NVIDIA (NVDA) has introduced its most affordable RTX 50 series card yet: the RTX 5050. Priced at $249 and set to launch in July 2025, this entry-level GPU is aimed at gamers looking to upgrade from older hardware like the GTX 1650 or RTX 3050. It brings next-gen Blackwell architecture to budget-conscious buyers, delivering improved performance at 1080p resolution.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

The desktop version of the RTX 5050 features 2,560 CUDA cores, 8GB of GDDR6 memory on a 128-bit bus, and supports both ray tracing and DLSS 4. NVIDIA says it’s built for smooth 1080p gaming, and early benchmarks show a 60% performance gain over the RTX 3050.

Can the RTX 5050 Drive an Upgrade Cycle?

Nvidia’s desires are quite clear; it’s positioning the 5050 to tap into a large upgrade cycle. According to the latest Steam hardware survey, the GTX 1650 remains one of the most-used GPUs globally. For users still running older 50-class cards that lack ray tracing or DLSS, the 5050 offers a compelling reason to switch.

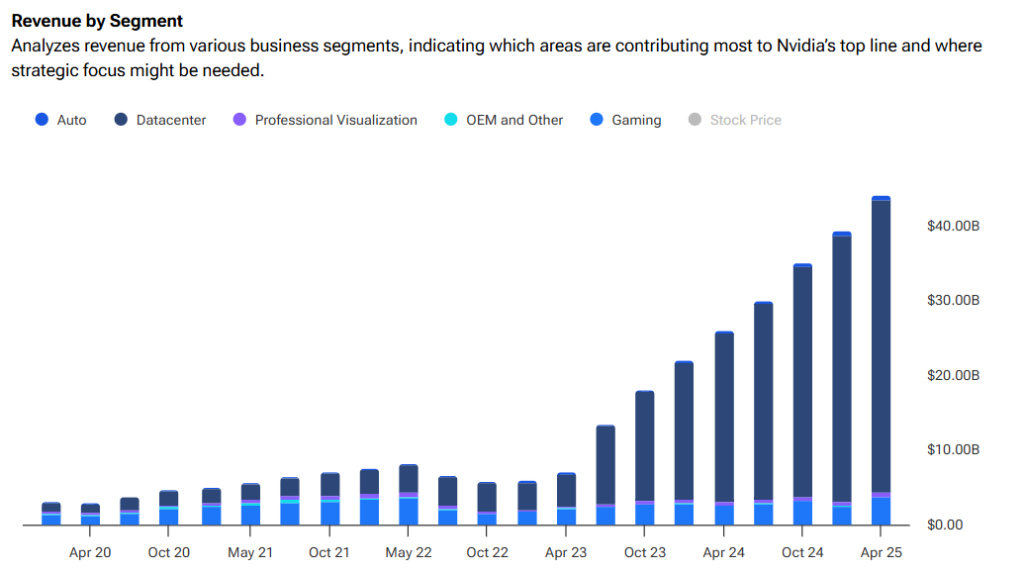

On the business side, the new GPU targets a segment that has historically driven strong volumes. Nvidia has not provided specific sales estimates for the RTX 5050, but prior x50 models have sold millions of units globally. The company recently reported $3.8 billion in gaming and AI PC revenue for Q1 FY26, up 48% from the previous quarter. The RTX 5050 could help sustain that momentum as it reaches a broad base of mainstream gamers and budget system builders.

The entry-level market may not offer the same margins as data center products, but volume plays a key role in keeping NVIDIA’s gaming revenue strong. With a competitive price and solid performance, the RTX 5050 strengthens the company’s position in the high-volume, low-cost segment just as Blackwell architecture rolls out across the full product stack.

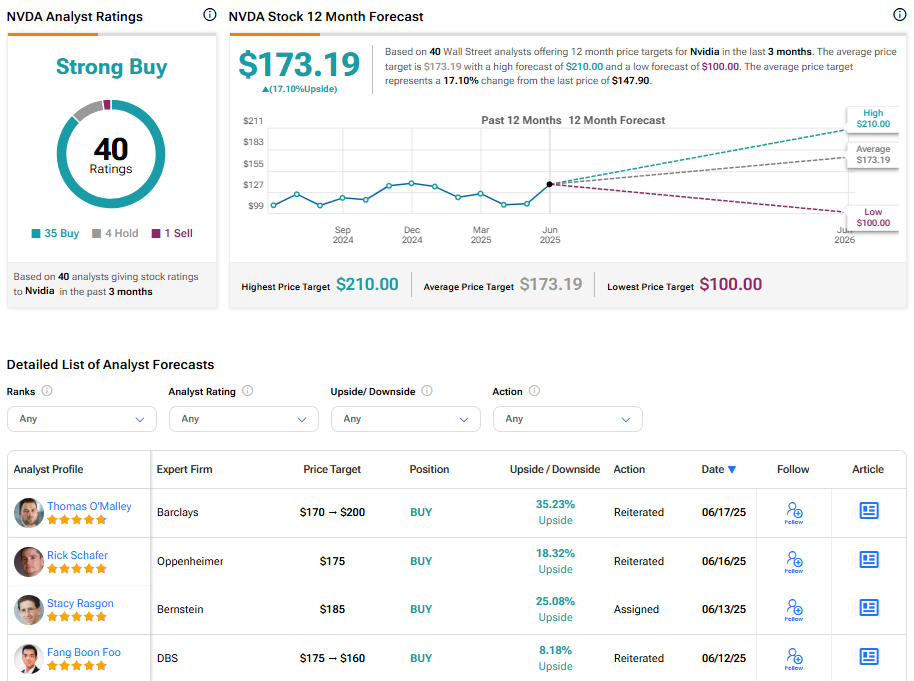

Is Nvidia Stock a Buy, Sell, or Hold?

On the Street, Nvidia boasts a Strong Buy rating, with an average NVDA stock price target of $173.19. This implies a 17.10% upside.