Novartis (NYSE:NVS) shares are trending nearly 3% lower in the early session today after the pharmaceutical company’s fourth-quarter results failed to impress investors. Despite rising by 8% year-over-year, revenue of $11.42 billion lagged expectations by $460 million. In sync, EPS of $1.53 came in lower than estimates by $0.12.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

For the full year, net sales rose by 8%, and operating income increased by 23%. In Q4, the company’s sales growth was primarily driven by double-digit gains in Entresto, Kisqali, Kesimpta, and Pluvicto.

Following the spin-off of the Sandoz business, Novartis has transformed itself into a “Pure play innovative medicines business.” The company is now focused on the four core therapeutic areas of cardiovascular-renal-metabolic, immunology, neuroscience, and oncology. For Fiscal Year 2024, Novartis foresees net sales growth in the mid-single-digits. Further, core operating income is seen rising in the high-single-digits.

Novartis is also increasing its dividend by 3.1% to CHF 3.30 per share. A shareholder vote on the proposed dividend increase is slated for March 5.

Is NVS Stock a Good Buy?

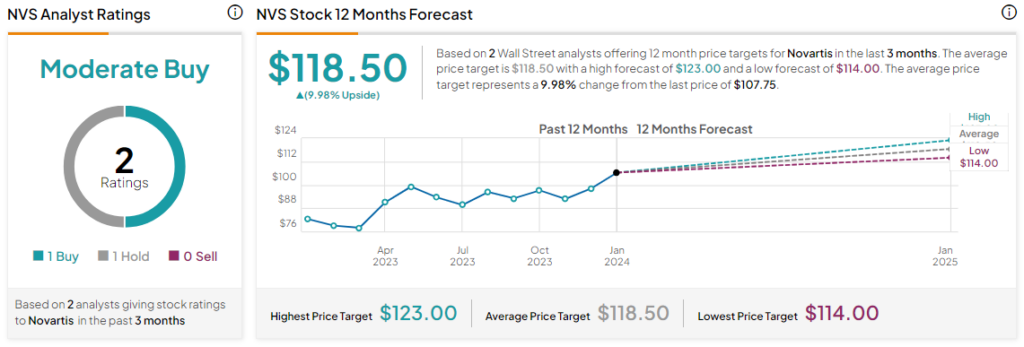

Overall, the Street has a Moderate Buy consensus rating on Novartis, and the average NVS price target of $118.50 implies a nearly 10% potential upside in the stock. That’s after a nearly 20% rise in the company’s share price over the past year.

Read full Disclosure