The 2026 AI chip market has officially moved from a one-horse race to a three-way battle for data center supremacy. While Nvidia (NVDA) continues to set the pace with its upcoming Vera Rubin architecture, rivals AMD (AMD) and Broadcom (AVGO) are aggressively carving out territories in open-standard hardware and custom silicon.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

In addition, as new hardware launches scheduled for the second half of the year, the focus is shifting from simply having more power to achieving the best performance-per-watt for the massive wave of AI inference.

Nvidia’s “Rubin” and the $20 billion Groq move

Nvidia remains the sector leader, setting an annual release cadence that few can match. The upcoming Vera Rubin hardware, powered by Rubin GPUs and the new custom “Olympus” ARM-based Vera CPUs, is designed for massive-context processing. This allows the system to handle tasks like video generation and complex coding at speeds far exceeding the current Blackwell generation.

To further solidify its lead in AI inference, the process of running models rather than just training them, Nvidia recently secured a $20 billion licensing deal with startup Groq, effectively absorbing the industry’s top inference talent and technology.

Furthermore, investors are keeping an eye on the GTC event in March, where CEO Jensen Huang is expected to provide the final roadmap for the Rubin rollout. With the stock already up 35% over the past year, the market is pricing in a seamless transition from Blackwell to Rubin. The integration of Groq’s low-latency technology is seen as a strategic “moat” that could prevent rivals from gaining ground in the increasingly important real-time AI service market.

AMD’s “Helios” and the Push for Open Standards

Advanced Micro Devices is having its strongest year yet in the data center, fueled by its “Helios” rack-scale architecture. Scheduled for a Q3 2026 deployment, Helios racks are designed to hold 72 of AMD’s MI450 Series GPUs. Unlike Nvidia’s closed systems, Helios is built on the “Open Rack Wide” standard co-developed with Meta (META), making it an attractive option for hyperscalers who want to avoid vendor lock-in. Oracle (ORCL) has already committed to deploying 50,000 of these chips, with OpenAI also listed as a key early customer.

The success of AMD in 2026 will depend on the smooth execution of these large-scale clusters. If the Helios racks can match Nvidia’s performance while offering the flexibility of open-source networking, AMD could see a significant shift in market share. With shares up 78% over the last 12 months, investors are clearly betting that AMD’s open philosophy is finally resonating with the world’s largest cloud providers.

Broadcom and the Custom Silicon Surge

Broadcom occupies a unique position by designing custom AI chips for others, most notably Google’s TPUs. The big story for 2026 is the expansion of these chips to external clients like Anthropic, which has placed orders totaling $21 billion. By offering a lower total cost of ownership than standard GPUs, Broadcom’s custom silicon is becoming a viable alternative for companies training trillion-parameter models.

However, this growth comes with risks. As AI systems make up a larger share of Broadcom’s revenue, analysts are watching for potential margin compression. The market is also looking for confirmation on a rumored 10-gigawatt deal with OpenAI, which would further cement Broadcom as the go-to partner for custom AI infrastructure. For now, the “Ironwood” TPU racks remain Broadcom’s most potent weapon in the fight against Nvidia’s dominance.

Key Takeaway

The key takeaway is that the “AI tax” is being challenged by customization and open standards. In 2026, the winner won’t just be the company with the fastest chip, but the one that offers the most efficient way to run models at scale. Whether it’s Nvidia’s integrated Rubin stack or AMD’s flexible Helios racks, the next 12 months will decide which architecture becomes the blueprint for the global AI factory.

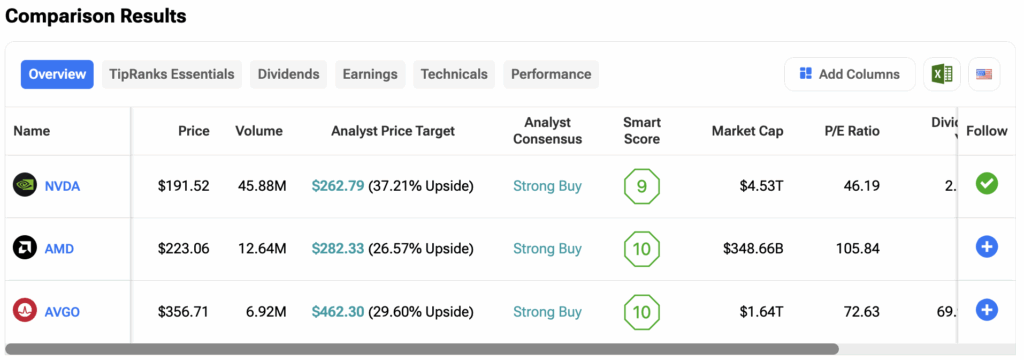

Investors can compare all 3 stocks side-by-side on the TipRanks’ Stocks Comparison Tool. Click on the image below to find out more.