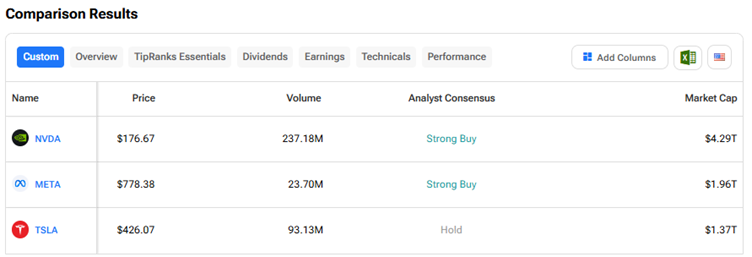

Magnificent 7 stocks – Alphabet (GOOGL), Amazon (AMZN), Apple (AAPL), Meta Platforms (META), Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA) are prominent tech companies that are known for their market dominance, innovation, and influence on the Nasdaq Composite and S&P 500 (SPX) indices. Using TipRanks’ Stock Comparison Tool, we placed Nvidia, Meta Platforms, and Tesla against each other to find the best Magnificent 7 stock among these three, according to Wall Street analysts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Nvidia (NASDAQ:NVDA) Stock

Semiconductor giant Nvidia continues to be viewed as one of the key beneficiaries of the ongoing generative artificial intelligence (AI) boom. Despite concerns over rising competition in the AI chip market from Broadcom (AVGO) and Advanced Micro Devices (AMD) and uncertainty related to China chip sales, NVDA stock is up about 32% year-to-date. The company stunned the stock market on Thursday when it announced a game-changing $5 billion investment in troubled chipmaker Intel (INTC). While the deal is a solid vote of confidence in Intel’s turnaround, it also benefits Nvidia through incremental revenue opportunities.

Overall, investors are bullish about Nvidia due to the company’s dominant position in the AI GPU (graphics processing units) market, continued innovation, strategic investments, and opportunities in sovereign AI. As part of its Sovereign AI focus, Nvidia announced £11 billion ($15 billion) of investment in the U.K. with partners Nscale and U.S. cloud infrastructure company CoreWeave (CRWV), deploying 120,000 Nvidia Blackwell Ultra GPUs in local data centers.

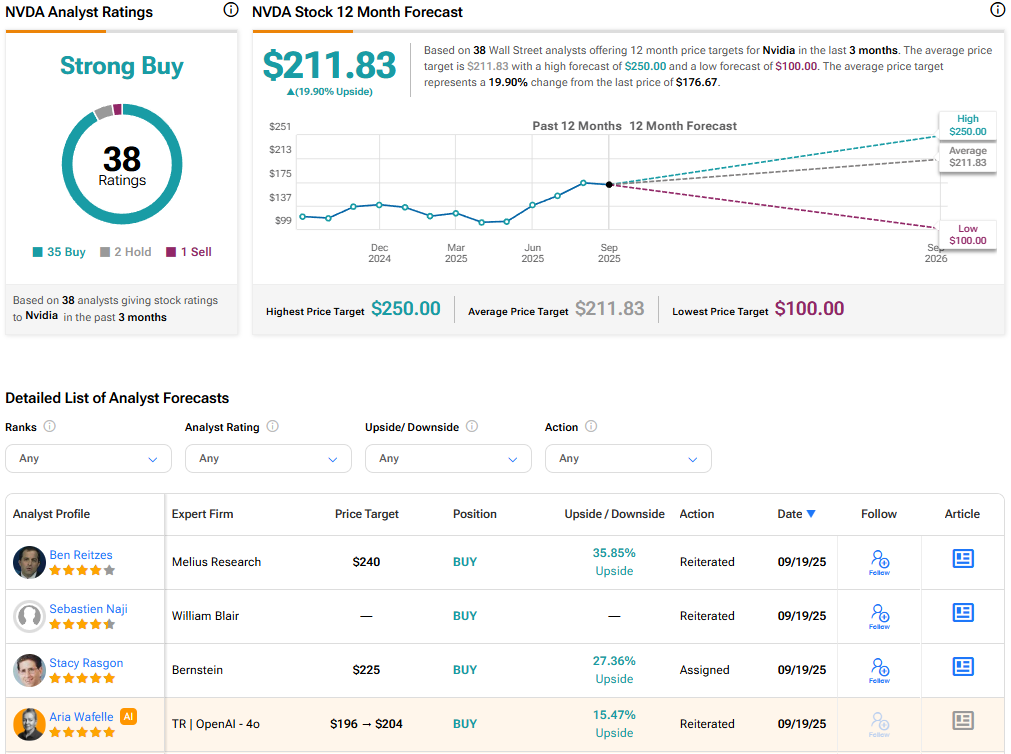

Is Nvidia a Good Stock to Buy?

Following the news of the Intel deal, DA Davidson analyst Gil Luria reiterated a Buy rating on Nvidia stock with a price target of $210. The 5-star analyst views the announcement of a “multi-generation collaboration” on the development of custom data center and PC products between the two chip giants as a strategic win for both companies, as Nvidia continues to accelerate momentum around the AI ecosystem while supporting the “only viable leading-edge domestic foundry.”

Luria believes that Intel is no longer a meaningful competitor for Nvidia, given that the latter has already captured the majority of demand for AI compute and is now investing in other AI entities to ensure continued momentum. The analyst believes that one of NVDA’s motivations for investing in Intel is the ability to diversify the CPU options beyond the Arm Holdings (ARM)-based solution manufactured by Taiwan Semiconductor Manufacturing Company (TSM). Additionally, Luria believes that Nvidia’s investment aligns with the Trump administration’s efforts to enhance domestic semiconductor capacity.

With 36 Buys, two Holds, and one Sell recommendation, Nvidia stock scores Wall Street’s Strong Buy consensus rating. The average NVDA stock price target of $211.83 indicates about 20% upside potential from current levels.

Meta Platforms (NASDAQ:META) Stock

Meta Platforms stock has risen 33% year-to-date. The social media giant has been delivering impressive growth in its revenue and earnings, with strong engagement across its Facebook, Instagram, WhatsApp, Messenger, and Threads apps. The integration of AI into the company’s apps is helping drive strong user engagement.

The company is spending significantly to support its AI-focused growth story. Meta Platforms expects its capital expenditure to be in the range of $66 billion to $72 billion for 2025. It has been spending aggressively to hire AI talent, including poaching key AI employees from tech rivals.

Meanwhile, Meta Platforms is also focused on offering innovative wearable tech. At the recently held Meta Connect event, the company unveiled the $799 Meta Ray-Ban Display glasses, its first consumer-ready smart glasses with a built-in display, as well as other innovations.

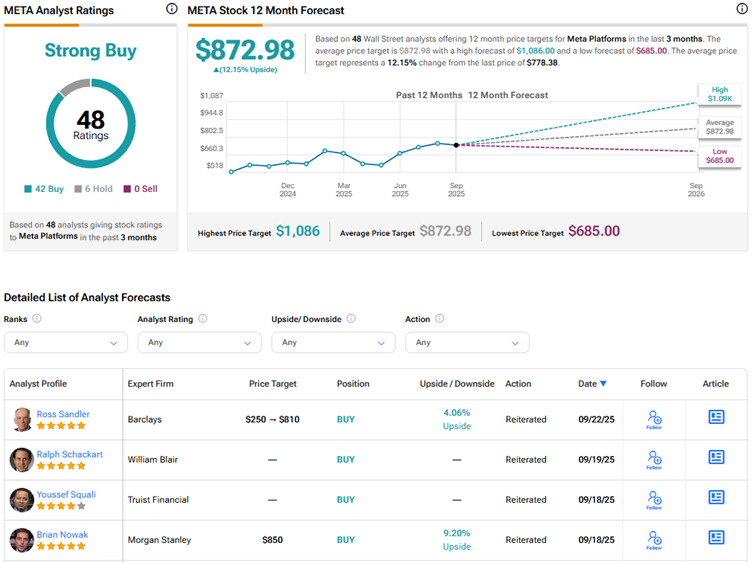

Is META Stock a Buy, Hold, or Sell?

Following the Connect event, Citi analyst Ronald Josey reiterated a Buy rating on Meta Platforms stock with a price target of $915. The 5-star analyst stated that with three new AI smart glasses launched at the event, he is “incrementally positive” on Meta’s AI glasses and broader AI device strategy. The analyst believes that adoption of the glasses could reach a tipping point next year.

Josey was particularly impressed with the heads-up display and Neural Band integration of the new Meta Ray-Ban Display glasses and sees multiple use cases as the technology evolves. Overall, the analyst believes that Meta Platforms’ short, medium, and long-term product roadmap can drive continued engagement, monetization gains, and margin expansion as its AI investments remain highly strategic.

Currently, Wall Street has a Strong Buy consensus rating on Meta Platforms stock based on 42 Buys and six Holds. The average META stock price target of $872.98 indicates 12.2% upside potential.

Tesla (NASDAQ:TSLA) Stock

After being under pressure due to multiple reasons, including CEO Elon Musk’s political ambitions, Tesla stock has recovered more than 29% over the past month and is up 5.5% year-to-date. Optimism about the company’s robotaxis, Optimus humanoid robot, and Musk’s recent $1 billion worth share purchase have driven the rebound in the electric vehicle (EV) maker’s stock.

That said, persistent weakness in Tesla’s EV volumes amid intense competition and the end of EV credits are keeping several analysts on the sidelines on the stock.

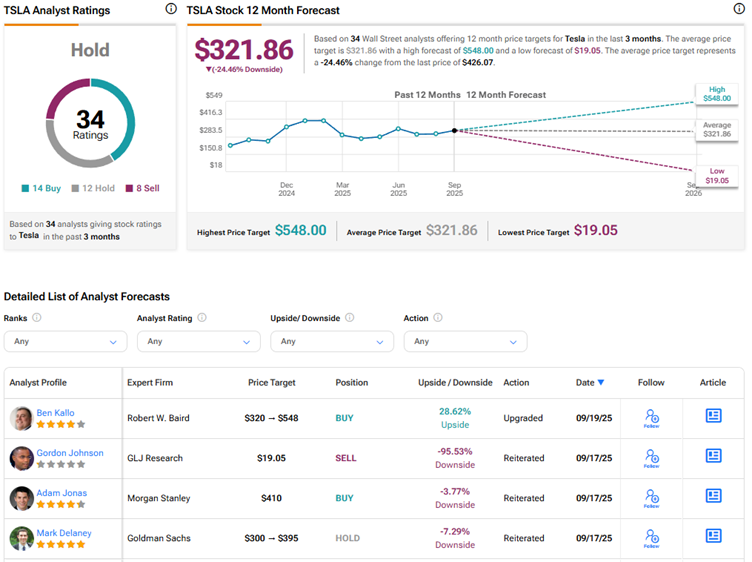

Is TSLA Stock a Buy, Sell, or Hold?

Recently, Goldman Sachs analyst Mark Delaney increased the price target for Tesla stock to $395 from $300 and reiterated a Hold rating. The 5-star analyst thinks that following the recent rally, investors will now focus on Tesla’s Q3 delivery report, the company’s progress with autonomy/robotaxis, mainly its ability to remove the safety observer from its robotaxis (as there is still a human present in the vehicles), and Optimus 3 updates. Investors will also pay attention to the EV maker’s profit margins and free cash flow, especially the impact of tariffs and the end of IRA credits.

While Delaney expects that over the longer term, Tesla’s earnings per share (EPS) will be driven in part by larger contributions from autonomy and robotics, his base case expectation for profits in these areas is more “measured” than what the company is targeting. The analyst added that if Tesla wins outsized share in areas such as humanoid robotics and autonomy, then there could be upside to his price target. However, he cautioned that if competition limits profits, as in the case of the ADAS market in China, or Tesla does not execute well, then there could be downside to his price target.

Currently, Wall Street has a Hold consensus rating on Tesla stock based on 14 Buys, 12 Holds, and eight Sell recommendations. The average TSLA stock price target of $321.86 indicates a possible downside of 24.5% from current levels.

Conclusion

Wall Street is bullish on Nvidia and Meta Platforms stocks but sidelined on Tesla stock. Currently, analysts see higher upside potential in NVDA than in the other two magnificent 7 stocks discussed here. Continued demand for Nvidia’s AI chips, solid execution, and a persistent focus on innovation support Wall Street’s bullish stance despite rising competition and China woes.