AI giant Nvidia (NVDA) is set to release its Q3 FY25 results on November 20. Analysts are predicting strong top-and bottom-line growth in Q3. They expect the company to report earnings of $0.75 per share and revenues of $33.09 billion, reflecting robust 88% and 82.6% year-over-year increases, respectively, according to TipRanks’ data.

Don’t Miss TipRanks’ Half-Year Sale

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Regarding share price growth, NVDA stock has skyrocketed 182% over the past year and 187% year-to-date, highlighting the company’s explosive growth. Given this impressive rally, it’s no surprise that NVDA boasts a strong earnings surprise history, surpassing estimates in eight of the past nine quarters.

Analysts‘ Opinions Ahead of Q3 Results

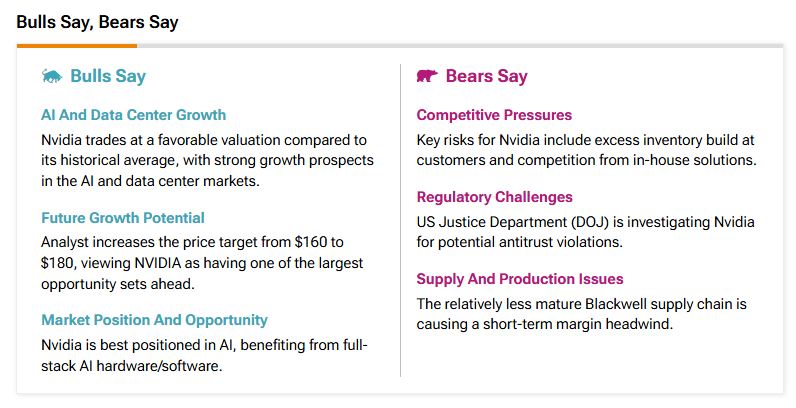

According to TipRanks’ Bulls Say, Bears Say tool, bullish analysts believe that Nvidia presents an attractive investment opportunity, driven by its strong growth potential in AI and data center markets. They contend that Nvidia’s strength in AI hardware and software positions it well to capitalize on significant opportunities in the evolving AI landscape.

This optimism is further supported by analysts’ actions ahead of Nvidia’s Q3 results. Over the past week, most analysts have maintained their Buy ratings on the stock and raised their price targets on NVDA, highlighting the company’s expansive growth prospects.

On the other hand, bears highlight several challenges for Nvidia. They point to risks like excess inventory and competition from in-house solutions. Additionally, the U.S. Department of Justice is investigating the company for potential antitrust violations, adding regulatory uncertainty. Furthermore, analysts note that the Blackwell supply chain is causing short-term margin pressures and contributing to production challenges.

What Do Options Traders Anticipate?

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 9.83% move in either direction.

Is Nvidia a Buy, Sell, or Hold?

Despite the stock’s solid rally over the past year, Wall Street’s sentiment on NVIDIA appears bullish, reflecting a combination of 39 Buy and three Hold recommendations over the past three months. At an average price target of $163.26, the average NVDA stock price target implies 14.99% upside potential.