Nvidia Corporation (NVDA) is expanding its role in Israel as part of its long-term growth plan. Speaking at the Consumer Electronics Show (CES) in Las Vegas, CEO Jensen Huang said the company plans to double its local staff to about 10,000 workers.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

“I am going to come to Israel pretty soon, and I am looking forward to that,” Huang said at the event. He added that Israel has become central to Nvidia due to its deep pool of tech talent.

At present, Nvidia employs close to 5,000 people in Israel. Most of them work at the Yokneam site, which joined Nvidia following the 2020 Mellanox deal. Since then, Israel has grown into Nvidia’s largest research base outside the U.S.

Meanwhile, Nvidia is moving forward with plans for a new campus in Kiryat Tivon near Haifa. The site will span about 160,000 square meters and is expected to house more than 10,000 workers once complete. When the project was announced, Huang said, “Israel is home to some of the world’s most brilliant technologists and has become Nvidia’s second home.”

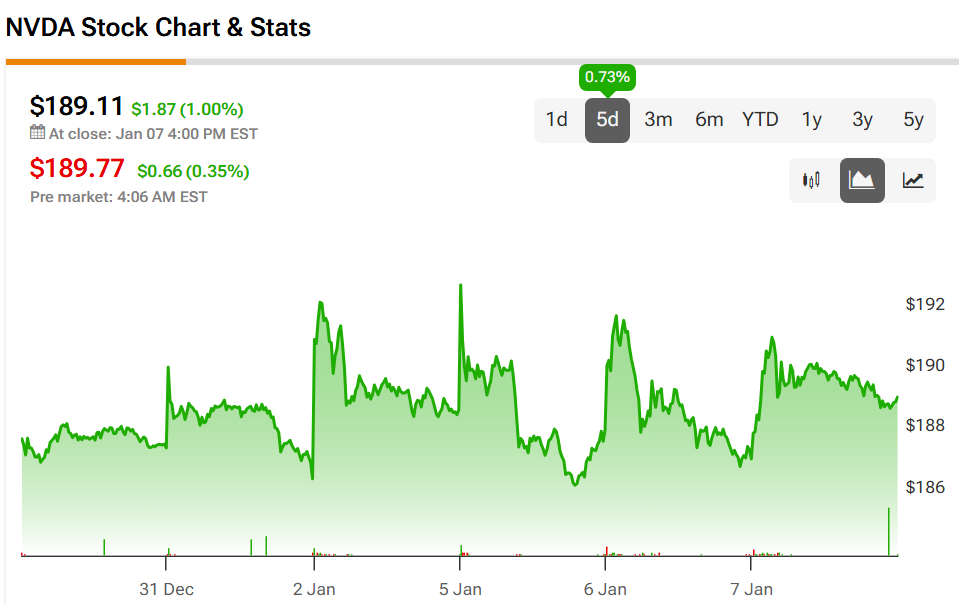

Meanwhile, NVDA shares rose 1% on Wednesday, closing at $189.11.

Deal Talk and Product Impact

Beyond staffing, Israel plays a major role in Nvidia’s product work. At CES, Huang said Israeli teams helped develop four of the six chips used in Nvidia’s new Vera Rubin platform. These parts support data speed, system links, and AI scale.

As Nvidia grows, the focus has shifted from single chips to full data center systems. As a result, the work done in Israel now feeds directly into Nvidia’s core business.

At the same time, Nvidia remains open to deals in the region. Reports have pointed to talks with AI21 Labs, a private AI firm based in Tel Aviv. Huang did not confirm a deal but said, “We might invest in, partner with, and we might, of course, acquire some semiconductor companies.”

AI21 co-founder Amnon Shashua also addressed the reports. Speaking to Bloomberg Television, he said, “There are talks with Nvidia, there are talks with others, but nothing even close to talking about it in the press.” He stressed that discussions are still at an early stage.

In recent years, Nvidia has already acquired several Israeli firms, including Run:ai and Deci. Together with the hiring push and campus plan, these moves point to a steady expansion path.

Is Nvidia Stock a Buy, Sell, or Hold?

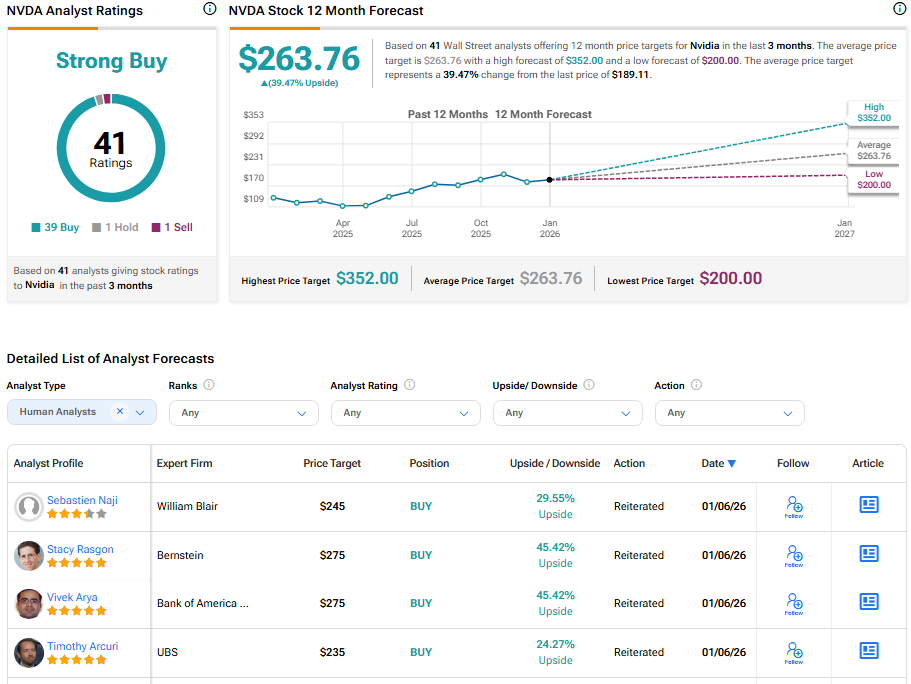

On the Street, Nvidia holds a Strong Buy consensus rating. The average NVDA stock price target is $263.76, implying a 39.47% upside from the current price.