Nvidia (NVDA) and Palantir Technologies (PLTR) sit on opposite sides of the AI market. Nvidia builds the chips that run AI workloads, while Palantir develops software that helps customers apply AI across real-world tasks. Using TipRanks’ Stock Comparison Tool, we lined up the two stocks to see which one Wall Street prefers so far in 2026.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Is Nvidia a Good Stock to Buy in 2026?

With a market value of about $4.59 trillion, Nvidia has firmly established itself as the leader in AI chips. The stock has gained 26% in 2025, reflecting strong demand for its GPUs, which power data centers, cloud platforms, and large AI models. Spending from hyperscalers and large enterprises continues to support that demand as companies expand AI capacity.

At CES 2026, Nvidia outlined its next phase of growth, including the Rubin platform, which is aimed at more advanced AI workloads over time. While these products will roll out gradually, they reinforce Nvidia’s long-term role at the center of AI infrastructure.

That said, valuation remains the key concern. Nvidia shares trade well above historical levels, leaving little room for error. The stock currently trades at around 46 times earnings, compared with a semiconductor sector average in the mid-20s. That multiple is also higher than peers such as Alphabet (GOOGL), Amazon (AMZN), and Microsoft (MSFT), which trade closer to the low-30s range.

With expectations already high, future gains are likely to depend more on earnings growth and execution than on product announcements alone.

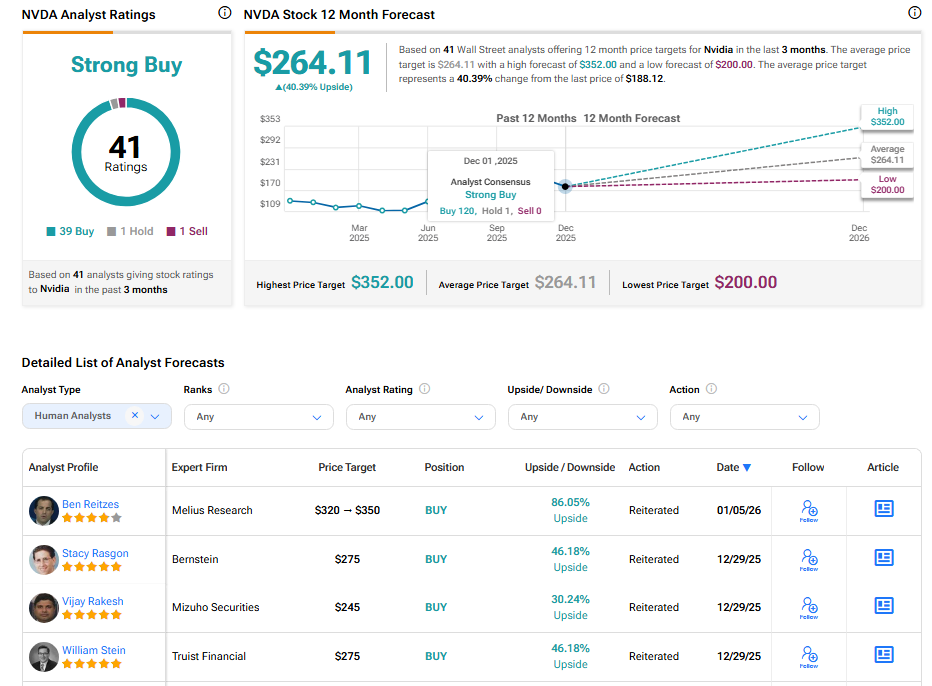

What Is NVDA Stock Forecast?

Despite valuation concerns, Wall Street remains largely positive. Analysts continue to point to Nvidia’s strong position in AI chips, strong margins, and long-term growth outlook, while acknowledging that the stock is no longer cheap.

According to TipRanks, NVDA has a Strong Buy consensus rating, based on 39 Buys, one Hold, and one Sell. At $264.11, Nvidia’s average stock price target implies an upside of 40% from the current level.

Is Palantir Stock Still a Buy after a Strong 2025 Run?

Palantir was one of the standout AI performers in 2025, with shares climbing more than 130% over the past year, driven by rising use of its AI tools across government and commercial customers. Its AI Platform (AIP) helps clients manage large data sets and support decision-making, which has lifted revenue growth and improved profitability.

So far in 2026, the stock has been more uneven. After a sharp run, some investors have grown more cautious toward high-priced AI names. Even so, Palantir continues to report steady customer activity, and management says AIP adoption remains healthy.

Like Nvidia, valuation is a key issue. Palantir trades at a much higher multiple than most software peers, which limits room for upside unless growth stays strong. That has kept analysts split on the stock, even as the business continues to expand.

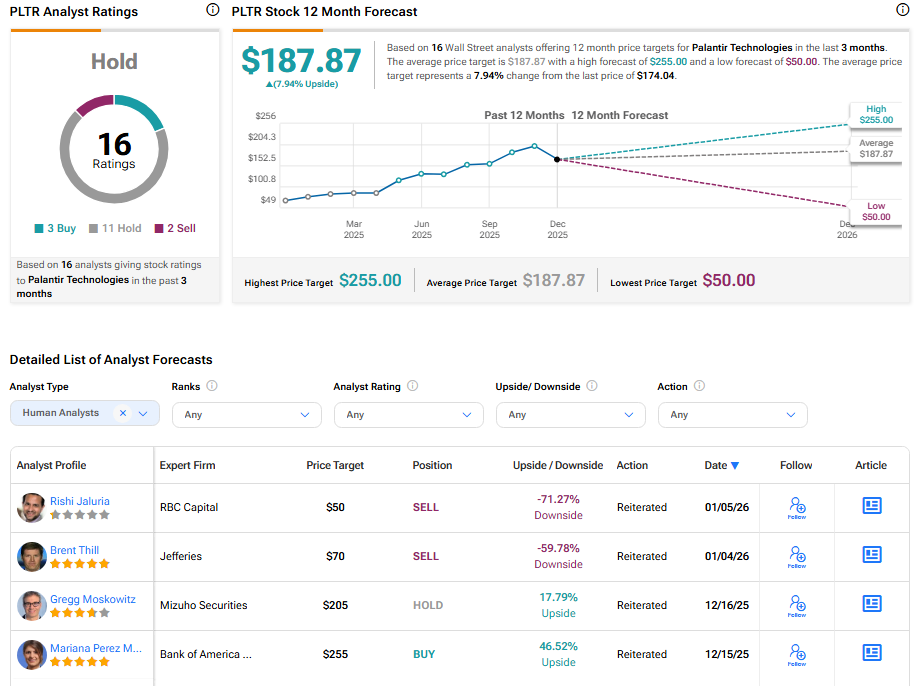

What Is the Price Target for PLTR Stock?

While Wall Street analysts believe the company has a long runway ahead, some caution that much of that future growth may already be priced into the shares.

On TipRanks, PLTR stock has a Hold consensus rating based on three Buys, 11 Holds, and two Sells assigned in the last three months. At $187.87, Palantir’s average stock price target implies an upside of 8% from the current level.

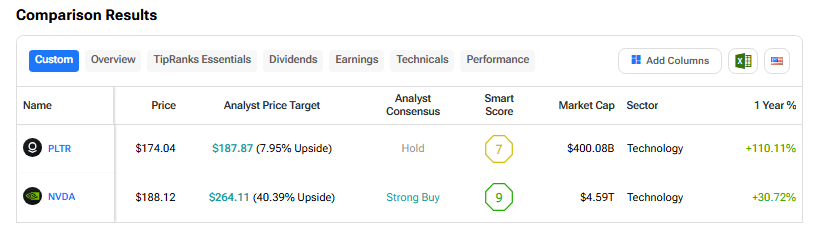

NVDA or PLTR: Which Stock Offers Higher Upside, According to Analysts?

Using TipRanks’ Stock Comparison Tool, we compared Nvidia and Palantir to see which AI stock Wall Street currently favors. Nvidia carries a Strong Buy consensus rating, while Palantir holds a Hold rating. Based on analyst price targets, NVDA offers about 40% upside, compared with roughly 8% upside for PLTR from current levels.

Nvidia also leads on TipRanks’ Smart Score, earning a 9 versus Palantir’s 7, suggesting stronger overall momentum when analyst sentiment, fundamentals, and technical factors are considered together.

Conclusion

Wall Street currently favors Nvidia, with a Strong Buy rating and much more room for gains based on analyst price targets. Meanwhile, Palantir remains an interesting AI stock, but its Hold rating and limited upside suggest analysts are more cautious for now.