U.S solar stocks surged on Tuesday after a draft Republican or GOP (Grand Old Party) tax bill turned out to be far less damaging to renewable energy incentives than investors had feared. Reacting to the news, Shawn Kravetz, president and CIO of Esplanade Capital, an investor in renewable energy, commented, “It isn’t nearly as draconian as was feared.”

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The surprise shift in tone from GOP lawmakers sparked renewed optimism across the solar sector, with First Solar Inc. (FSLR) leading the charge. FSLR stock soared 22.6% on Tuesday, delivering its biggest single-day gain in over a year. The surge extended across the clean energy sector on Tuesday, with Sunrun (RUN) climbing 8.5%, while wind turbine giant Vestas Wind Systems (VWDRY) gained over 9%.

GOP Proposal Softens Blow to Clean Energy

To be clear, the proposal does take away some key clean energy benefits from the Biden-era Inflation Reduction Act, but it doesn’t cancel everything immediately. Instead, the popular 30% tax credits for clean energy projects will begin to phase out in 2029. The tax credit gradually decreases to 80% in 2029, 60% in 2030, and 40% in 2031, before ending entirely in 2032. Also, the $7,500 tax credit for buying electric vehicles will end after 2026.

Still, the slower phase-out came as a welcome surprise for solar stocks, especially for First Solar, the largest U.S.-based solar panel manufacturer. The company also stands to benefit from proposed rules that would restrict imports from certain foreign countries, likely aimed at Chinese competitors. This is a key advantage, as First Solar competes directly with several heavily subsidized Chinese firms.

JPMorgan Calls House Bill a Major Tailwind for First Solar Stock

According to J.P. Morgan’s top-rated analyst Mark Strouse, the proposed updates meet, or even go beyond, the most optimistic expectations investors had for solar, wind, battery storage, and geothermal energy companies.

He added that restrictions on products from certain foreign-influenced companies are a big win for First Solar. That’s because around 60% of the company’s expected earnings over the next two years come from 45X tax credits, which could be better protected under the new rules. For context, Section 45X is a U.S. tax credit under the Inflation Reduction Act that rewards domestic production of clean energy components.

Is FSLR a Good Stock to Buy Now?

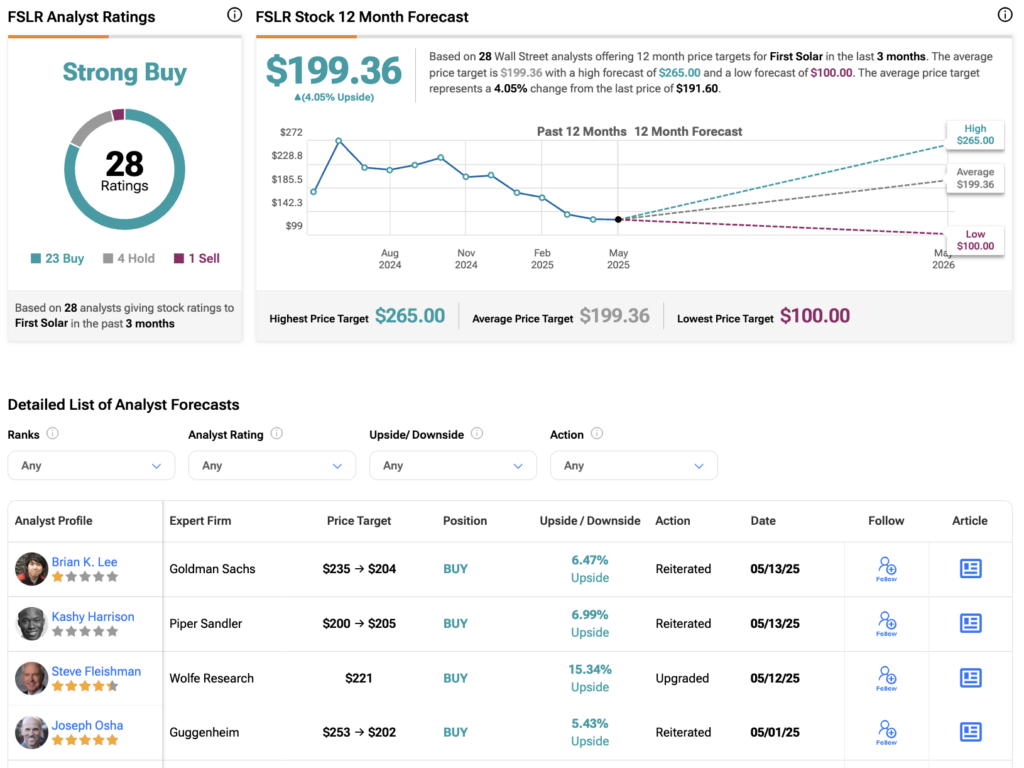

Turning to Wall Street, FSLR stock has a Strong Buy consensus rating based on 23 Buys, four Holds, and one Sell assigned in the last three months. Also, the average First Solar stock price target of $199.36 implies a 4% upside potential from current levels.