Norwegian Cruise Line Holdings (NCLH), the fourth-largest cruise line in the world by passenger capacity, is now performing full steam ahead after successfully navigating pandemic woes. Norwegian Cruise stock is up almost 40% in the past 12 months amid a stellar financial recovery for the company. The long-term outlook continues to improve, aided by favorable macroeconomic developments. On the back of an upgrade by Citigroup, Norwegian Cruise stock popped 11% on October 9, and I believe the momentum is just getting started. I am bullish on Norwegian Cruise as I believe the company is still attractively valued amid improving prospects.

TipRanks Cyber Monday Sale

- Claim 60% off TipRanks Premium for data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

Cruise Demand Will Likely Remain Strong

A major factor contributing to my bullish stance on Norwegian Cruise is the favorable demand environment enjoyed by the company. According to Cruise Lines International Association (CLIA), the cruise industry is expected to carry 35.7 million passengers this year, almost four million more passengers as compared to 2023. This also marks a substantial increase from the pre-pandemic high of 29.7 million passengers carried in 2019. That volume still pales in comparison to the overall number of international travelers, which suggests there is a long potential runway for the industry to capture market share. For context, in the first seven months of this year, approximately 790 million tourists traveled internationally.

A key driver of cruise booking demand in recent times has been the massive surge in the number of first-time customers. According to CLIA data, 27% of cruise passengers in the last two years were first-time cruise travelers, which is an indication that successful marketing efforts by cruise companies are attracting a new customer base. There are positive demographic shifts to consider as well. Although Baby Boomers dominated cruise bookings before the pandemic, according to CLIA survey data 73% of Millennials and Gen X travelers are now interested in cruise vacations. One major reason behind this shift is the rising wealth levels of new generations.

In addition, the cruise industry’s expansion to new destinations and investments in high-end land-based offerings should also drive demand higher in the future. Royal Caribbean (RCL) and Carnival Corporation (CCL) are aggressively investing in developing private beach destinations in the Bahamas, and these attractions are likely to expand the addressable market opportunity for all cruise companies, including Norwegian Cruise Line. The addition of new destinations such as India and China also bodes well for the growth of the industry.

Cost Control Measures Should Boost Norwegian’s Profitability

In addition to the favorable demand trends enjoyed by Norwegian Cruise, I am impressed by the company’s recently announced cost management initiatives. The company aims to slash $300 million in recurring costs over the next three years and has already appointed a dedicated team of executives to identify areas that could be streamlined to achieve operational efficiencies. Approximately $100 million in cost savings are expected to be realized in 2024. This year’s cost savings will stem from a reduction in ship operating costs and lower administrative expenses. Moving forward, Norwegian Cruise may also look for headcount reductions to drive operating costs lower.

In addition to this newly announced cost reduction plan, the company has been looking at increasing port efficiency by concentrating on a few major ports. According to company filings, Norwegian Cruise’s top 10 departure ports currently feature on 65% of itineraries offered to customers, but in the long term, the company is planning to increase the concentration of top 10 ports to more than 80%. As part of this strategy, Norwegian will focus on Florida ports in contrast to its historical practice of depending on European ports which are comparatively expensive.

Strategic Investments Should Drive Margins Higher

My bullish stance on Norwegian Cruise is also buoyed by the company’s recent investments in fleet modernization, cabin upgrades, and even AI. Last April, the company ordered eight new ships for its three brands, scheduled to be delivered between 2025 and 2036. The first four ships will be delivered between 2025 and 2028. In total, these new ships will add approximately 25,000 berths to Norwegian’s fleet. In addition to expanding the company’s passenger capacity, these new ships are likely to help Norwegian embrace sustainable energy sources as they are designed with larger fuel tanks to hold cleaner fuel such as methanol. Overall, these investments should lead to an acceleration in revenue growth and margin improvement.

Norwegian is also investing in AI technology to optimize cruise pricing. By using advanced data analytics capabilities, the company plans to maximize the revenue potential from cabin upgrades and onboard sales by better tracking customer spending patterns. This is a promising pursuit that will likely drive margins higher in the coming years. The success of these investments may also pave the way for the company to automate revenue management tasks, creating more opportunities for headcount reductions.

Is Norwegian a Buy According to Wall Street Analysts?

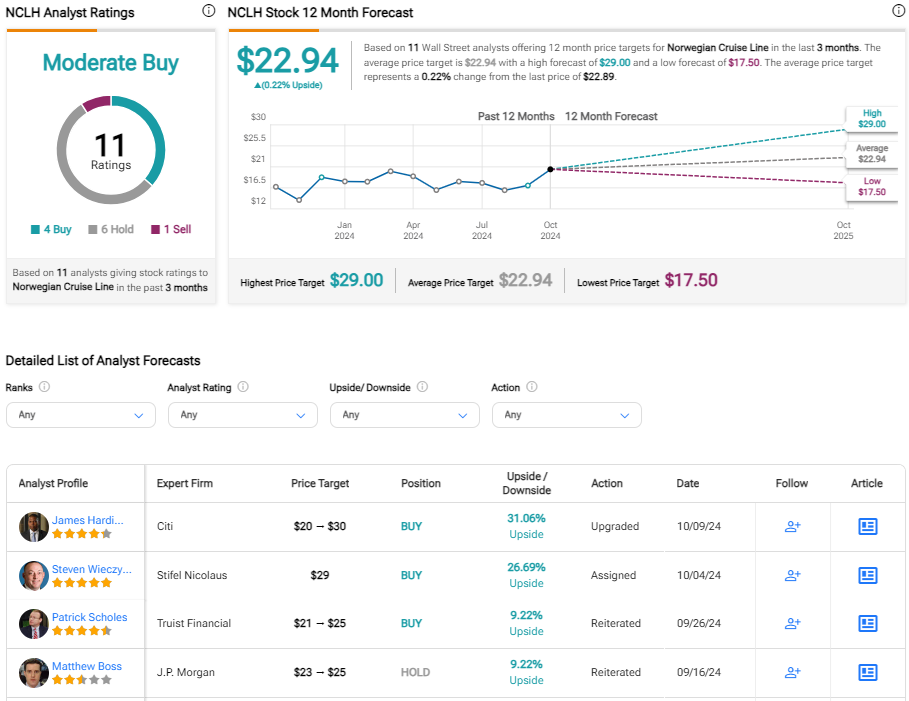

Norwegian Cruise’s recent cost control measures and revenue optimization initiatives are already attracting Wall Street analysts. On October 9, Citigroup analyst James Hardiman upgraded Norwegian Cruise to a Buy rating and hiked his price target to $30 from $20. The analyst cited the company’s improved pricing power and increased focus on cost control.

Based on the ratings of 11 Wall Street analysts, the average NCLH stock price target is $22.94, which implies the company is fairly valued today at a market price of around $23.

Despite the limited upside potential implied by analyst ratings, I am confident that Norwegian will see an expansion in valuation multiples next year when earnings growth accelerates, aided by strong revenue growth and an expansion in operating margins. Today, NCLH shares are valued at a forward P/E of 14.6x compared to 15.2x for Carnival and 16.7x for Royal Caribbean. In the long term, I expect Norwegian to enjoy premium multiples given its comparatively strong balance sheet and cost profile.

Takeaway

Norwegian Cruise is well-positioned to benefit from favorable macroeconomic developments in the cruise industry. The company is keeping an eye on its cost profile to ensure projected revenue growth will lead to robust earnings growth, which is encouraging. Even on the back of recent gains, NCLH stock seems attractively valued given the potential for a meaningful margin expansion in the coming years.