Richmond Fed President Thomas Barkin sees no reason to rush rate cuts while the job market and consumer spending remain strong. “I don’t think the data gives us any rush to cut… I am very conscious that we’ve not been at our inflation target for four years,” said Barkin in an interview with Reuters.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

He added that unemployment remains stable at 4.2% while the risk of tariff-driven inflation still persists, explaining, “Being modestly restrictive is a good way to address that.”

Fed Members Differ on Rate Cut Timeline

Members of the Fed are split on whether to cut sooner or later. In an interview with CNBC’s Squawk Box on Friday, Fed Governor Christopher Waller said that the central bank is in a position to cut rates as early as July, although the process would be slow instead of sudden in order to account for a potential resumption of inflation.

President Trump has urged the Fed to slash rates in order to lower interest payments on government debt. He believes that the rate should be at least 2% lower and argues that the Fed can just increase the rate if inflation returns. “He’s a political guy who’s not a smart person, but he’s costing the country a fortune,” said Trump in regard to Fed Chair Jerome Powell.

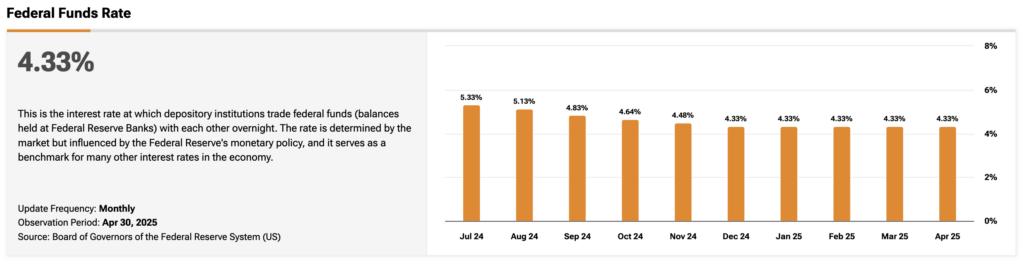

Stay up-to-date on the federal funds rate with TipRanks’ Economic Indicators Dashboard.