Ace fund manager Cathie Wood’s ARK ETFs took advantage of the latest dip in tech stocks, adding more shares of Nvidia (NVDA) and Amazon (AMZN) on Tuesday. The buying spree came as markets swung sharply lower following the U.S. administration’s surprise move to impose a 104% tariff on Chinese imports, triggering a broad sell-off across tech stocks.

Since April 2, when President Donald Trump first unveiled his aggressive global tariff plan, the combined market value of the ‘Magnificent Seven’ tech giants has dropped by an estimated $2.1 trillion. Among them, both Nvidia and Amazon stocks have plunged nearly 13%.

ARK Invest Loads Up on Amazon and Nvidia

Wood continued her strategy of buying the dip, adding 33,746 shares of Amazon on April 8, worth around $5.76 million. This follows two earlier purchases, including 16,881 shares on April 7 and 54,120 shares on April 4, bringing ARK’s three-day total investment in Amazon to about $12.21 million.

ARK ETFs also increased their position in Nvidia. On Tuesday, they bought 188,980 shares valued at approximately $18.2 million. This comes on top of a previous buy of 152,000 shares on April 7, worth about $14.84 million. The back-to-back investments reflect Wood’s strong conviction in Nvidia’s long-term role in artificial intelligence.

Is Nvidia a Good Buy Right Now?

Despite the recent pullback, analysts remain confident in Nvidia’s future. The upcoming launch of its next-gen Blackwell chips is expected to fuel strong demand and increase its presence in the AI space.

On TipRanks, NVDA stock commands a Strong Buy consensus rating based on 37 Buys and four Hold ratings. Also, the average Nvidia price target of $175.06 implies 81.79% upside potential from current levels. NVDA stock has lost 28.8% so far this year.

Is Amazon Still a Buy?

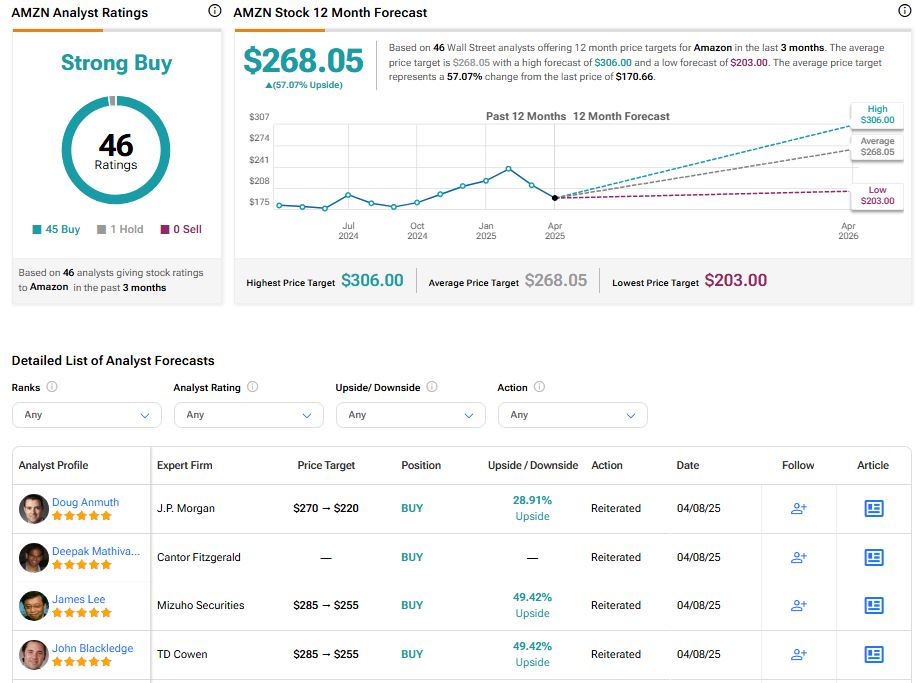

Even as markets wobble, Wall Street remains bullish on Amazon’s long-term prospects, supported by its strong e-commerce and cloud businesses.

On TipRanks, AMZN stock has a Strong Buy consensus rating based on 45 Buys and one Hold rating. Also, the average Amazon.com price target of $268.05 implies 57.07% upside potential from current levels. Year-to-date, AMZN stock has lost 22.2%.