The first-quarter earnings season is in full swing, and the results are painting a nuanced picture. About 36% of S&P 500 companies have reported, and while 73% have delivered upside surprises on EPS, that’s a touch below the 5-year average of 77%. Still, the size of the beats is impressive. The average earnings surprise clocks in at 10%, outpacing the 5-year norm of 8.8%.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

These numbers haven’t gone unnoticed. Stifel’s 5-star analyst Ruben Roy, who is rated by TipRanks among the top 4% of his peers, sees signs of cautious optimism taking shape. He’s especially focused on the tech sector, which he believes could hold the key to upside potential as more earnings roll in.

“Following the initial wave of C1Q earnings, results and outlook across our group and adjacencies have largely fared better than expected, particularly for companies that have exposure to hyperscaler/AI spend. Our discussions with investors, though, suggest continued concerns regarding the broader demand implications as trade talks continue… While we think there is still potential for some downside risk across the board, we believe selective opportunities in certain segments, such as in Processors and Optical/Networking, look more attractive as tactical entries, amidst the current set up,” Roy opined.

The current set up will see two chip giants, Nvidia (NASDAQ:NVDA) and Advanced Micro Devices (NASDAQ:AMD), report their next quarterly results in the coming weeks, and Roy believes that both companies are well-positioned to weather a tariff storm and bring long-term gains. Let’s take a look at both companies to see the overall Wall Street take in conjunction with Roy’s comments.

Nvidia

Nvidia has long been a leader in the chip industry, and its proven expertise with GPUs gave it a step up when the AI boom started at the end of 2022. The company’s global footprint, however, left it vulnerable to the impact of the recent turmoil over tariffs, and shares in NVDA are down 15% so far this year. That said, the company still boasts a market cap of $2.8 trillion, ranking it as the third-largest publicly traded firm on Wall Street.

That strength was on full display on April 28, when Nvidia announced that Oracle Cloud Infrastructure has deployed thousands of its Blackwell GPUs. These chips will boost Oracle Cloud Infrastructure’s ability to provide low-latency performance, and will be tasked with developing and running next-generation agentic AI and reasoning models.

In addition to its continued success as a provider of cutting-edge semiconductors, Nvidia is also building a position for itself in the next generation of computing technology. The company announced in March that it is building a leading-edge research and development center in Boston, to focus on new advances in quantum computing. Specifically, the research center will work on accelerated quantum supercomputing, derived from the integration of leading quantum hardware with AI-powered supercomputers.

On the financial front, Nvidia’s momentum is unmistakable. For fiscal Q4 2025 (ending January 26), the company pulled in $39.3 billion in revenue, a 78% jump from the year before, and $1.19 billion above expectations. Non-GAAP EPS came in at 89 cents, topping estimates by 4 cents. The data center segment, the engine behind its AI surge, generated $35.6 billion, up 93% year-over-year. For the full fiscal year, Nvidia’s revenue soared 114%, reaching an $130.5 billion.

Nvidia is scheduled to release its fiscal 1Q26 results on May 28, and the Street is expecting to see revenues of approximately $43 billion.

While there are headwinds facing the tech sector, including ongoing uncertainties about tariffs and interest rates, analyst Ruben Roy believes that continued strong demand should provide support for Nvidia.

“Our recent supply chain discussions indicate that demand visibility extends well into 2H2025 with Blackwell Ultra appearing well positioned to accelerate through year-end and into 2026… We think tariff decisions, trade regulations (most recently tied to the banning of H20 sales in China resulting in a $5.5bn inventory charge this upcoming quarter) and Fed interest rate uncertainties will weigh on returns in the near-term, which likely bring estimates down some post-earnings, but… a lot of that action seems to be preemptively priced in. There is still some downside risk to the stock but we think it is far less than the opportunity for upside at current levels (i.e. current levels are still well off historic lows in terms of annual returns),” Roy opined.

Roy’s stance here backs up his Buy rating on Nvidia’s stock, and his price target of $180 implies a 57% upside potential for the shares in this coming year. (To watch Roy’s track record, click here)

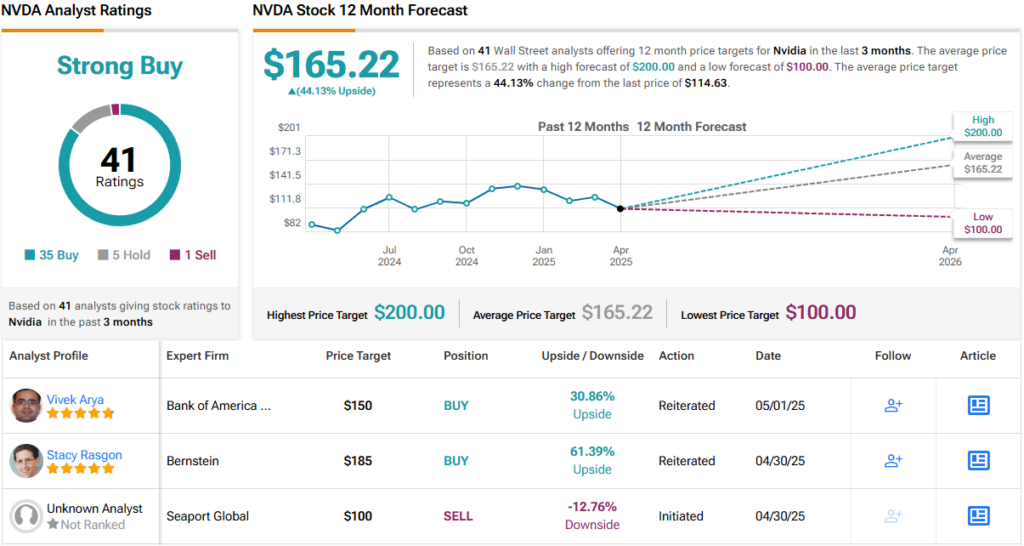

Like its ‘Magnificent 7’ peers, Nvidia has picked up a lot of attention from the Street, in the form of 41 recent analyst reviews. These break down to 35 Buys and 5 Holds, for a Strong Buy consensus rating. The shares are currently trading at $114.75 and their $165.22 average target price suggests that a gain of 44% lies ahead. (See NVDA stock forecast)

Advanced Micro Devices (AMD)

While AMD may not share Nvidia’s mega-cap status, it still ranks as the world’s seventh-largest chipmaker. The company first made its mark as a powerhouse in the PC market, earning a solid reputation for crafting high-performance processors tailored to everyday consumers. In recent years, however, AMD has been pushing into new territory, expanding its footprint in both gaming and data centers. At first glance, these markets may seem worlds apart, but they share a crucial common thread: both rely on cutting-edge, high-capacity processors – technology that AMD is increasingly leveraging to tap into the booming demand for AI computing.

Earlier this year, AMD released several new products targeting the AI market. These include new AI chips in the Ryzen line, which are designed to run AI apps on consumer or small business PCs, combining AMD’s ambition with its known strength. Additionally, AMD has recently announced that its 5th-gen EPYC processors are in use with Google Cloud’s new C4D and H4D virtual machines.

AMD isn’t just releasing new products to power its moves into AI. The company is also moving to acquire new capabilities. In March of this year, AMD completed just such an acquisition, of ZT Systems. ZT specialized in providing AI and general-purpose computer infrastructure for major hyperscalers on the global scene. By acquiring the company, AMD can add its new AI-capable GPUs and CPUs into a large-scale mix with AI and cloud computing applications.

The last set of earnings AMD released covered 4Q24, and in that quarter the company showed a top line of $7.7 billion. This figure was a company record, beat the forecast by $170 million, and was up 24% from 4Q23. AMD’s earnings total, reported as $1.09 per share in non-GAAP measures, was about as expected. As noted, the company had total revenues of $25.8 billion for all of 2024.

Looking ahead, we’ll see AMD’s 1Q25 results on May 6. The revenue estimate currently stands at $7.11 billion.

Ruben Roy, in his notes on AMD, points out that this company is likely to continue showing strong revenue performance despite a potential ‘tariff war.’ He writes, “In spite of tariff-driven macroeconomic uncertainty (coupled with an uncertain export restriction outlook) we believe that AMD will reaffirm this F2025 GPU revenue curve; while tariffs remain uncertain, recent commentary from the Trump administration indicates a potential US-China deal on the horizon, and strong customer engagements point to a persistent demand environment for AMD AI.”

Getting into the specifics of AMD’s prospects, Roy adds, “We think AMD stands to gain meaningful market share within the compute infrastructure and processors sub-sector over the coming years, particularly as they close the innovation gap with NVDA via their open-source platforms. We are not expecting a meaningful upward revision of estimates post-earnings and, if anything, believe we’ll see sell-side estimates moderate. However, we think much of the downside for AMD is largely baked-in, with more limited room to drop on returns relative to historic lows versus upside potential over the longer-term.”

To this end, the Stifel tech expert puts a Buy rating on AMD shares, and backs that up with a $132 price target, implying a one-year potential gain of 33%.

Overall, AMD has a Moderate Buy consensus rating, based on 35 recent analyst reviews that include 23 Buys and 12 Holds. The shares are priced at $99 and the $138.19 average price target suggests that the stock will gain ~40% this year. (See AMD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue