The growing rivalry between the world’s two largest economies might put about $400 million of Nvidia Corporation’s (NASDAQ:NVDA) third-quarter sales at stake. In an SEC filing, the chip maker recently informed its stakeholders that the U.S. government has imposed new licensing requirements on the future export of its most advanced A100 and upcoming H100 integrated circuits to China (including Hong Kong), and Russia, effective immediately.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

According to the filing, the U.S. government intends to keep a check on the national security risk with the new licensing requirement that may arise from the covered products being utilized in or diverted to ‘military end use’ or ‘military end user’ in China and Russia.

Although Nvidia doesn’t sell products in Russia, it estimates that the new requirements by the U.S. government will dent its sales to China by about $400 million in the third quarter of Fiscal Year 2023.

The company’s management stated that the new export rule will hurt its ability to develop H100 in time and may have to move some of its operations out of China.

The largest chip maker by market value in the United States has already been treading through tough times. It has been witnessing plunging Gaming revenues, which were partially getting offset by strong Data Center performance in the second quarter of Fiscal Year 2023. The latest development can hammer the Data Center segment revenue in the future.

What Is the Prediction for NVDA Stock?

NVDA’s average price prediction of $215.18 implies 42.6% upside potential. According to TipRanks, NVDA has a Strong Buy consensus rating based on 23 Buys and seven Holds.

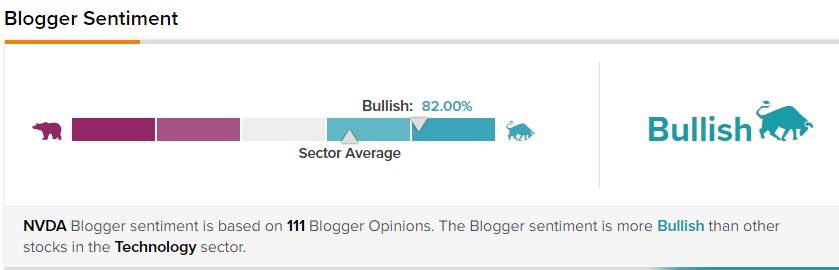

Similarly, financial bloggers are 82% Bullish on NVDA stock, compared to the sector average of 66%.

Contrary to analysts and financial bloggers, hedge funds are apprehensive about NVDA stock. They have sold 456,200 shares of NVDA stock in the last quarter. Retail investors on TipRanks also seem to be sharing a similar stance and have decreased their NVDA stock holdings by 0.6% in the last 30 days.

Tough Times Continue for NVDA Stock

NVDA’s stock came under pressure due to the new export rules and lost about 6.6% in the after-hours trading session on Wednesday. Shares of NVDA have already had a disappointing run in 2022, as they have lost around 49.9% so far this year, in comparison to the wider PHLX Semiconductor Index’s 32.2% fall in the same period.

Read full Disclosure