Mobile phone group Nokia (NOK) has dialed up better than expected fourth quarter results, boosted by rising demand for its equipment from telecoms providers and corporates looking to transform their digital operations.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The positive update left its shares zooming higher in pre-market trading.

Industrial Demand for Digital Rises

The Finland-headquartered group said quarterly sales rang up 10% higher to $6.2 billion, outpacing analysts’ expectations of $5.9 billion. It noted a 17% leap in sales at its network infrastructure business, helped by a recovery in demand from communication services providers, mainly in North America.

Its cloud and network services recorded a 7% net sales growth in the quarter, helped by demand from, again, North America, but also Asia. It highlighted the strong performance of its Enterprise Campus Edge, which helps accelerate digital transformation in manufacturing and industrial sites.

“What we have seen previously is that when the markets turn, the North American market turns first, both up and down,” CEO Pekka Lundmark said.

Nokia Talks up 2025 Prospects

Nokia added that its positive momentum was set to continue into 2025, with expectations of a full-year profit of between $1.98 billion and $2.5 billion. That is higher than analyst estimates of around $2.2 billion.

These figures are set to be helped by Nokia’s proposed deal to buy Infinera – a supplier of advanced optical semiconductors – for $2.3 billion, which it first announced last June. It hopes that this will help it further tap into the boom for AI and data centers worldwide.

In its results, Nokia said it was now only waiting for approvals from European Union and Taiwan regulators and expects the Infinera acquisition to close during the first quarter of this year. That’s ahead of previous forecasts of by the end of the first half of 2025.

Is NOK a Good Stock to Buy?

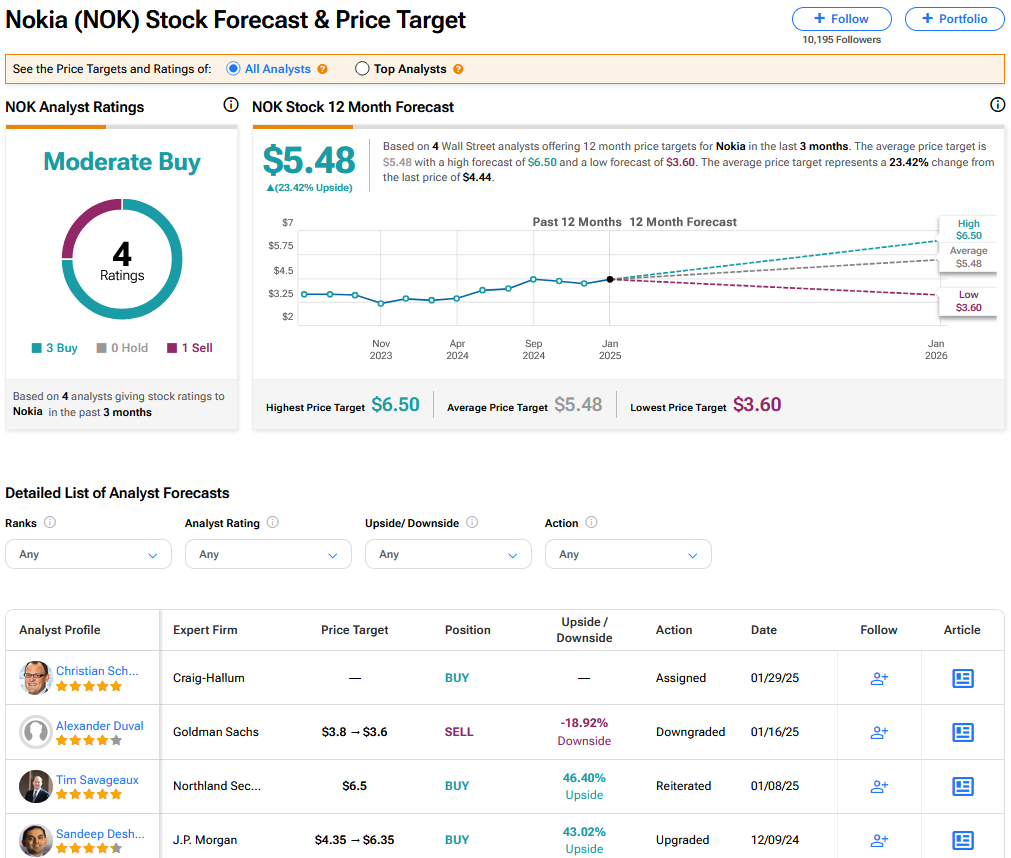

On TipRanks, NOK has a Moderate Buy consensus based on 3 Buy and 1 Sell rating. Its highest target price is $6.50. NOK stock’s consensus price target is $5.48 implying an 23.42% upside.