Nvidia (NVDA) has made a significant change to its leadership team, according to reports. Chief Executive Officer Jensen Huang has trimmed his number of direct reports from 55 to 36, according to a new internal chart shared with Business Insider. The update comes as Nvidia holds a market value of nearly $4.37 trillion and continues to expand rapidly through the rise of AI.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The new setup shows a smaller but still broad team that reports straight to Huang. It includes several of the company’s most well-known names. Ian Buck, who built the CUDA software that powers many AI systems, now serves as Vice President of hyperscale and high-performance computing. Chief Technology Officer Michael Kagan and Chief Scientist Bill Dally remain key figures behind Nvidia’s core research. Other senior leaders include Executive Vice President and Chief Financial Officer Colette Kress, Executive Vice President of Operations Debora Shoquist, and co-founder Chris Malachowsky.

Together, they cover areas from chip design and data centers to software and automotive systems.

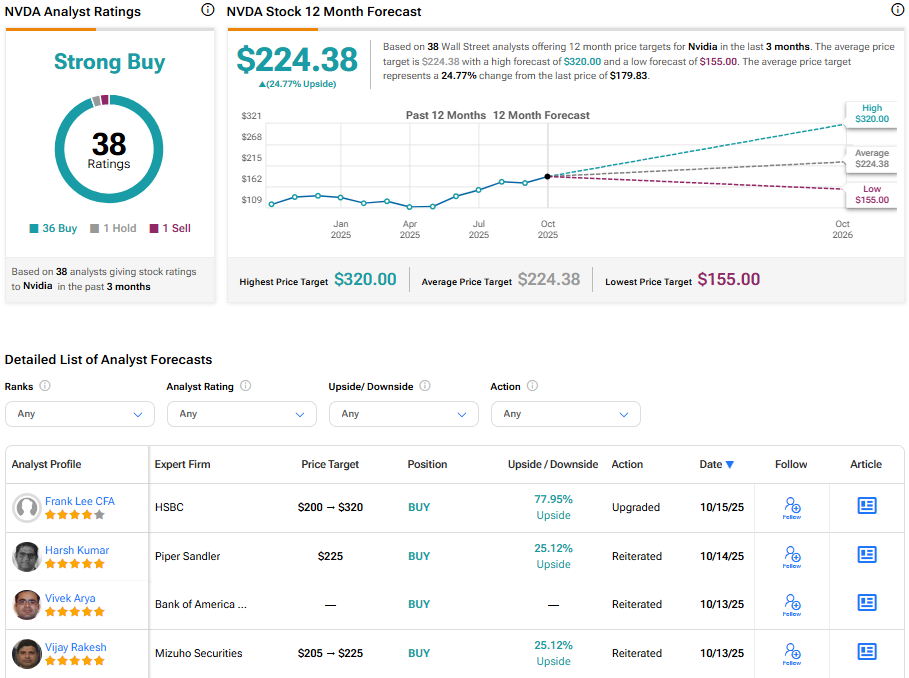

Meanwhile, NVDA shares remain steady, shedding 0.11% and closing at $179.83.

A Flatter Way to Run a Giant Company

Even with fewer executives, Huang has kept what he calls a flat structure. Unlike many large companies, Nvidia avoids heavy layers of management. Huang prefers to have a wide circle of leaders who can share updates directly with him. During a past interview at The New York Times DealBook Summit, he explained that this setup keeps information flowing and helps everyone stay aligned. He also chooses group meetings instead of regular one-on-one sessions, so every leader receives the same information at once.

The smaller leadership circle could signal a shift in how Nvidia handles its rapid growth. The company has moved from a chip maker for gamers to the key supplier behind much of the world’s AI hardware. As it grows, cutting down on duplicate roles may help it stay efficient while keeping decision-making quick.

Overall, the reshuffle points to a tighter and more focused approach at Nvidia. The company continues to scale across data centers, cloud platforms, and new AI markets, but still aims to keep its structure simple.

Is Nvidia Stock a Buy?

Across Wall Street, analysts remain bullish on the stock. Out of 38 ratings, there are 36 signaling a Buy. The average price target is $224.38, implying about 24.77% upside from the current level.