Shares of chipmaker Nvidia (NVDA) slipped in after-hours trading after the company reported earnings for its third quarter of Fiscal Year 2025. Earnings per share came in at $0.81, which beat analysts’ consensus estimate of $0.75 per share. Interestingly, Nvidia has only missed expectations once since November 2020.

Don’t Miss TipRanks’ Half-Year Sale

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

In addition, sales increased by 94% year-over-year, with revenue hitting a new quarterly record of $35.1 billion. This beat analysts’ expectations of $33.17 billion and was mainly driven by a 112% jump in Data Center revenue, which came in at $30.8 billion – also a quarterly record. Nvidia’s operational momentum appears to show no signs of slowing down.

In fact, CEO Jensen Huang stated, “The age of AI is in full steam, propelling a global shift to NVIDIA computing.” He also went on to say that the demand for Hopper GPUs, as well as the anticipation for Blackwell GPUs, remain exceptionally strong. He believes that AI is driving a transformative wave across industries and nations as businesses overhaul workflows while governments recognize the critical importance of developing a national AI strategy and infrastructure.

Nvidia Returns $11B to Shareholders

During the third quarter, Nvidia returned over $11.2 billion to shareholders. Dividends made up $245 million, while buybacks made up nearly $11 billion. Although this is a massive amount on an absolute basis, it makes up about 0.3% of the company’s more than $3.6 trillion market cap. In addition, Nvidia returned over $26 billion during the first nine months of its fiscal year, which equates to a little over 0.7% of its current market cap.

Outlook for 2025

Looking forward, management has provided the following guidance for Q4 2025:

- Revenue of $37.5 billion (+/- 2%) versus analysts’ estimates of $37.03

- Non-GAAP gross margin of 73.5% (+/- 0.5%)

- non-GAAP operating expenses of $3.4 billion

As we can see, the company’s revenue outlook and Q3 results are better than expected, but the stock price still fell. This is likely because shares rallied into earnings in anticipation of a beat. However, it appears that the beat was not convincing enough to enthuse investors.

What Is a Good Price for NVDA?

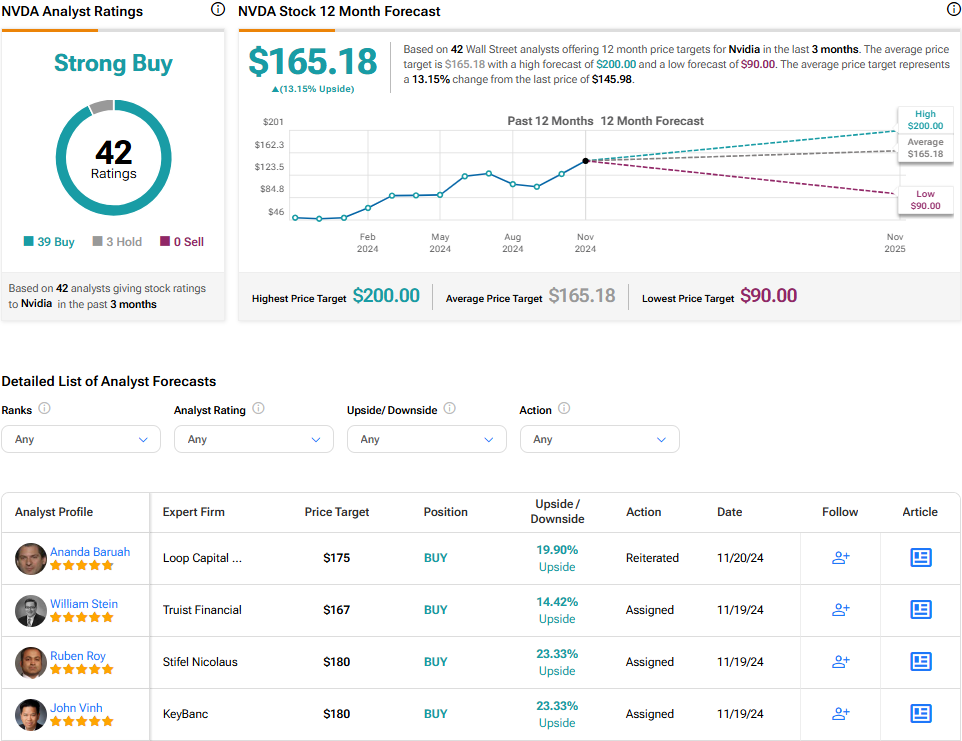

Turning to Wall Street, analysts have a Strong Buy consensus rating on NVDA stock based on 39 Buys, three Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 192% rally in its share price over the past year, the average NVDA price target of $165.18 per share implies 13.15% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.