As we are about to wrap up 2025, investors are eyeing high-growth tech stocks that could deliver strong returns in 2026. Nvidia (NVDA), SoundHound AI (SOUN), and Palantir Technologies (PLTR) are three of the most talked-about names in the sector this year, each offering unique exposure to AI. But which stock presents the best opportunity for long-term potential? Let’s dig deeper.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Here is a quick snapshot:

- Nvidia continues to benefit with the growing global AI spending as a leading supplier of AI chips used in data centers worldwide.

- SoundHound, a pure-play AI company focused on voice and conversational AI, offers high-risk, high-reward upside.

- Palantir’s strong position in AI-driven data analytics for governments and enterprises makes it well-positioned for steady growth as AI moves from hype to real-world use.

We have also compared these stocks across key metrics using TipRanks’ Stock Comparison Tool.

Is NVDA a Good Stock to Buy?

Nvidia’s revenue is rising fast, showing strong demand for its AI and data-center chips. In Q3, the company surpassed $50 billion in revenues, highlighting the massive demand driven by AI. This strong growth is backed by Nvidia’s powerful cash generation, which gives the company the flexibility to keep investing in new chips, expand capacity, and navigate market swings with confidence. At the same time, Nvidia’s deep partnerships with leading AI and cloud players reinforce its dominant position, helping it stay ahead of competitors as the AI market continues to expand.

Among the Wall Street bulls, five-star-rated analyst Mark Lipacis at Evercore ISI has the highest price target of $352 on NVDA, predicting an upside of roughly 100%. Lipacis believes Nvidia’s strong earnings and solid growth outlook confirm its leadership in the AI market. He also noted that its forecast of $493 billion in combined revenue for 2025 and 2026 may be conservative, given the current strength in AI demand.

Overall, analysts are strongly bullish on NVDA stock, with 39 out of 41 analysts covering the stock rating it as a Buy. At $258.97, the Nvidia average share price target implies a 51.52% upside potential.

Is SOUN a Good Investment?

Unlike Nvidia’s massive scale, SoundHound is much smaller—but still, its growth story is catching investors’ attention. That said, SOUN stock has had a tough year, falling about 44% year to date. SoundHound’s valuation concerns weigh on the positive sentiment around the stock. Notably, its forward price-to-sales ratio is 27, much higher than the sector median of 3.4.

While its stock looks expensive for its current size, it has strong potential for fast growth. The company’s Q3 revenue jumped 68% year-over-year. Looking ahead, SoundHound raised its full-year revenue outlook to $165–$180 million, reflecting stronger demand for its voice-enabled technology.

On Wall Street, analyst sentiment remains moderately positive. SoundHound has a Street-high price target of $26 from top-rated analyst Scott Buck at H.C. Wainwright. Buck believes the company is steadily moving toward profitability, driven by improving margins and a clearer path to positive EBITDA. As more industries adopt SoundHound’s voice-AI platform, he expects the company to scale revenue and continue closing the gap to profitability.

According to TipRanks, SOUN stock has received a Moderate Buy consensus rating, with four Buys and two Holds assigned in the last three months. The average stock price target for SoundHound is $17.60, suggesting a potential upside of 60.15% from the current level.

Is PLTR Stock a Good Buy?

Palantir has had a strong run in 2025, with the stock up more than 130% year to date. Like SoundHound, PLTR also faces valuation concerns. Palantir’s price-to-earnings ratio stands at 428.6, far above the sector median of 31.3, showing that investors are paying a premium for its proven track record and long-term government and enterprise contracts.

On the plus side, many analysts believe its strong fundamentals and strategic positioning justify this valuation. However, the stock offers more stability than explosive upside, limiting the chances of short-term gains.

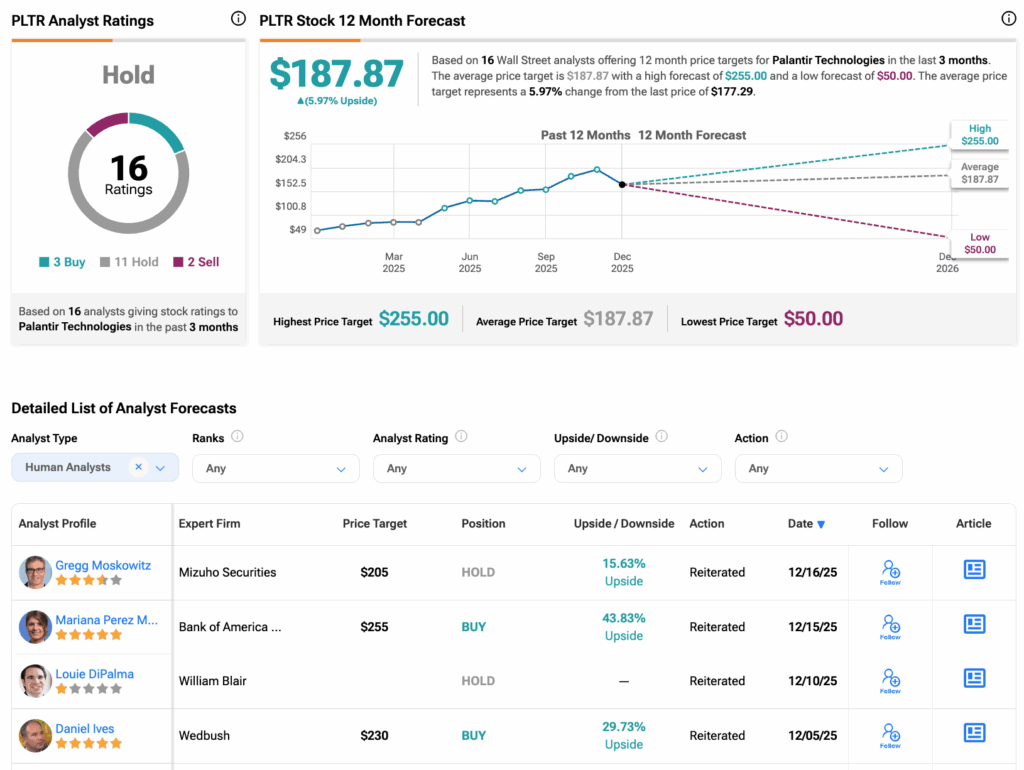

Turning to Wall Street, BofA’s five-star-rated analyst Mariana Perez Mora has the Street-high price target of $255 on PLTR, implying an upside of nearly 40% from its current price. Mora said Palantir’s revenue growth shows no signs of slowing, fueled by strong demand from enterprise customers and expanding government contracts.

Overall, PLTR stock has a Hold consensus rating based on three Buys, 11 Holds, and two Sell ratings. The average Palantir’s price target of $187.87 implies 6% upside potential from current levels.

Conclusion

Nvidia offers the safest and most proven way to benefit from the AI boom, backed by massive revenue, strong cash flow, and industry dominance.

Meanwhile, Palantir provides a stable, fundamentals-driven AI play, though much of its upside may already be priced in after a strong run. Lastly, SoundHound is the highest-risk, highest-reward option, with a smaller scale but meaningful long-term upside if it can keep growing and move toward profitability.