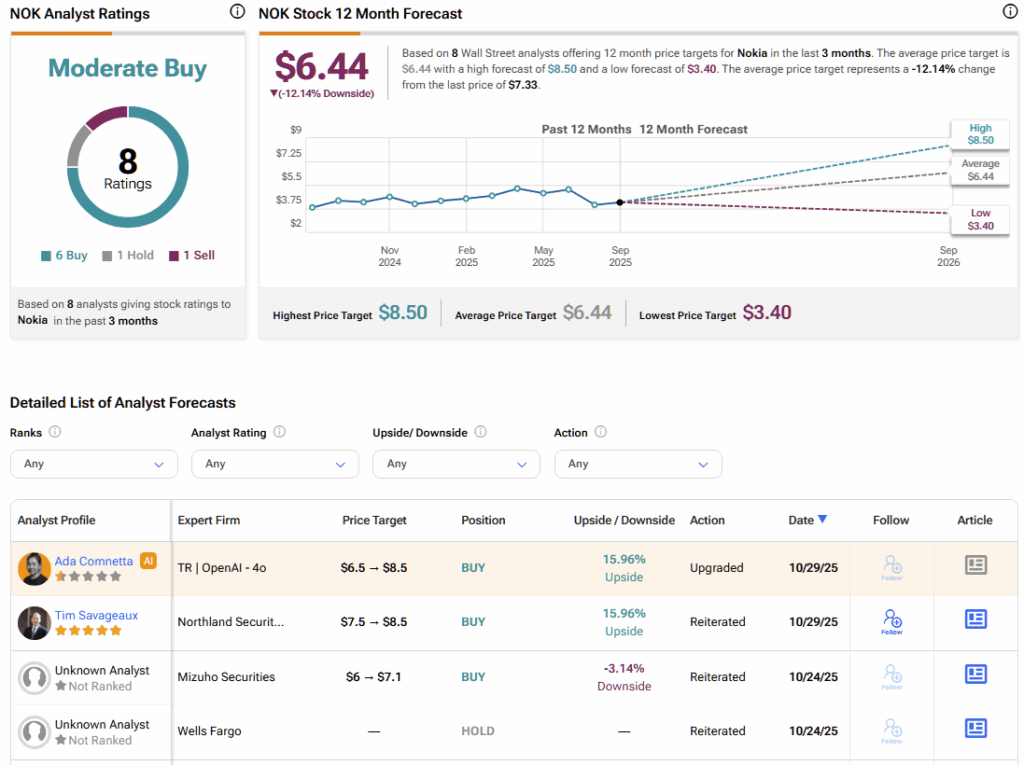

Based on the ratings of 8 Wall Street analysts, the average Nokia price target is $6.44, which implies a downside of 12% from the current market price.

I believe Nokia’s stellar stock market performance this year (up 75% YTD) has pushed the company’s valuation into the fairly valued territory. Given the challenges I discussed earlier, I believe the risk-reward profile is not favorable to long-term investors today.

Is NVDA Stock a Buy, Hold, or Sell?

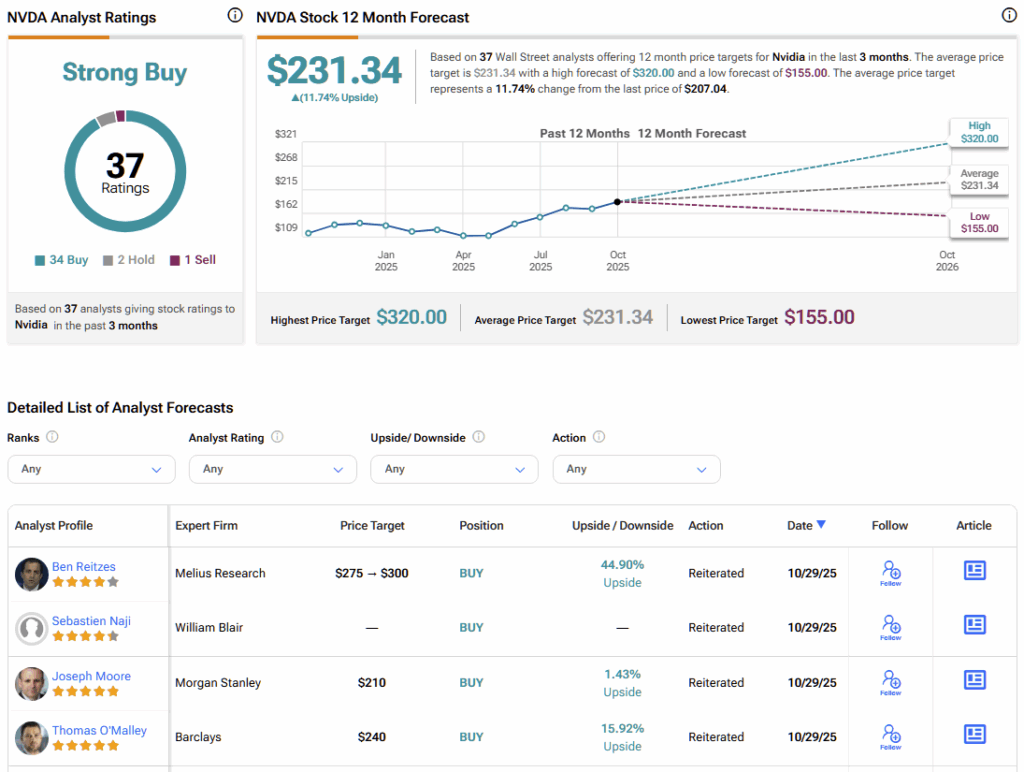

Nvidia, however, remains a Wall Street darling, having emerged as the dominant player in the AI chip market. Based on the ratings of 37 Wall Street analysts, the average Nvidia price target is $231.34, which implies upside of almost 12% from the current market price.

Despite the upside potential represented by analyst ratings, I believe investors need to be cautious as Nvidia is trading well above the average valuation levels of its closest rivals (forward P/E of 45x compared to the sector median of 25x).

While I believe Nvidia deserves to trade at a premium, I am concerned about a slowdown in the broad AI trade that could result in a valuation re-rating for all chipmakers, which could drag Nvidia’s stock price lower.

Strategic Win and a Long-Term Play Rolled into One

Nvidia is investing $1 billion in Nokia as part of a strategic partnership to develop an AI-native wireless stack designed to power the rollout of 6G technology. This move underscores Nvidia’s push into the rapidly expanding AI-RAN market, broadening its reach beyond traditional AI computing. Following the announcement, Nokia’s stock surged, as investors welcomed the validation that comes from securing a major investment from one of the world’s leading chipmakers.

According to Nokia’s management, partnering with hyperscalers and semiconductor leaders like Nvidia is a key pillar of its optical networks growth strategy, aligning with the company’s efforts to reposition itself as a critical player in the global AI infrastructure landscape. While I view this partnership as a strategic win for both companies, I remain neutral on Nokia and Nvidia, as their current valuations appear to price in much of the near-term optimism—leaving the risk-reward balance more favorable for long-term investors at this stage.