Nvidia (NVDA) and Tesla (TSLA) are two of the most closely watched members of the “Magnificent Seven,” but their paths into 2026 look very different. Nvidia has become the backbone of the AI and data center boom, with demand for its chips far outpacing supply. Tesla, meanwhile, is navigating a more complex phase, balancing EV growth with big bets on autonomy, AI, and robotics.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

For investors, the question isn’t which company is more innovative—but which stock offers the better risk-reward heading into 2026. Here’s how the two Mag 7 giants stack up as potential buys for the year ahead.

Nvidia vs. Tesla: Valuation Risks

Nvidia trades at a premium valuation, reflecting its dominant position in AI chips and data center infrastructure. Investors are willing to pay up for Nvidia’s strong revenue growth, expanding margins, and high visibility into future demand, especially as hyperscalers continue ramping AI spending. For context, NVDA TTM P/E ratio is 45.76, compared to the sector average of 33.3.

Tesla, by contrast, carries a more debated valuation. While the stock has come down from prior highs, it still trades at a premium to traditional automakers, despite near-term pressure on vehicle margins. Bulls argue Tesla’s valuation is supported by long-term opportunities in autonomy, AI, and robotics, while bears see execution risk and slower growth. Notably, TSLA P/E ratio stands at 307.09, way above the sector’s average of 20.74.

Overall, Nvidia’s valuation is driven by current earnings momentum and clear demand visibility, while Tesla’s valuation depends more on future optionality and long-term breakthroughs. Among other risks, Tesla faces more execution- and demand-related challenges, while Nvidia’s risks are largely valuation- and policy-driven.

Nvidia Stock Forecast

In 2025, Nvidia’s stock has climbed almost 30% year-to-date. The stock’s rise has been driven by expectations of strong future earnings, even as investors remain mindful of valuation risks. Looking toward 2026, Nvidia’s technology sits at the heart of data centers, cloud AI, and autonomous systems, giving the company a broad footprint across industries.

In addition, Nvidia stock remains a clear favorite on Wall Street. On average, analysts see NVDA climbing about 40% in 2026, driven by strong AI demand. Overall, the stock carries 39 Buy ratings, along with one Hold and one Sell, highlighting broad analyst confidence.

For instance, Cantor Fitzgerald’s five-star-rated analyst C.J. Muse reaffirmed Nvidia as a “top pick,” saying the stock looks increasingly attractive heading into 2026. Meanwhile, Tigress Financial’s top-rated analyst Ivan Feinseth calls Nvidia a “must-own core holding” for investors looking to benefit from long-term AI growth.

TSLA Stock Forecast

Compared to NVDA, Tesla’s stock had a volatile 2025, pressured by weaker vehicle deliveries, softer demand in key markets, and rising EV competition. However, shares rebounded later in the year, reaching fresh 52-week highs in late December near $490 as optimism grew around robotaxis, autonomy, and AI-driven growth. Overall, TSLA gained about 10% in 2025.

Looking ahead, analysts’ views on Tesla remain mixed, with bulls pointing to autonomy and AI upside, while bears cite margin pressure and slowing EV demand.

NVDA or TSLA: Which Stock Offers Higher Upside, According to Analysts?

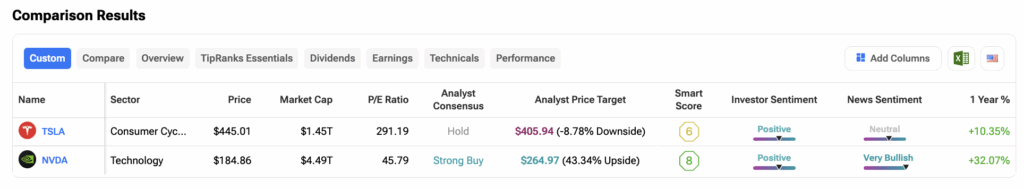

Using TipRanks’ Stock Comparison Tool, we have compared NVDA and TSLA to see which stock offers higher upside to investors. Nvidia stock currently holds a Strong Buy rating, with an average price target of $264.97, implying an upside of 43.34% from current levels.

On the other hand, TSLA stock carries a Hold consensus among 30 analysts. Tesla’s average stock price target of $405.94 suggests a downside of 9%.

Conclusion

Overall, Nvidia stands out as the stronger pick for investors seeking exposure to the core of AI hardware. Tesla, by contrast, represents a higher-risk bet tied to its AI and autonomy goals. In addition, analysts currently favor NVDA, which carries a Strong Buy rating and a 43% upside from current levels.