Northland Power (TSE:NPI), a Canadian renewable energy producer, has achieved a significant milestone in its Baltic Power offshore wind project by securing C$5.2 billion in “non-recourse green financing,” aiding the project’s development over a 20-year term.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The venture, in collaboration with Orlen S.A., comes with a hefty price tag of approximately C$6.5 billion and is financially supported by a unique 25-year agreement with the Government of Poland, referred to as a Contract for Difference (CFD). This arrangement ensures that Baltic Power will be paid a fixed rate for the energy it generates, which is “Euro-pegged and inflation-indexed,” providing financial stability and protection against inflation.

Northland emphasized the project’s potential to generate considerable cash flow and adjusted EBITDA. Once it’s up and running, Northland’s Baltic Power interest is anticipated to produce a “five-year average Adjusted EBITDA of approximately [C]$300 to [C]$320 million and [C]$95 to [C]$105 million of Free Cash Flow per year.” The secured funding covers 80% of the total capital cost, with project partners contributing the remainder.

With all the essential environmental approvals and primary construction contracts in place, the project is on track to commence full operations by the second half of 2026. Nevertheless, the stock is down modestly on the news.

Is NPI Stock a Buy, According to Analysts?

According to analysts, NPI stock comes in as a Strong Buy based on nine unanimous Buy ratings assigned in the past three months. The average NPI stock price target of C$34.54 implies 48.1% upside potential.

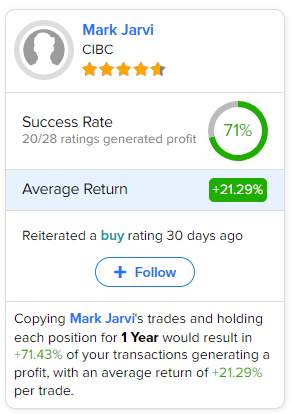

If you’re wondering which analyst you should follow if you want to buy and sell NPI stock, the most accurate analyst covering the stock (on a one-year timeframe) is Mark Jarvi of CIBC, with an average return of 21.29% per rating and a 71% success rate. Click on the image below to learn more.