NuScale Power (SMR) stock soared on Friday after the nuclear power plant company received updated analyst coverage. Bank of America analyst Dimple Gosai upgraded SMR stock to a Neutral rating from an Underperform but lowered his price target to $28 from $34, implying a possible 42.35% upside for the shares.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Gosai upgraded NuScale Power after it overcame a period that resulted in a mismatch between the price of the stock and the company’s value. He linked this to recent ENTRA1 milestones, higher near-term cash needs, and dilution risk. With these changes, the company has reached a more balanced risk-and-reward position, warranting the upgrade to a Neutral rating.

NuScale Power isn’t the only nuclear energy stock that was on the rise Friday. Oklo (OKLO) stock also gained alongside news that it will act as a nuclear power provider for Meta Platforms (META). The social media and artificial intelligence (AI) company needs more power for its AI endeavors, which resulted in it signing a deal with Oklo and two other companies.

NuScale Power Stock Movement Today

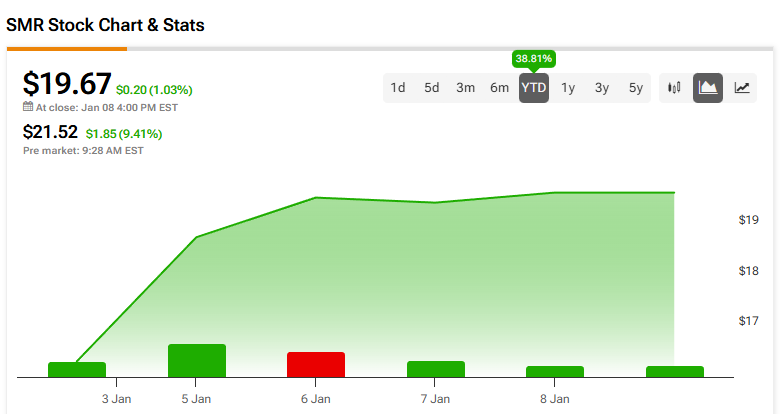

NuScale Power stock was up 9.41% in pre-market trading on Friday, following a 1.03% rally yesterday. The stock has also increased 38.81% year-to-date but was down 2.21% over the past 12 months.

With today’s news came decent trading activity for SMR stock, as some 7 million shares changed hands, compared to a three-month daily average trading volume of about 23 million units.

Is NuScale Power Stock a Buy, Sell, or Hold?

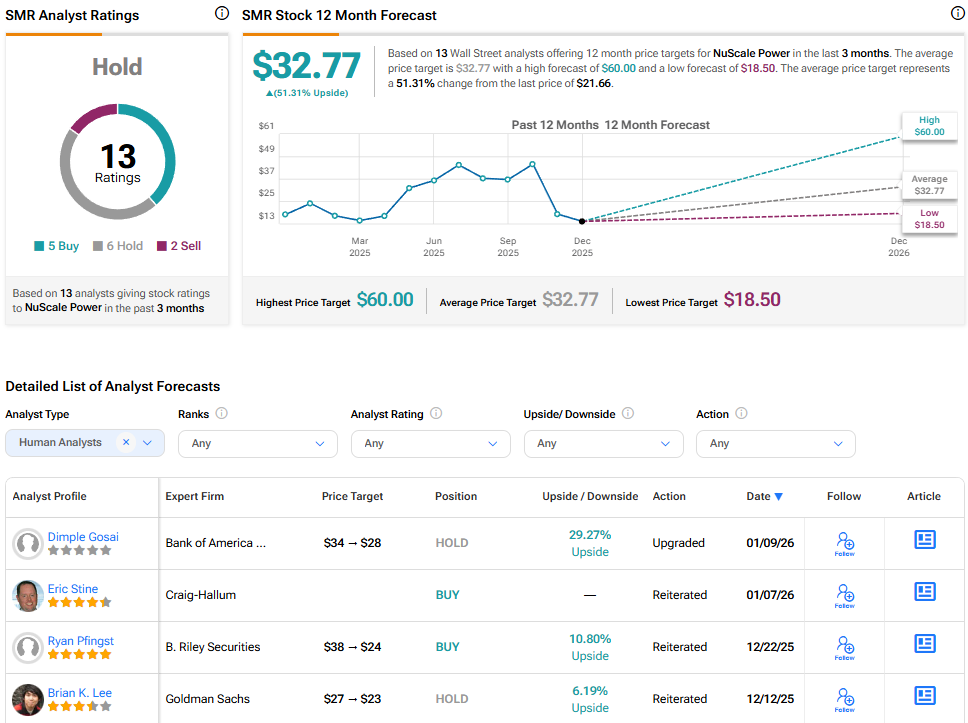

Turning to Wall Street, the analysts’ consensus rating for NuScale Power is Hold, based on five Buy, six Hold, and two Sell ratings over the past three months. With that comes an average SMR stock price target of $32.77, representing a potential 51.31% upside for the shares.