Nokia (NYSE:NOK) shares are trending marginally lower today after the Finnish technology and network solutions provider’s first-quarter top line declined by nearly 20% year-over-year to €4.67 billion. The EPS for the quarter stood at €0.09.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

A Mixed Picture

The revenue decline was attributable to an overall challenging environment for the telecom sector. However, the company’s president and CEO, Pekka Lundmark, noted a continued improvement in order trends. As a result, the CEO anticipates a stronger second half for the year.

Despite the revenue decline, Nokia’s operating margin improved to 12.8% from 8.2% a year ago on the back of patent licensing deals from Nokia Technologies. Additionally, the company’s free cash flow generation remained healthy at €1 billion.

Nokia’s Future Expectations

For Fiscal year 2024, Nokia expects operating profit in the range of €2.3 billion to €2.9 billion. For 2026, the company aims to grow its net sales at a faster pace than the market. While it aims for a 13% or higher operating margin in 2026, the company believes that an operating margin of 14% is achievable over the longer term. Additionally, Nokia has announced a dividend of €0.04 per share. The NOK dividend is payable on May 3 to investors of record on April 23.

What Is the Target Price for NOK?

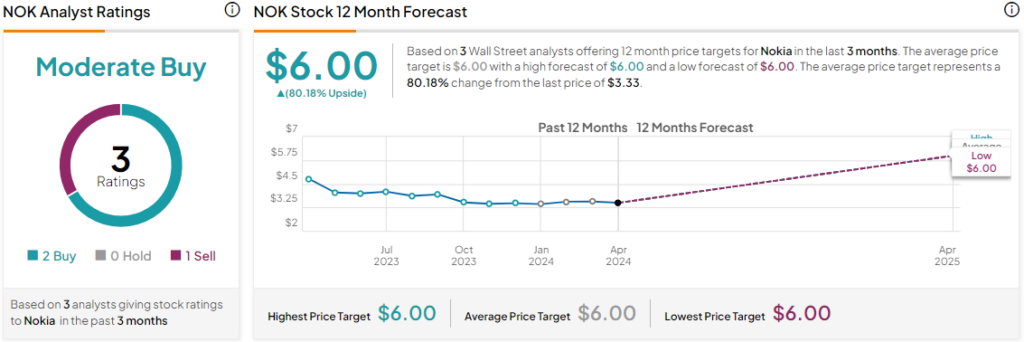

Nokia’s stock price has plunged by nearly 27% over the past year amid a tough macroeconomic environment. Overall, the Street has a Moderate Buy consensus rating on Nokia, alongside an average NOK price target of $6. However, analysts’ views on the company could see revisions following today’s earnings report.

Read full Disclosure