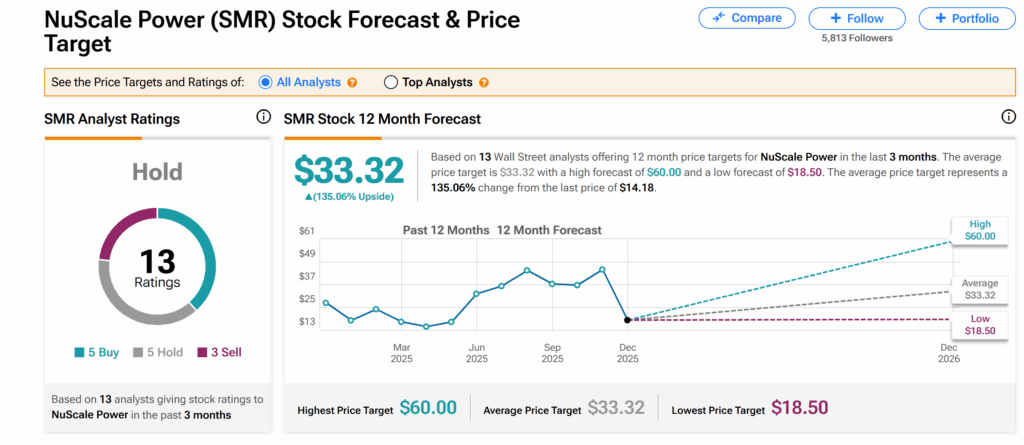

Shares in U.S.-based nuclear reactor manufacturer NuScale Power (SMR) saw a change in fortunes in 2025, dropping about 21%. Yet, analysts on Wall Street see a 135% upside for SMR in 2026 despite their overall Hold rating.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The current Hold consensus rating breaks down to five Buys, five Holds, and three Sells issued over the last three months. This comes with an average SMR price target of $33.32, implying 135.06% upside potential.

Why NuScale Power Losses Widened

As of early September, NuScale’s shares were up by almost 400% from their price twelve months earlier. However, things took a drastic turn, even as NuScale saw its operating loss deepen by over 1,200% year-over-year to $538.44 million in Q3 2025. The massive loss came despite the firm’s revenue ballooning by over 1,600% from a year ago to reach $8.2 million.

The revenue growth was driven by services provided to RoPower, a joint venture currently owned by Nuclearelectrica, Romania’s state nuclear operator, and Nova Power & Gas, a private Romanian energy company. However, the firm’s net loss widened due to a one-time charge of $495 million to meet the first milestone of its agreement with energy developer ENTRA1.

Where Does Wall Street See NuScale Power in 2026?

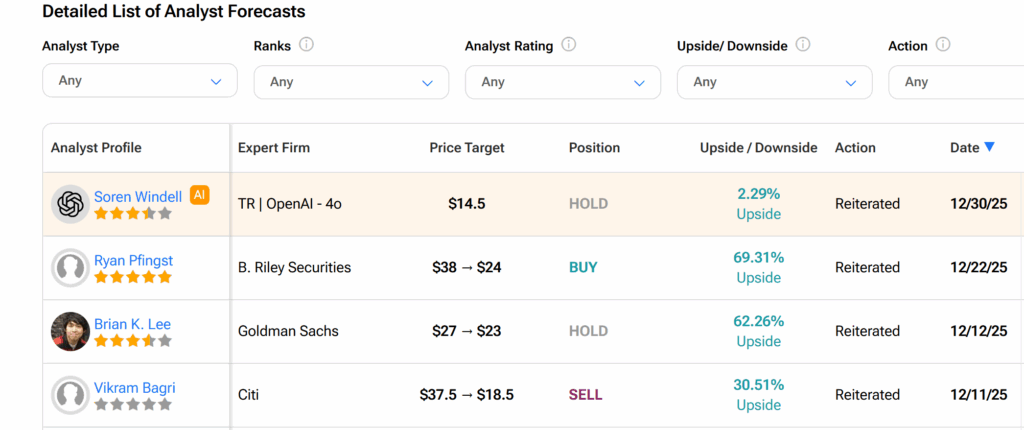

In recent days, B. Riley analyst Ryan Pfingst trimmed his SMR price target by 37% to $24 per share, implying about 71% upside. Defending the lower price target, Pfingst pointed to the nearly double increase in shares approved by the company’s stakeholders — the number of authorized shares of class A common stock is to rise from 332 million to 662 million. Nonetheless, the analyst recommends buying the stock.

In sharp contrast, Citi analyst Vikram Bagri in early November reaffirmed his Hold rating on SMR stock and slashed his price target by 51% to $18.50, implying about 32% upside. Vikram pointed to major shareholder Fluor’s (FLR) plan to monetize its stake and uncertainty around NuScale’s first binding, commercial agreement with a customer.

The analyst also argued that NuScale, in the short-to-medium term, is unlikely to ink a contract with the U.S. public utility, Tennessee Valley Authority (TVA). This is even though ENTRA1 is expected to deploy 72 of NuScale’s modules to meet the six gigawatts of new nuclear energy capacity agreed in its deal with the TVA.

Amid the broader bearish mood, Wall Street’s lofty consensus target for 2026 seems to largely reflect the potential windfall NuScale could reap from the shift in the United States’ nuclear policy. However, how this would play out remains to be seen.

Should You Buy NuScale Power in 2026?

Analysts on Wall Street suggest NuScale Power’s shares could potentially rise about 135% over the next 12 months, with a few seeing even bigger jumps of more than 200%.