Next week marks an important deadline for Novo Nordisk (NVO) investors. After seeing the pharma company’s strong run since 2021, now fading, the latest factor to add to the sentiment slump is a class-action lawsuit in the U.S. Those who held the stock between May and July this year have the opportunity to join a bandwagon in search of financial reparations.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

In the meantime, NVO stock was down more than 10% last week and is 34% lower year-to-date. NVO shareholders could be forgiven for feeling like the walls are closing in.

In addition, fresh reports point to looming legal action tied to Ozempic, Novo Nordisk’s blockbuster semaglutide drug approved for type 2 diabetes. Emerging studies suggest that higher doses can cause gastroparesis, a severe digestive condition. Several U.S. law firms allege that, until recently, Ozempic’s warning label failed to fully inform patients and physicians of these risks—potentially opening the door for injured users to seek financial compensation.

Clearly, some NVO shareholders will be reaching the end of their tether and must be wondering how they’ve ended up in a siege scenario in the blink of an eye. NVO’s annual report said 2024 was “a year of significant growth characterised by continued innovations.”

Historical Precedent Favors NVO

By Tuesday, shareholders must decide whether to petition the court for lead plaintiff status in a class-action lawsuit against NVO alleging fraud. While such deadlines often pass quietly, the broader implications are worth unpacking—both for Novo Nordisk and for its global shareholder base.

Securities fraud class actions are not uncommon, particularly against high-profile pharmaceutical and biotech firms. Precedent suggests that these cases can take years to resolve, with motions to dismiss, class certification battles, discovery, and appeals often stretching across three to five years or more. Importantly, the largest class action settlements in U.S. securities law, such as Enron, WorldCom, and Tyco, dwarf biotech-only cases. Biotech tends to produce smaller dollar settlements, but on the flip side, they generate much higher reputational risk.

A case in point is Valeant Pharmaceuticals in 2021 – the suit was settled for $1.2 billion after affected investors claimed Valeant had made misleading financial disclosures, inflated pricing, and business model risks. The case became the 9th-largest securities class action settlement in corporate history and the largest to be reached against a pharmaceutical manufacturer.

Another case is Puma Biotechnology (PBYI) in 2019, where plaintiffs alleged that Puma’s CEO falsely overstated the efficacy of its drug neratinib (later marketed as Nerlynx). The jury sided with the plaintiffs, concluding that the misrepresentation inflated the company’s stock price. Both cases took over three years to settle, so a similar timeframe is likely expected for NVO.

NVO’s Stretched Timeline

In its Review and Analysis report published last year, Cornerstone Research stated that the median time to settlement for securities class actions has recently been ~3.2–3.4 years. In comparison, some studies place the global average closer to ~45 months (or 3.8 years).

Assuming NVO’s case tracks the median line, a realistic timeline could be the following, according to Cornerstone Research:

- Late 2025 – mid 2026: Lead-plaintiff appointment; motion to dismiss briefing and ruling.

- 2026 – 2027: Class certification briefing and fact/expert discovery (often the longest phase).

- Late 2027 – 2028: Summary judgment; many cases settle around or after these rulings.

- If no settlement: Trial could be 2029+, with appeals adding 1–2 years beyond that.

According to last month’s filing, a settlement-track resolution may be reached sometime in 2028–2029; a full trial/appeal path could push it into 2030 or later, depending on motions and appeals.

That timeline cuts both ways for investors. On the one hand, long legal horizons tend to soften immediate market sentiment. On the other hand, the mere existence of litigation generates negative publicity, creates a distraction for management, and piles on legal costs.

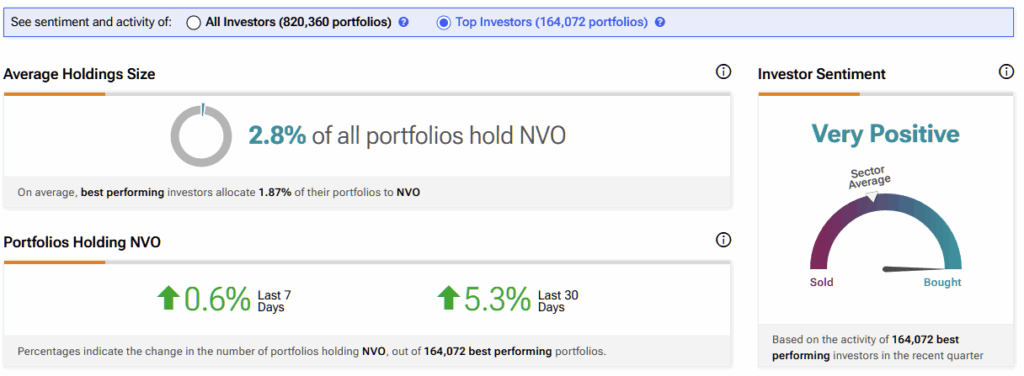

For current shareholders, the decision to participate carries an awkward paradox. If they join the case and eventually prevail, any damages awarded would be paid out of Novo Nordisk’s own coffers—the same source of future dividends, buybacks, and capital appreciation. Suing the company you own is, in effect, a version of biting the hand that feeds you. For the time being, sentiment is “very positive,” according to ~164,000 investor portfolios tracked by TipRanks.

The Dilemma Facing NVO Shareholders

The takeaway for current investors is mixed. Novo Nordisk remains a global leader in diabetes and obesity care, expanding its reach and pipeline. Yet the class action highlights the risks associated with heightened expectations and the pressure on management to deliver consistent U.S. growth. Even if the lawsuit takes years to resolve, the reputational costs are immediate. In the meantime, NVO shareholders face a significant decision, as new NVO investors are scarce due to the cloud of uncertainty now surrounding the company. The stock’s rapid decline waits for no one.

Yet the broader picture shows a company both surging ahead and stumbling at the same time. Given the confluence of factors, it seems that NVO stock may be too good to sell and too bad to buy — leaving shareholders trapped in a bind where every choice seems like the wrong one.