Legacy automaker Ford (F) revealed its second quarter sales numbers today. The numbers prompted sheer joy from the investors’ perspective, and the resulting share price bump proved as much. Ford shares were up nearly 5% in Tuesday afternoon’s trading, as sales numbers and a whole new employment push gave Ford a clear edge.

Don’t Miss TipRanks’ Half-Year Sale

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Overall, reports noted, Ford sales were up a hefty 14.2% for the second quarter, as measured against the second quarter of last year. The entire auto industry was projected to see an average of a mere 1.4% increase, so Ford walking in with a figure that was over 10 times that suggests one of two things: one, the estimates were woefully inadequate, or two, Ford nailed the second quarter.

A breakdown of the larger number showed that the second point on that short list was very likely. New vehicle sales came in at 612,095, with F-Series trucks having the best second quarter seen since before the pandemic, back in 2019. F-Series trucks put up 222,459 units sold, and pickup sales overall pulled in 288,564 sales. Electrified vehicles, including hybrids, posted 82,886 total units, but pure electric vehicles actually saw sales drop, falling 31.4% for the quarter.

Getting the Young Guys In

When Jim Farley discovered that many of his younger workers were taking shifts at Amazon (AMZN) just to make ends meet, he did not take this news lying down. In fact, he turned right to Henry Ford’s old playbook—the one that started out paying workers $5 a day to get them in the door—and responded accordingly.

The change dates back to 2019, but Farley talked about it while at the Aspen Ideas Festival recently. Farley set a program in motion that saw many “temporary” workers turned into full-time ones, which opened up a clear path to “…higher wages, profit-sharing checks, and better health care coverage.” Farley went on to note that it was not easy to do this. It turned out to cost Ford quite a bit. But, Farley noted “…I think that’s the kind of changes we need to make in our country.”

Is Ford Stock a Good Buy Right Now?

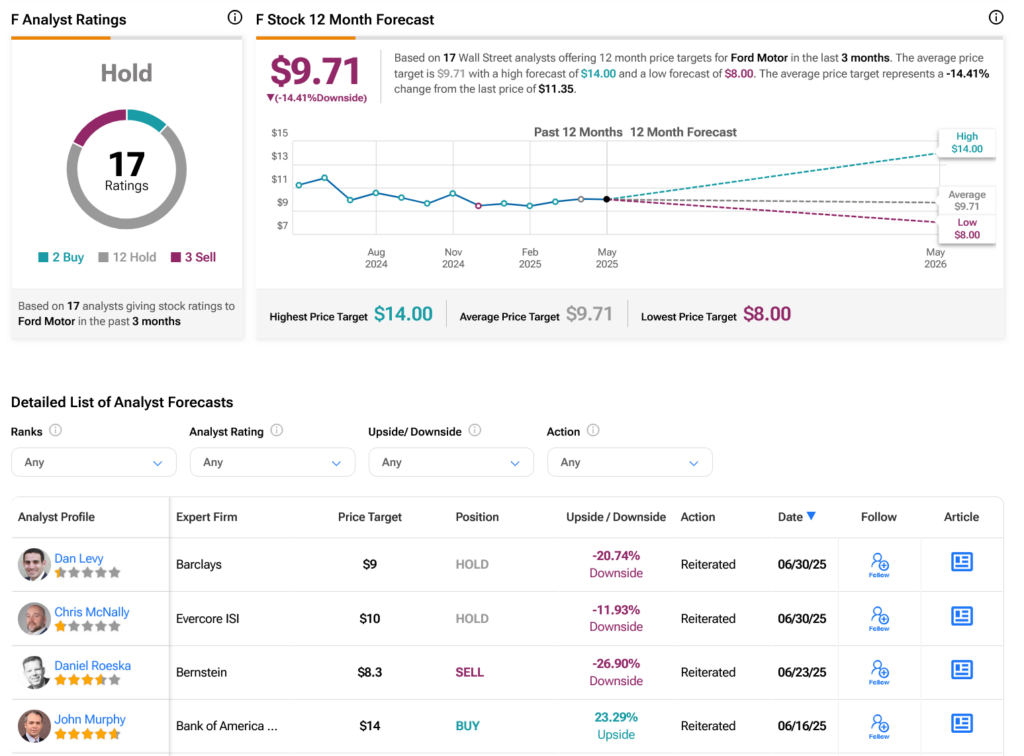

Turning to Wall Street, analysts have a Hold consensus rating on F stock based on two Buys, 12 Holds and three Sells assigned in the past three months, as indicated by the graphic below. After a 15.7% loss in its share price over the past year, the average F price target of $9.71 per share implies 14.41% downside risk.