Nvidia (NVDA) CEO Jensen Huang is cashing in big as the artificial intelligence (AI) boom pushes the chipmaker to record heights. The stock has clawed back most of its earlier losses this year, now down just 3% year-to-date, and has jumped more than 42% over the past 12 months. His total pay surged 46% to nearly $50 million in Fiscal 2025, up from $34.2 million a year ago.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

According to a regulatory filing, the increase came largely from stock awards fueled by Nvidia’s meteoric share rally. Huang’s base salary also rose for the first time in a decade, reaching $1.5 million, up from just under $1 million.

The AI wave has also lifted Huang’s personal fortune. His net worth has climbed to $120 billion, up from $80 billion last year. The surge puts him just outside the world’s top 10 richest people, according to Forbes’ real-time billionaires list.

AI Chips Fuel a Historic Run

Huang, 62, co-founded Nvidia over 30 years ago. Under his leadership, the company has evolved from a graphics chipmaker into the engine room of the AI revolution. Its high-performance chips now power everything from ChatGPT to Saudi Arabia’s newest AI project.

In fact, Nvidia just hit a $3 trillion market value, topping Apple for the No. 2 spot behind Microsoft. The latest stock surge followed news of a massive deal with Saudi Arabia to deliver 18,000 high-end AI chips to Humain, an AI startup backed by the kingdom’s wealth fund.

The agreement highlights the rising global appetite for AI hardware and reinforces Nvidia’s long-term momentum in the AI race.

Blowout FY25 Results Fuel Momentum Ahead of Q1 Print

Nvidia’s financial performance in fiscal 2025 was nothing short of explosive. Revenue soared 114% year-over-year to $130.5 billion, driven by strong demand for its AI chips. Meanwhile, adjusted earnings per share surged to $2.99, marking a 130% increase from the year-ago period.

Looking forward, analysts expect the growth to continue. Some predict that sales could rise another 50% this year as AI spending picks up across cloud, business, and government customers.

Investors now turn their attention to Nvidia’s upcoming Q1 FY26 earnings, slated for May 28. With the stock back above a $3 trillion market cap and fresh demand signals from international deals like Saudi Arabia’s Humain, expectations are running high. The report could serve as the next major catalyst in Nvidia’s continued AI-driven growth story.

Is NVDA Stock a Buy?

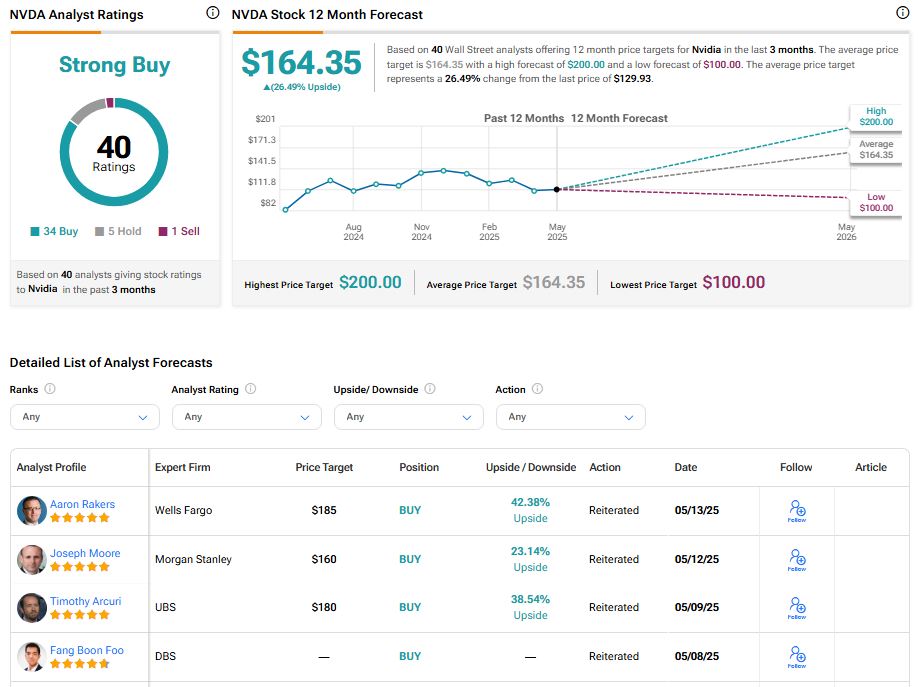

The stock of Nvidia has a consensus Strong Buy rating among 40 Wall Street analysts. That rating is based on 34 Buy, five Hold, and one Sell recommendations assigned in the last three months. The average NVDA price target of $164.35 implies 26.49% upside from current levels.