Nvidia (NVDA) is betting on robotics as its next big growth driver due to the rising competition in its core AI chipmaking business, according to a report by the Financial Times. The company is set to launch the Jetson Thor in early 2025, a new generation of compact computers designed for humanoid robots.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The move complements Nvidia’s existing robotics toolkit, which includes software for training AI-powered robots and the chips that power them. Further, companies such as Amazon (AMZN), Toyota (TM), and Boston Dynamics are already using Nvidia’s robotics simulation technology.

Here’s What Is Driving NVDA’s Shift in Robotics

This push into robotics comes as Nvidia faces increased competition from rival chipmakers like AMD (AMD). Also, cloud giants such as Amazon, Microsoft (MSFT), and Alphabet’s (GOOGL) Google are boosting their own AI capabilities as they seek to reduce reliance on Nvidia’s AI chips.

Nvidia’s robotics push is further fueled by advancements in AI, particularly the rise of generative AI models and the ability to train robots effectively in simulated environments. Interestingly, the global robotics market is currently valued at nearly $78 billion and is expected to reach $165 billion by 2029, according to BCC Research.

Investors should note that NVDA is actively investing in the physical AI to bolster its presence in this space. For instance, in February 2024, Nvidia, alongside Microsoft and OpenAI, invested in the humanoid robotics firm Figure AI.

Is Nvidia a Good Stock to Buy Now?

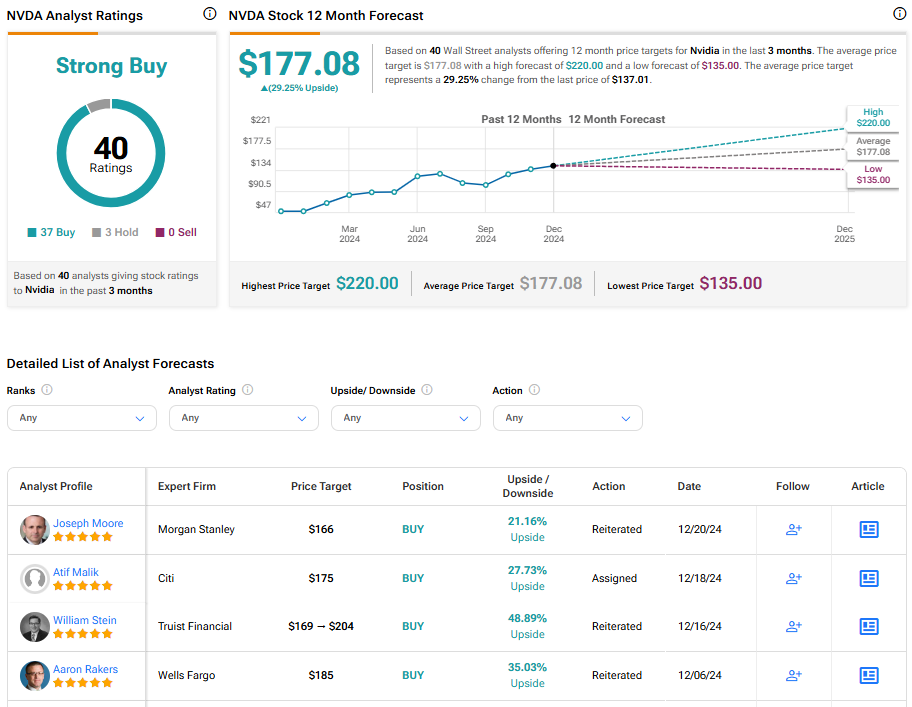

Turning to Wall Street, NVDA has a Strong Buy consensus rating based on 37 Buys and three Holds assigned in the last three months. At $177.08, the average Nvidia price target implies a 29.25% upside potential.