Nvidia’s (NVDA) finance chief says that demand for the company’s artificial intelligence (AI) microchips and processors exceeds its current $500 billion forecast.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Speaking at a JPMorgan Chase (JPM) event on Jan. 6, Colette Kress, Nvidia’s Chief Financial Officer (CFO), said that demand for the company’s products continues to increase, surpassing the $500 billion revenue forecast for current and future data center chips by the end of 2026.

Kress added that demand has grown since the company’s initial $500 billion projection. “The $500 billion has definitely gotten larger,” she said at the event. In its most recent earnings report, Nvidia forecast $500 billion in revenue from its current and future data center chips by the end of this year.

Nvidia’s China Business

Kress was asked at the JPMorgan conference about the current status of Nvidia’s China business. The CFO said that Nvidia does not yet know when or if licenses for operations in China will be approved by the U.S. government in Washington, D.C.

Kress stressed that the U.S. government is “working hard” on the approval process for licenses that will allow Nvidia to sell at least some of its microchips to China. Nvidia has found itself caught up in geopolitics and used as a bargaining chip in trade negotiations between the U.S. and China.

The U.S. government has alternatively banned Nvidia’s microchip sales to China on national security concerns and also authorized limited sales of the company’s older and weaker microchips and processors. Chinese authorities have, at times, threatened to ban Nvidia’s chips within the Asian superpower.

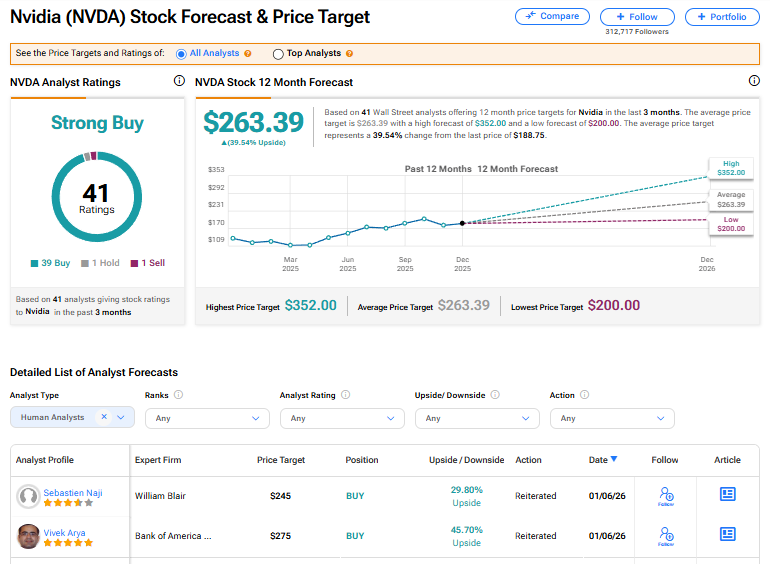

Is NVDA Stock a Buy?

The stock of Nvidia has a consensus Strong Buy rating among 41 Wall Street analysts. That rating is based on 39 Buy, one Hold, and one Sell recommendations issued in the past three months. The average NVDA price target of $263.39 implies 39.54% upside from current levels.