U.S. Treasuries are declining and stocks are soaring amid reports that U.S. President Donald Trump will take a more targeted approach with his next round of tariffs scheduled for implementation on April 2.

The yield on the 10-year Treasury rose as much as four basis points to 4.29%. At the same time, the blue-chip Dow Jones Industrial Average is up more than 500 points and the technology-laden Nasdaq index is up nearly 2% at noon hour on March 24.

Technology stocks, in particular, are surging, with shares of mega-cap names such as Nvidia (NVDA), Amazon (AMZN), and Alphabet (GOOGL) each up more than 2% on the day. The positive moves come amid widespread reports that Trump’s reciprocal trade tariffs scheduled to go into effect on April 2 will be narrower and more targeted than initially planned.

Targeted Approach

A more targeted approach is easing fears of a global trade war that will hamper U.S. economic growth. Trump’s tariff and trade-war threats sparked fears of a recession in America, pushing investors out of stocks and into the safety of bonds. That trend may now be reversing.

Media reports say Trump’s upcoming April 2 tariffs might be sector specific and are likely to exclude many areas of the U.S. and global economies. That said, President Trump himself hasn’t made any formal announcements on what products and sectors will be hit with tariffs on April 2, other than to refer to the upcoming date as “liberation day” for American industry.

NVDA stock has decreased 10% so far in 2025.

Is NVDA Stock a Buy?

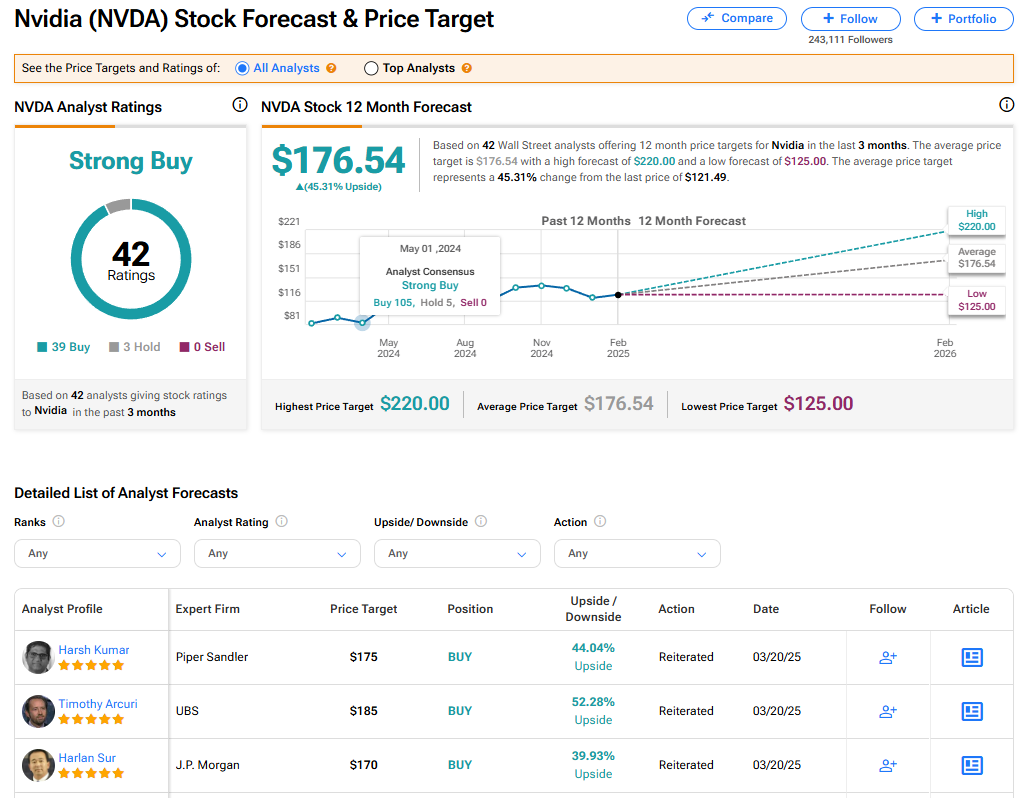

The stock of Nvidia has a consensus Strong Buy rating among 42 Wall Street analysts. That rating is based on 39 Buy and three Hold recommendations issued in the last three months. The average NVDA price target of $176.54 implies 45.31% upside from current levels.

Read more analyst ratings on NVDA stock

Questions or Comments about the article? Write to editor@tipranks.com