After one of the wildest weeks Wall Street has weathered in years, the stock market pulled off a surprising rally, with the S&P 500 surging 6% by week’s end.

President Trump, facing mounting pressure, appeared to blink – sort of. On Wednesday, after a week of market chaos, he announced a 90-day pause on most of the aggressive “reciprocal” tariffs that had sent global equities into a tailspin. Yet, in the same breath, he escalated the trade war with China, raising punitive tariffs to 125%. Markets, choosing to focus on the pause rather than the provocation, rallied on the news – while the White House swiftly claimed victory.

That rally may signal a moment of calm, but the damage is already considerable. Trillions in market value have evaporated, and fears of a looming recession are gaining traction. Still, according to UBS’s Chief Investment Office, current stock prices could present an opportunity for investors willing to navigate the volatility.

“The selling in markets has been vicious, and many companies with good longer-term prospects are now trading at more attractive valuations,” the CIO said. “Whether this… bounce proves to be durable will be highly contingent on the ultimate outcome of tariff policy. Nonetheless, we believe it is worth looking for opportunities in the market.”

The analysts at UBS have pinpointed such opportunities in 2 of the biggest AI names out there – Nvidia (NASDAQ:NVDA) and Microsoft (NASDAQ:MSFT), believing now is the right time to be loading up on these AI stalwarts.

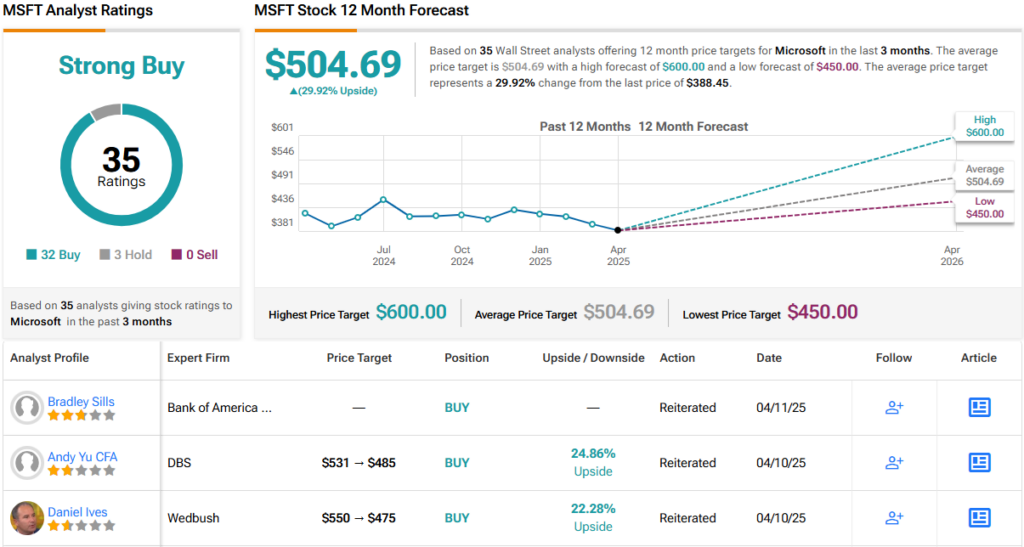

The rest of the Street seems to share that sentiment. According to the TipRanks database, both stocks are rated Strong Buys. Let’s take a closer look and see what makes them so.

Nvidia

Trump’s tariffs and the attendant implications could signal an end to the bull market that at some point made Nvidia the most valuable company in the world. The chipmaker has been at the forefront of the AI revolution, and it is hardly a headscratcher to work out why. Simply put, the company has cornered the market for the AI chips that power the data centers used for AI applications, commanding more than an 80% share of the market.

The unique part about Nvidia, however, is that its offerings span the whole AI stack – from powerful chips and systems to software, frameworks, and cloud services that help build, train, and run AI models.

That walled ecosystem acts as a unique moat and Nvidia’s pace of growth over the past few years has been mind-blowing and is the reason behind the huge stock market gains. However, even before the advent of Trump’s tariff fever dream, there were concerns that Nvidia’s growth trajectory could be unsustainable. While the company has made a habit of delivering beat-and-raise earnings reports, the beats have been steadily narrowing. In a sense, Nvidia has become a victim of its own success. Add in other elements such as delays to its latest GPU architecture Blackwell, the noisy market entrance of Chinese AI startup DeepSeek, and of course the tariff situation and all have combined to send shares down by 17% so far this year.

However, UBS’ Timothy Arcuri, an analyst who ranks in 5th spot amongst the thousands of Wall Street stock pros, points out that the company’s value proposition remains as strong as ever.

“In our view, Nvidia remains well positioned to supply the computing power needed for wide-scale AI adoption,” the 5-star analyst said. “We see its CUDA software as an important competitive moat and believe its increasing range of product offerings (from GPU chips to full rack AI systems) and rapid pace of innovation (annual new product families) will help maintain its lead versus competitors. While we recognize near-term risks from tariffs, we nonetheless believe that AI is a powerful secular trend that will drive significant economic value over time.”

Conveying his confidence, Arcuri rates the shares a Buy while his $185 price target suggests the stock will gain ~67% in the months ahead. (To watch Arcuri’s track record, click here)

The Street’s average target is also highly bullish; at $174, the figure implies shares will climb ~57% higher in the months ahead. All told, the stock claims a Strong Buy consensus rating, based on a mix of 37 Buys vs. 4 Holds. (See NVDA stock forecast)

Microsoft

Nvidia might be the de facto poster boy for AI, but fellow tech giant Microsoft’s AI credentials are also sound. Recall, the current bull market’s opening shot can be traced back to the release of ChatGPT, a product that is tied to Microsoft.

Its big move into AI started with its major backing of OpenAI – ChatGPT’s creator. It invested billions of dollars to support OpenAI’s research and development, and in return, gained access to cutting-edge AI technology. Microsoft quickly integrated OpenAI’s models into its own products, like adding AI-powered features into Word, Excel, and other Microsoft 365 apps under the “Copilot” brand. It also brought these tools to its Azure cloud platform, letting businesses use powerful AI through the cloud.

That said, Microsoft faces growing headwinds in its AI push, including signs of slowing Azure growth, which slightly fell short of expectations in the recent fiscal second quarter readout.

Meanwhile, while the company has been investing heavily in its data center buildout and intends to keep on doing so, following a reassessment of AI demand, it recently paused or scaled back several data center projects in various parts of the world, totaling up to 2 gigawatts of capacity. Additionally, new tariffs on tech imports threaten to disrupt Microsoft’s data center expansion in the U.S., adding further uncertainty to its AI plans.

As all of these headwinds have added up, the stock has been losing ground and is down 8% year-to-date.

Nevertheless, UBS’ Karl Keirstead, an analyst who ranks in the top 3% of Wall Street stock pros, thinks it would be foolish to write Microsoft off at this point, as the company boasts an impressive AI product lineup and is well-equipped to deal with the difficult macro backdrop.

“We believe Microsoft is well positioned to continue to gain market share through its Azure cloud business,” the 5-star analyst said. “We also are bullish on the company’s positioning in AI and its ability to monetize AI on several fronts (copilots, embedded AI in applications, and AI platform services via Azure). Against a backdrop of increased tariff risk, we believe Microsoft has several attractive defensive qualities including strong cash flow and stability through its subscription-based business.”

These comments underpin Keirstead’s Buy rating and $510 price target, suggesting the stock will gain 31% over the one-year timeframe. (To watch Keirstead’s track record, click here)

Elsewhere on the Street, the stock garners an additional 31 Buys and 3 Holds, for a Strong Buy consensus rating. At $504.69, the average target makes room for 12-month returns of ~30%. (See MSFT stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.